Rent a own is a financing and purchasing pathway that sits between traditional renting and outright buying. Instead of paying monthly for temporary use only, you make regular payments with the option—sometimes the expectation—that ownership can transfer after a defined term or after certain conditions are met. In many markets, rent a own arrangements show up for furniture, electronics, appliances, and vehicles, and they also appear in housing through rent-to-own or lease-option structures. The appeal is straightforward: people who cannot or do not want to qualify for a conventional loan may still gain access to essential items and, potentially, build a path toward ownership. The structure can feel empowering when it is transparent, fairly priced, and aligned with the customer’s budget and goals. It can also become costly when fees are high, terms are confusing, or the buyer’s situation changes and they cannot complete the agreement.

Table of Contents

- My Personal Experience

- Understanding the “rent a own” concept and why it exists

- How rent a own agreements are structured: payments, terms, and ownership transfer

- Common products offered through rent a own and what to watch for

- Rent a own for housing: lease-option and lease-purchase realities

- Cost breakdown: total price, implied interest, and the real premium of rent a own

- Credit, reporting, and financial impact: what rent a own does and does not do

- Legal and consumer protection considerations: reading the contract like a pro

- Expert Insight

- Comparing rent a own to alternatives: layaway, buy-now-pay-later, used purchases, and traditional financing

- Choosing a reputable rent a own provider: signals of fairness and transparency

- Strategies to make rent a own work in your favor: budgeting, early payoff, and avoiding fee traps

- Rent a own pitfalls and red flags: when to walk away

- Practical steps to evaluate a rent a own offer before signing

- Conclusion: using rent a own responsibly for real-life needs

- Watch the demonstration video

- Frequently Asked Questions

- Trusted External Sources

My Personal Experience

When my old car finally died, I didn’t have the savings or credit to finance another one, so I tried a rent-to-own place near my apartment. The weekly payments looked manageable on paper, and I liked the idea that I could return it if things got tight. After a couple months, though, I realized how quickly the fees added up, and the total cost was way higher than buying used from a private seller. I stuck with it because I needed reliable transportation for work, but I started tracking every payment and called to confirm how the ownership transfer actually worked. In the end, I did get the title, but it taught me to read every line of the contract and compare the full price—not just the weekly number. If you’re looking for rent a own, this is your best choice.

Understanding the “rent a own” concept and why it exists

Rent a own is a financing and purchasing pathway that sits between traditional renting and outright buying. Instead of paying monthly for temporary use only, you make regular payments with the option—sometimes the expectation—that ownership can transfer after a defined term or after certain conditions are met. In many markets, rent a own arrangements show up for furniture, electronics, appliances, and vehicles, and they also appear in housing through rent-to-own or lease-option structures. The appeal is straightforward: people who cannot or do not want to qualify for a conventional loan may still gain access to essential items and, potentially, build a path toward ownership. The structure can feel empowering when it is transparent, fairly priced, and aligned with the customer’s budget and goals. It can also become costly when fees are high, terms are confusing, or the buyer’s situation changes and they cannot complete the agreement.

Several economic realities explain why rent a own exists. Many households have uneven income, limited savings, or credit challenges that make traditional installment loans difficult. At the same time, life still requires a refrigerator, a reliable laptop, or a vehicle to get to work. Rent a own providers attempt to fill that gap by making approval easier and bundling the cost into predictable payments. In return for that flexibility, the total paid over time is often higher than cash price or a low-interest loan. That tradeoff is not automatically “bad,” but it must be evaluated carefully. A fair assessment compares total cost, the probability you will complete the term, the value of included services (delivery, setup, maintenance, early payoff options), and your alternatives, such as buying used, saving up, or using a secured credit product. When the agreement is clear and you understand the economics, rent a own can function as a bridge rather than a trap.

How rent a own agreements are structured: payments, terms, and ownership transfer

A rent a own contract typically lists the item, its condition (new or pre-owned), the payment schedule, the length of the term, and the point at which ownership transfers. Some agreements are “rental with option to purchase,” meaning you are not obligated to buy, but you can choose to complete the term or pay off early to take title. Others are closer to installment plans but are still written as rentals until the final payment. Understanding how your payments are applied is critical: in many plans, each payment counts toward the eventual purchase, but the purchase price embedded in the schedule may be substantially higher than the retail cash price. There may also be fees for delivery, late payments, damage waivers, processing, reinstatement after missed payments, or pickup if you return the item. These details determine whether the arrangement is manageable or unexpectedly expensive.

