A credit card without balance transfer fee is designed to let you move existing debt from one card to another without paying the typical upfront transfer charge that many issuers add at the time of the move. That charge is often a percentage of the amount transferred, and it can be large enough to cancel out some of the savings you expect from a lower interest rate. When the transfer fee is removed, more of your payment goes to the principal, and the economics of consolidating debt can improve quickly, especially for people carrying balances across multiple accounts. The appeal is straightforward: if you can shift a balance to a new account with a promotional APR and avoid paying a fee for the move, you can focus on paying down the debt rather than covering an extra cost that doesn’t reduce what you owe. Still, the absence of a fee doesn’t automatically make the offer better than every alternative, because the promotional APR window, the ongoing interest rate after the promo ends, and the card’s rules can change the real cost of borrowing.

Table of Contents

- My Personal Experience

- Understanding a credit card without balance transfer fee

- How balance transfer fees work and why a $0 fee matters

- Key features to compare beyond the fee

- Who benefits most from a fee-free balance transfer

- Potential drawbacks and hidden costs to watch for

- How to calculate savings with real-world scenarios

- Eligibility, credit score considerations, and approval odds

- Expert Insight

- Steps to execute a balance transfer smoothly

- Alternatives if you can’t find the right fee-free offer

- Best practices to stay debt-free after the transfer

- Choosing the right credit card issuer and reading the fine print

- Final thoughts on using a credit card without balance transfer fee strategically

- Watch the demonstration video

- Frequently Asked Questions

- Trusted External Sources

My Personal Experience

When I decided to move my credit card debt to a new card, the balance transfer fee was the one thing I didn’t want to pay again. I’d done a transfer before and the 3% fee felt like an instant setback, so this time I specifically searched for a credit card without a balance transfer fee. It took some digging because a lot of offers advertise 0% APR but still charge the fee, and the fine print is easy to miss. I finally found one with a limited-time promo that waived it, and transferring my balance was surprisingly straightforward through the app. Not having that extra charge made a bigger difference than I expected—it felt like I was actually starting at zero instead of immediately adding another hundred dollars to what I owed. If you’re looking for credit card without balance transfer fee, this is your best choice.

Understanding a credit card without balance transfer fee

A credit card without balance transfer fee is designed to let you move existing debt from one card to another without paying the typical upfront transfer charge that many issuers add at the time of the move. That charge is often a percentage of the amount transferred, and it can be large enough to cancel out some of the savings you expect from a lower interest rate. When the transfer fee is removed, more of your payment goes to the principal, and the economics of consolidating debt can improve quickly, especially for people carrying balances across multiple accounts. The appeal is straightforward: if you can shift a balance to a new account with a promotional APR and avoid paying a fee for the move, you can focus on paying down the debt rather than covering an extra cost that doesn’t reduce what you owe. Still, the absence of a fee doesn’t automatically make the offer better than every alternative, because the promotional APR window, the ongoing interest rate after the promo ends, and the card’s rules can change the real cost of borrowing.

It also helps to understand the language issuers use. Some cards advertise “$0 balance transfer fee,” while others offer “introductory balance transfer fee” that is waived only during an early period, such as the first 60 days after account opening. A credit card without balance transfer fee may also come with restrictions, including minimum transfer amounts, limits based on your credit line, or exclusions for certain types of debt. In most cases, you cannot transfer debt within the same bank family, and you typically can’t transfer balances from a card issued by the same institution. Knowing these limitations up front reduces the risk of applying for a product that can’t accept your existing balances. It’s equally important to plan how you’ll use the new account; the best outcomes come when the new card is treated as a payoff tool rather than a new spending channel that adds fresh debt on top of old balances.

How balance transfer fees work and why a $0 fee matters

Balance transfer fees are usually assessed as either a flat amount (for example, $5 or $10) or, more commonly, a percentage of the transferred balance, often around 3% to 5%. If you move $10,000 and the fee is 5%, you pay $500 immediately, sometimes added to the new balance and therefore accruing interest if not paid right away. That one-time cost can be manageable when the promotional APR period is long and the interest savings are significant, but it’s still a hurdle. A credit card without balance transfer fee changes the payoff timeline because you begin with a lower starting balance compared to a fee-based transfer. That can translate into fewer months of payments, less total interest, and a simpler payoff plan. The impact is even more pronounced for people transferring multiple balances who might otherwise pay several fees across different transfers.

However, the value of a fee-free transfer depends on the full structure of the offer. Some issuers offset the lack of a transfer fee by offering a shorter promotional APR window, a higher post-promotional APR, or fewer ancillary benefits. Others make the deal highly competitive by pairing a $0 fee with a strong introductory APR and reasonable ongoing terms. It’s also possible that the fee is waived but only for a limited time after opening the account, meaning procrastination can turn a fee-free plan into a fee-based one. When comparing options, it’s helpful to run a simple scenario: estimate your monthly payment, calculate how much you can pay during the promo period, and project what remains afterward. A credit card without balance transfer fee tends to shine when you can pay most or all of the balance during the promotional APR window, because you capture both the fee savings and the interest savings in a concentrated timeframe.

Key features to compare beyond the fee

Even when you find a credit card without balance transfer fee, you’ll want to compare several other features that can materially change the total cost. The first is the length of the introductory APR period on balance transfers. A longer window provides more time to pay down principal without interest, but only if you actually direct payments toward the debt. Next is the standard APR after the promotional period ends. If the remaining balance is likely to persist beyond the promo window, a lower ongoing APR can reduce the sting later. The credit limit also matters because you can only transfer up to a portion of your available line, and some issuers cap transfers at a percentage of the total limit. If your goal is to consolidate multiple accounts, a higher starting limit can make consolidation realistic rather than partial.

You should also evaluate how payments are applied when you make purchases on the same card. Some issuers allocate payments in ways that can cause purchases to accrue interest while transferred balances are at 0%, particularly if you don’t pay the statement balance in full. That means a fee-free transfer can still become expensive if you start using the card for everyday spending. Look for terms that clarify whether the card offers a 0% intro APR on purchases as well, and whether there is a grace period. Other items worth comparing include annual fees, penalty APR policies, late payment consequences, foreign transaction fees, and whether the issuer offers hardship options or flexible due dates. A credit card without balance transfer fee is often used as a debt payoff instrument, so features that support on-time payments—like autopay, alerts, and the ability to choose a due date—can be as valuable as the fee waiver itself.

Who benefits most from a fee-free balance transfer

A credit card without balance transfer fee can be especially helpful for borrowers who have solid credit and a clear payoff plan. If you’re carrying high-interest revolving debt and can commit to a structured monthly payment that retires the balance during the introductory APR period, the combination of low or 0% interest and a waived fee can produce meaningful savings. This is often the case for people who experienced a temporary expense spike—medical bills, car repairs, or a short-term income disruption—and now have stable cash flow again. For them, the balance transfer becomes a bridge from high-cost interest to a disciplined payoff schedule. The fee waiver effectively lowers the starting principal and can reduce the psychological burden of seeing the balance jump right after the transfer.

Fee-free transfers can also benefit people consolidating multiple small balances. When you have three or four cards with moderate amounts, the cumulative cost of transfer fees can add up quickly if you move each balance separately. A single credit card without balance transfer fee may allow you to consolidate those balances without paying a percentage fee on each one, assuming the limit is high enough and the issuer accepts multiple transfers. That said, this approach works best when you stop using the old cards for new purchases, or you at least avoid carrying new balances. Another group that may benefit includes borrowers who are near the edge of being able to pay off the debt: if a fee would push the amount just beyond what they can realistically clear during the promo period, removing the fee might be the difference between finishing on time and carrying an expensive remainder. In practice, the best candidate is someone who can combine the fee savings with behavioral changes—budgeting, cutting discretionary spending, or increasing income—so the transfer becomes a turning point rather than a temporary reshuffling.

Potential drawbacks and hidden costs to watch for

While a credit card without balance transfer fee can look like an obvious win, there are still pitfalls that can undermine the benefit. One common issue is the promotional APR period ending before the balance is paid off. If you transfer a large amount and only make minimum payments, you may still owe most of the balance when the standard APR applies, and that APR can be high. Another risk is missing a payment. Many issuers reserve the right to end promotional terms if you pay late, and some may apply a penalty APR. Even a single slip can turn a carefully planned payoff into a costly situation, especially if the issuer retroactively changes terms or removes the promotional rate going forward. That’s why automation—autopay at least the minimum, plus reminders for additional principal payments—can be essential.