Ownership transfer is not always automatic in practice, even if it appears simple on paper. Some rent a own companies require a final “purchase option” fee or documentation at the end of the term. For vehicles, title transfer rules are especially important: who holds title during the term, who pays registration, who carries insurance, and how mileage or condition affects the end value. For housing rent-to-own, the mechanics can be even more complex: you may have a lease with an option fee, rent credits that apply to a future purchase, and a separate purchase contract that must be executed later. In any version, the safest approach is to treat the agreement as a financing product and calculate the total outlay, not just the weekly or monthly payment. Ask for a full payment schedule in writing, confirm the early payoff amount at different points in time, and verify whether you can return the item without penalty beyond past-due amounts and reasonable wear. Clarity at the start prevents disputes later.

Common products offered through rent a own and what to watch for

Rent a own is widely used for household essentials like sofas, mattresses, washers, dryers, refrigerators, and televisions. It is also common for computers, gaming systems, smartphones, and other electronics that depreciate quickly. In some regions, rent a own is offered for tires, jewelry, musical instruments, and even small business equipment. The product category matters because depreciation and maintenance can significantly affect value. An expensive, fast-depreciating item can become a poor deal if the contract price is far above market value after a year. On the other hand, an appliance that is delivered, installed, and serviced under the agreement may offer convenience worth paying for, especially if the provider includes repairs or replacements that you would otherwise fund yourself.

When evaluating products, focus on three practical checkpoints. First, compare the cash price of the same or equivalent model at multiple retailers, including used or refurbished sources, because rent a own pricing often assumes a premium for flexibility. Second, consider how long you realistically need the item and whether you truly want ownership at the end. If you are renting a television for a temporary living situation, a short-term rental might be cheaper than a long-term ownership path. Third, examine what happens if the item fails or becomes obsolete. Does the provider repair it quickly? Do you get a loaner? Are you responsible for damage that is not your fault? Agreements sometimes bundle optional waivers; sometimes those waivers are valuable, and sometimes they are overpriced. The best approach is to match the product to your timeline and to choose items whose value and usefulness will still be strong at the end of the term.

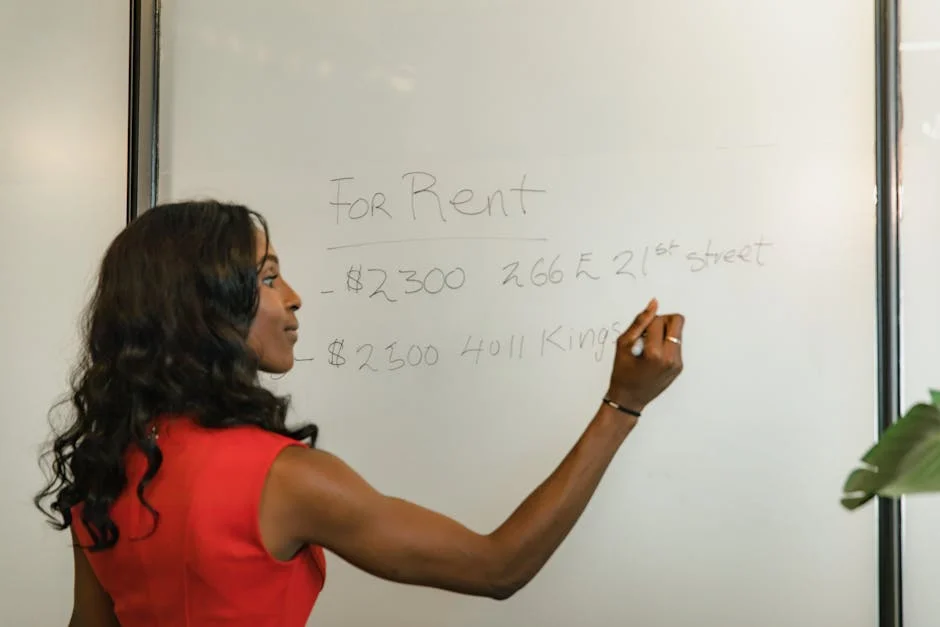

Rent a own for housing: lease-option and lease-purchase realities

Housing versions of rent a own are often described as rent-to-own, lease-option, or lease-purchase. While the phrase is similar, the legal and financial structure can differ from store-based plans for furniture or electronics. In a lease-option, you rent the home for a set period and pay an option fee for the right (not the obligation) to buy later at a set price or a price determined by a formula. In a lease-purchase, you may be obligated to buy at the end, which can be risky if your financing is not guaranteed. Many arrangements also include rent credits, where a portion of your monthly rent is credited toward the eventual purchase. These credits can help build a down payment-like amount, but the credits often apply only if you exercise the option and close the purchase on time.