There are also behavioral traps. Some consumers view a balance transfer as a fresh start and then run up balances again on the old cards, creating a larger total debt load. A fee-free transfer doesn’t solve underlying spending patterns; it only changes the interest and fee structure. Another subtle cost can come from using the new card for purchases while carrying a transferred balance. Depending on the issuer’s policies, you may lose the grace period on purchases, causing interest to accrue immediately. If the card doesn’t offer a 0% intro APR on purchases, those new charges can become expensive. Additionally, keep an eye on balance transfer timing. Some offers waive the transfer fee only within a short window after account opening, and transfers initiated later may incur fees. Finally, credit score dynamics matter: opening a new account can cause a short-term dip from the hard inquiry and reduced average age of accounts, even though utilization may improve. A credit card without balance transfer fee is still a credit product, and it requires careful management to ensure the savings are real and lasting.

How to calculate savings with real-world scenarios

To evaluate a credit card without balance transfer fee, it helps to compare at least two scenarios: staying on your current card(s) versus transferring. Start by identifying the current APR and the balance amount. Next, estimate how much you can pay each month. If your current APR is high, a large portion of each payment may be consumed by interest, slowing principal reduction. Now compare that with a transfer offer that provides a 0% introductory APR for a set period and no transfer fee. In the transfer scenario, nearly all of your monthly payment goes to principal during the promotional period, assuming you avoid new purchases that accrue interest. Even without complex calculators, you can approximate the difference: if you pay $500 per month on a $6,000 balance, a long 0% period can allow you to retire the debt in about 12 months, whereas a high APR might extend the payoff and raise total interest significantly.

Then consider edge cases. If the promotional period is 12 months but your payoff plan requires 18 months, the remaining balance will be subject to the standard APR for six months or longer. In that case, the savings might still be positive, but smaller, and you should compare it to alternatives like a lower-APR personal loan or a different transfer card with a longer promotional window even if it has a small fee. The unique advantage of a credit card without balance transfer fee becomes clearer when you’re transferring a large balance and intend to pay aggressively. Eliminating a 3% to 5% fee can be equivalent to several months of interest on its own. Also factor in annual fees: a fee-free transfer on a card with an annual fee might still be worthwhile, but only if the interest and fee savings outweigh that annual cost. The most practical approach is to set a target payoff date and verify that your monthly payment can meet it under the promotional terms, leaving no balance—or as little as possible—when the standard APR kicks in.

Eligibility, credit score considerations, and approval odds

Approval for a credit card without balance transfer fee typically depends on creditworthiness, income, existing debt, and recent credit behavior. Issuers look at your credit score, but also at your debt-to-income ratio, utilization, and whether you have recent delinquencies. Many of the strongest balance transfer offers are aimed at borrowers with good to excellent credit, though some issuers provide competitive terms to people in the fair range as well. If your score is borderline, you might still be approved but with a lower credit limit, which can restrict how much you can transfer. That can lead to partial consolidation, where you still carry balances elsewhere at higher rates, reducing the overall benefit of the move.

| Option | Best for | Key pros (re: no balance transfer fee) | Watch-outs |

|---|---|---|---|

| No-balance-transfer-fee credit card | Moving debt while minimizing upfront costs |

|

|

| 0% intro APR balance transfer card (with fee) | Paying down a large balance over a longer promo window |

|

|

| Personal loan (debt consolidation) | Fixed payments and a set payoff date |

|

|

Expert Insight

Confirm the balance transfer fee is truly $0 by checking the card’s pricing terms for both introductory and ongoing periods, and note any time limits to qualify. If the $0 fee applies only within the first 60–90 days, schedule the transfer immediately after approval and request the exact payoff amount from your current issuer to avoid residual interest. If you’re looking for credit card without balance transfer fee, this is your best choice.

Choose a card with a 0% intro APR long enough to eliminate the balance, then set a fixed monthly payment that pays it off before the promotional period ends. Avoid new purchases on the transfer card unless it offers 0% on purchases too, and keep utilization low to protect your credit score while you pay down the debt. If you’re looking for credit card without balance transfer fee, this is your best choice.