The biggest risks in housing rent a own deals come from unclear contracts, unrealistic timelines, and property condition issues. If the home needs repairs, the contract may assign maintenance responsibilities to the tenant-buyer earlier than a normal lease would. That can be fair if the purchase is likely, but it can be expensive if the deal falls through. Another common issue is the option fee: it may be non-refundable, meaning you lose it if you cannot secure financing by the deadline. Additionally, the home’s title and underlying mortgage situation matter. If the seller is behind on payments or has liens, you could spend years paying rent and credits only to discover the property cannot transfer cleanly. A cautious approach includes a professional inspection, a title search, clear language about rent credits and deadlines, and a plan to improve your mortgage eligibility during the lease term. Housing rent a own can work, but only when it is treated with the same seriousness as a traditional purchase from day one.

Cost breakdown: total price, implied interest, and the real premium of rent a own

The most important number in any rent a own arrangement is not the weekly or monthly payment; it is the total amount you will pay if you complete the term. Many consumers focus on affordability per pay period, but the cumulative cost is what determines value. A payment plan might look manageable at $25 per week, yet over 78 weeks that becomes $1,950 for an item that retails for $900. That difference is the premium you pay for accessibility, speed, and flexible approval. Sometimes the premium also covers delivery, setup, maintenance, and the provider’s risk of nonpayment or returns. The question is whether that premium is proportionate to the benefits you receive and your alternatives.

It can help to think in terms of implied interest, even if the contract is not described as a loan. If you know the cash price and the total of payments, you can estimate how expensive the financing is compared to other options. While the exact calculation can be complex due to fees and the rental structure, a simple comparison still reveals whether you are paying double, triple, or something closer to a modest markup. Also consider the probability of completion. If your budget is tight and you might return the item halfway through, rent a own can become the most expensive way to temporarily access a product because you may pay a lot without building equity or ownership. Ask about early purchase discounts and whether your payments accelerate ownership or mainly cover rental fees. A provider that offers transparent early payoff terms and fair pricing can be a better fit than one that hides the true cost behind small periodic payments.

Credit, reporting, and financial impact: what rent a own does and does not do

Many people choose rent a own because they assume it will automatically build credit. In reality, credit impact depends on whether the provider reports payments to credit bureaus and how the agreement is categorized. Some companies offer optional reporting programs or partner with third parties to report on-time payments. Others do not report at all, meaning you could pay faithfully for years and see no direct credit score benefit. That does not mean the arrangement is worthless, but it does mean you should not rely on it as your only credit-building strategy. If your main goal is improving credit, compare rent a own with secured credit cards, credit-builder loans, or reporting rent payments through reputable services, which may be cheaper ways to demonstrate payment history.

Another financial impact is cash-flow timing. Rent a own payments are often weekly or biweekly, which can align with paychecks but also increases the number of payment events and the chance of late fees if you miss a date. Late fees, reinstatement fees, and pickup charges can compound quickly. It is also important to understand whether the provider can repossess the item after missed payments and what your rights are to reinstate the contract. If you are using rent a own as a stepping-stone, build a buffer: set aside at least one payment cycle in savings, automate payments if possible, and ask for grace periods in writing. The best outcome is not merely acquiring an item; it is doing so without destabilizing your budget or triggering a cycle of fees that makes future financial progress harder.

Legal and consumer protection considerations: reading the contract like a pro

Rent a own is regulated differently depending on jurisdiction, and the rules can vary significantly between product categories. Some areas treat these agreements as consumer leases, others have specific rent-to-own statutes, and housing deals can fall under landlord-tenant law plus real estate contract principles. Because of that variability, the practical safeguard is careful contract review. Key items to locate include: total number of payments; total cost to own; cash price or fair market value reference; all fees and the conditions that trigger them; maintenance and damage responsibilities; return and cancellation rules; early purchase option details; and dispute resolution terms. If arbitration clauses or waiver language is present, understand what rights you may be giving up. A reputable provider should be willing to explain terms in plain language and provide copies before you sign.

Expert Insight

Before signing a rent-to-own agreement, compare the total cost (rent premiums, option fee, and purchase price) against local market values and a standard mortgage scenario. Get every term in writing—how much of each payment credits toward the purchase, who pays for repairs, and what happens if you miss a payment—so there are no surprises later. If you’re looking for rent a own, this is your best choice.

Protect your path to ownership by securing a home inspection and verifying the seller’s title status, taxes, and any liens before you move in. Set a clear timeline to improve credit and save for closing costs, and negotiate an extension or exit clause so you don’t lose your option fee if financing takes longer than expected. If you’re looking for rent a own, this is your best choice.

For big-ticket arrangements—especially housing rent a own—professional support is often worth the cost. A local attorney or licensed real estate professional can spot predatory structures, missing disclosures, or unrealistic obligations. Even for smaller consumer goods, you can protect yourself by insisting on written terms and avoiding verbal promises. If the salesperson claims “you can return anytime with no penalty,” ensure the contract reflects that. If they claim “ownership in 12 months,” verify the payment schedule and whether a final fee applies. Also watch for bundled add-ons that inflate the total. Damage waivers, insurance, and service plans can be helpful, but they should be optional and clearly priced. A contract is not just paperwork; it is the product. With rent a own, the contract determines whether you are purchasing convenience or purchasing regret.

Comparing rent a own to alternatives: layaway, buy-now-pay-later, used purchases, and traditional financing

Rent a own is only one way to access needed items without paying full price upfront. Layaway allows you to reserve an item and pay over time before taking it home, which can be safer and cheaper but does not solve immediate need. Buy-now-pay-later services may offer short-term installment plans, sometimes with low or zero interest, but approval can still depend on credit checks and the repayment timeline is often shorter. Traditional financing through a credit union, a store card, or a personal loan may offer lower total cost if you qualify, but it can be inaccessible to those with limited credit history or recent delinquencies. Buying used through local marketplaces, refurbishers, or outlet stores can reduce the cash price dramatically, which can eliminate the need for premium financing altogether.

| Option | How it works | Best for | Key trade-offs |

|---|---|---|---|

| Rent-to-Own (Lease-Option) | Rent the home with the option to buy later; you typically pay an option fee and may receive rent credits toward the purchase. | Buyers who need time to improve credit, save for a down payment, or confirm the neighborhood/home fit. | Option fee may be nonrefundable; purchase price may be pre-set; you can walk away but may lose credits/fees. |

| Rent-to-Own (Lease-Purchase) | Rent with a binding commitment to buy at the end of the lease term under agreed conditions. | Buyers confident they will qualify and want to lock in terms and a path to ownership. | Higher legal/financial risk if you can’t close (potential penalties); less flexibility than a lease-option. |

| Traditional Rental + Save | Rent a standard lease while independently saving for down payment and improving credit; buy when ready. | People who want maximum flexibility and minimal contractual risk. | No rent credits toward purchase; home price may rise while you wait; less “built-in” structure to buy. |

The best comparison method is to align each option with your constraints: urgency, budget stability, and your tolerance for risk. If you need a washer today and have no savings, rent a own might be the fastest path, but you should still compare at least three scenarios: (1) rent a own total cost if completed; (2) buying a reliable used unit with a short-term repair fund; and (3) a low-cost financing option through a community lender. Consider also the consequences of failure. If you miss payments on a buy-now-pay-later plan, you may face late fees and credit reporting issues. If you miss payments in rent a own, you may lose the item and the money already paid, depending on the contract. If you buy used, you bear the risk of breakdown but you retain ownership and can resell. There is no universal best choice, but rent a own should win on transparency, service value, and realistic affordability—not merely on the fact that “approval is easy.”

Choosing a reputable rent a own provider: signals of fairness and transparency

Provider quality makes a huge difference in the rent a own experience. Reputable companies disclose total cost to own, provide clear early payoff amounts, and avoid confusing add-ons. They also maintain the products they rent, offer reasonable delivery and setup, and respond quickly when something breaks. A fair provider explains what happens if you want to return the item, how reinstatement works after a missed payment, and what fees apply—without burying the details in fine print. They also avoid pressure tactics such as “sign today or the price doubles,” which is often a sign that the deal relies on urgency rather than value.

You can evaluate a provider with a practical checklist. Ask for a written quote that includes the total number of payments, the amount of each payment, and the total cost to own. Confirm whether taxes are included. Ask whether there is an early purchase discount and request examples: “If I pay it off after 90 days, what is the exact payoff amount?” Review the return policy: “If I return after 10 weeks, do I owe anything beyond the payments already made and any damage?” Check service terms: repairs, replacement timelines, and what happens if a model is discontinued. Look at reviews, but interpret them carefully: complaints about pricing are common across the industry, so focus on patterns involving hidden fees, poor service, or disputes about contract terms. A well-run rent a own business will not mind detailed questions because clarity reduces defaults and improves customer outcomes.

Strategies to make rent a own work in your favor: budgeting, early payoff, and avoiding fee traps

If you decide rent a own is the right tool for your situation, structure your approach to minimize total cost and risk. Start with a budget that treats the payment as non-negotiable, like rent or utilities. Because these agreements often have frequent payment schedules, set reminders and consider autopay if it does not add fees. Build a small buffer fund—ideally one to two payment cycles—so a minor disruption does not cause late fees or repossession. Choose the shortest term you can comfortably afford, because longer terms usually increase total cost. Also consider selecting a product that meets your needs without unnecessary premium features, since every upgrade multiplies the final price when financed through a rent a own schedule.

Early payoff is one of the most effective ways to reduce the premium. Many providers offer a purchase option discount if you pay off within a certain window. Get the early payoff policy in writing and track your payoff opportunities. If you receive a tax refund, bonus, or side-income, applying it to an early purchase can convert a high-cost arrangement into a more reasonable one. Another strategy is to treat rent a own as temporary access while you search for a lower-cost solution. For example, you might rent an appliance short-term while saving for a used replacement, then return the rented unit according to contract terms. That approach only works if the return policy is fair and you avoid damage or pickup fees. Finally, be proactive about communication. If you anticipate a missed payment, contact the provider before the due date to ask about extensions or partial payments. Fee traps thrive on silence and confusion; a planned, documented approach keeps you in control.

Rent a own pitfalls and red flags: when to walk away

Some rent a own offers are structured in ways that make success unlikely. A major red flag is the inability or refusal to provide the total cost to own in writing. Another is a contract that emphasizes repossession rights and fees while being vague about maintenance, returns, or early payoff. Watch for pricing that is wildly out of line with market value, especially for older models or used items. For housing, walk away if the seller cannot prove clear title, if you are pressured to skip inspection, or if the contract makes your rent credits contingent on unrealistic conditions. Also be cautious if you are told that missed payments “don’t matter” or that the company “will work with you no matter what,” but none of that flexibility is documented.

Behavioral red flags matter too. High-pressure sales tactics, rushed signing, or discouraging you from taking the contract home to review are all signals that the provider benefits from confusion. Another pitfall is stacking multiple rent a own agreements at once. Weekly payments can appear small individually but become overwhelming in aggregate, leading to a cascade of late fees and returns. If you already have volatile income, consider whether a less rigid option—like buying used with a small emergency fund—might be safer. Rent a own can be a bridge, but it should not be a bridge built on optimistic assumptions. If the deal only works in a “perfect month” where nothing goes wrong, it is not a stable plan. Walking away is often the most cost-effective decision you can make.

Practical steps to evaluate a rent a own offer before signing

A disciplined evaluation process can turn rent a own from an emotional decision into a rational one. Start by identifying the exact product you need and the minimum acceptable specifications. Then price the same or comparable item in at least three places: a major retailer’s cash price, a used/refurbished source, and the rent a own provider’s total cost to own. Write these numbers down. Next, request the full contract or a sample agreement and read it slowly. Highlight payment frequency, total number of payments, fees, and conditions for return. If anything is unclear, ask for clarification in writing. A reputable business will answer plainly and consistently. If you receive conflicting explanations from different staff members, assume the contract language controls and proceed cautiously.

Then test the plan against your real budget. Map the payment dates against your paydays and other obligations. Include a conservative estimate for late-fee risk by asking what a single missed payment costs and how quickly repossession can occur. Consider the “completion likelihood” honestly: if there is a meaningful chance you will move, change jobs, or face medical expenses, choose a contract that allows easy returns and avoids steep penalties. Finally, decide your exit strategy on day one. Will you aim for early purchase at 90 days? Will you return the item after a short period if a cheaper option appears? Will you refinance the purchase through a lower-rate loan once your credit improves? Rent a own is most manageable when you control the timeline instead of letting the timeline control you.

Conclusion: using rent a own responsibly for real-life needs

Rent a own can solve immediate problems—getting a working appliance, furnishing a home, securing a computer for school, or creating a path toward ownership when traditional financing is out of reach. The same flexibility that makes it accessible can also make it expensive, especially when fees, long terms, or unclear rules inflate the total cost. The best outcomes come from transparent providers, contracts you fully understand, and a plan that prioritizes early payoff or a clear, low-penalty exit. Comparing alternatives, calculating total cost to own, and aligning payment schedules with your income are practical steps that prevent unpleasant surprises.

When approached with careful math and clear expectations, rent a own can be a temporary bridge to stability rather than a recurring financial burden. Choose only what you truly need, keep the term as short as your budget allows, and insist on written disclosures for total price, fees, and early purchase options. If the agreement feels confusing, rushed, or unfair, walking away protects both your wallet and your peace of mind. With the right provider and a realistic plan, rent a own can fit into a broader strategy of building a more secure household without sacrificing transparency or control.

Watch the demonstration video

In this video, you’ll learn how rent-to-own works and whether it’s a smart path to homeownership. We’ll break down the typical steps, key contract terms, upfront fees, and how rent credits apply to the purchase price. You’ll also discover common risks, what to watch for, and questions to ask before signing. If you’re looking for rent a own, this is your best choice.

Summary

In summary, “rent a own” is a crucial topic that deserves thoughtful consideration. We hope this article has provided you with a comprehensive understanding to help you make better decisions.

Frequently Asked Questions

What is rent-to-own?

Rent-to-own is a flexible arrangement that lets you move in and start making payments like a renter, while keeping the option to purchase the home later. In many cases, a portion of each monthly payment is credited toward the final price—making it easier to plan ahead if you want to **rent a own** instead of buying outright right away.

How does a rent-to-own home contract typically work?

You usually pay an upfront option fee, rent for a set term, and have the right (not obligation) to buy at a predetermined price or based on a future appraisal. If you’re looking for rent a own, this is your best choice.

What is an option fee and is it refundable?

An option fee locks in your right to buy the home later; it’s usually nonrefundable, but in many **rent a own** agreements it can be applied toward the purchase price if you move forward—exact terms depend on the contract.

Do rent payments build equity in rent-to-own?

In some **rent a own** agreements, part of your monthly rent may be applied toward the purchase price as a rent credit—but only if your contract specifically includes this option and you meet the required conditions, such as making all payments on time.

Who handles repairs and maintenance in a rent-to-own agreement?

Responsibilities can differ widely—some rent a own agreements place more maintenance and repair duties on the tenant-buyer than a typical lease, so it’s important that the contract clearly spells out who pays for what.

What are common risks of rent-to-own and how can I reduce them?

One of the biggest risks with a **rent a own** arrangement is losing your option fee or rent credits if you don’t end up buying, along with running into confusing pricing terms or problems on the seller’s side—like title defects or an existing mortgage that complicates the sale. You can lower these risks by hiring a real estate attorney, confirming the property’s title status upfront, and making sure every detail is clearly documented in writing.

📢 Looking for more info about rent a own? Follow Our Site for updates and tips!

Trusted External Sources

- Can Rent-to-Own 2.0 offer an affordable path to homeownership in …

Dec 12, 2026 … Rent-to-Own not only requires no down payment but also has no realtor fees, no stamp duty, no exorbitant notary closing costs, all of which in … If you’re looking for rent a own, this is your best choice.

- Rent-to-own – Wikipedia

Rent-to-own—sometimes called rent-to-buy or a rental purchase—is a legally documented agreement that lets you use tangible items, like furniture, while making regular payments over time. With many plans, you can choose to keep the item at the end by completing the agreed payments, making it a flexible option for people who want to **rent a own** without paying the full cost upfront.

- Rent-to-Own – Division of Banking

Starting July 1, 2026, anyone—whether an individual landlord or a business—who offers property in Wyoming through a **rent a own** (rental-purchase) agreement will be required to hold a valid license.

- Selling a property as rent to own : r/realestateinvesting

Aug 17, 2026 … IE: if normal rent is $1,200, a rent to own buyer might pay $1,400 w/ $200 going towards the principal payment. Ultimately it comes down to … If you’re looking for rent a own, this is your best choice.

- Rent to Own Store, Furniture, Appliances, TVs | RENT-2-OWN

RENT-2-OWN proudly serves Ohio and Kentucky with over 40 convenient locations, where friendly, knowledgeable staff make it easy to **rent a own** furniture, appliances, electronics, computers, and more.