It’s also important to anticipate how the application will affect your credit profile. A new account can slightly lower your score in the short term due to the hard inquiry and reduced average age of accounts. On the other hand, transferring balances can reduce utilization on your existing cards, which may improve your score if you avoid running them back up. If you’re preparing for a major loan—like a mortgage—timing matters, and it may be wise to avoid new credit applications shortly before underwriting. Additionally, some issuers consider how many cards you’ve opened recently and may deny applicants with frequent new accounts. If your goal is specifically a credit card without balance transfer fee, it can help to strengthen your application by paying down utilization before applying, verifying your income information, and avoiding multiple applications in a short window. Once approved, keep the account in good standing: on-time payments during a promotional period can preserve the favorable terms and may also position you for credit line increases over time, which can help with utilization if managed responsibly.

Steps to execute a balance transfer smoothly

Once you decide on a credit card without balance transfer fee, execution matters. Start by confirming the offer details in writing: the length of the promotional APR, whether the transfer fee is truly $0 or waived only during a limited period, and whether there are any minimum or maximum transfer amounts. Next, gather your existing account information, including creditor names, account numbers, and payoff amounts. Most issuers allow you to initiate the transfer during the application or immediately after approval through an online dashboard. It’s wise to request transfers as soon as possible if the fee waiver is time-limited. During the transfer process, continue making at least the minimum payments on your old cards until you see the balances updated to zero or to the expected remaining amount. Transfers can take days or even a couple of weeks, and missing a payment on the old account during that window can trigger late fees and credit reporting issues.

After the transfer posts, create a payoff plan that fits the promotional period. Divide the transferred balance by the number of months in the 0% window to estimate the monthly payment needed to finish on time. If you can pay more, do it early; early principal reduction reduces risk if an unexpected expense disrupts your plan later. Also consider how you’ll handle the old cards. Many people benefit from leaving them open to preserve credit history and available credit, but they should be used cautiously—ideally not at all until the transferred debt is gone. Set up autopay for at least the minimum on the new account and schedule additional payments aligned with your paycheck cycle. Finally, avoid new purchases on the transfer card unless you understand the issuer’s payment allocation rules and purchase APR terms. A credit card without balance transfer fee can be a powerful tool, but only if the transfer is completed correctly, payments are consistent, and the card is treated as a payoff vehicle rather than a spending extension.

Alternatives if you can’t find the right fee-free offer

If a credit card without balance transfer fee isn’t available to you or the promotional terms don’t fit your timeline, there are several alternatives that can still reduce borrowing costs. Some balance transfer cards charge a fee but offer a longer 0% APR period, which can be more valuable if you need extra time to pay off the debt. In that case, the fee might be outweighed by interest savings, especially if your current APR is very high. Another option is a low-interest personal loan used for debt consolidation. Personal loans typically have fixed monthly payments and a set payoff date, which can help with discipline and budgeting. The tradeoff is that you may pay origination fees or a higher rate than a promotional 0% card, but the structure can reduce the risk of lingering revolving debt.

You can also explore a credit union card with a lower ongoing APR, even if it doesn’t have a promotional period. For borrowers who can’t qualify for top-tier promotions, a lower standard rate can still reduce interest substantially over time. Another alternative is negotiating with your current issuer. Some issuers offer temporary hardship rates or promotional APR reductions to retain customers, especially if you have a history of on-time payments. While that won’t replicate the exact benefit of a credit card without balance transfer fee, it can lower costs without requiring a new application. Finally, if debt levels are unmanageable, a nonprofit credit counseling agency may help you evaluate a debt management plan that can reduce interest rates and consolidate payments. The key is to compare total cost, payoff timeline, and behavioral fit. A fee-free transfer is attractive, but it’s not the only path to reducing interest and regaining control; the best solution is the one you can follow consistently until the balance reaches zero.

Best practices to stay debt-free after the transfer

Using a credit card without balance transfer fee effectively is only half the challenge; the other half is preventing the debt from returning. A practical first step is to create a spending plan that prioritizes essentials, sets realistic limits for discretionary categories, and allocates a fixed amount to debt repayment each month. Many people succeed by tying extra payments to specific triggers, such as every paycheck or every time they receive a bonus or tax refund. It also helps to build a small emergency fund—even a few hundred dollars—so unexpected expenses don’t go back onto a card. If you transferred balances from multiple cards, consider what led to the debt accumulation in the first place. Was it irregular income, medical expenses, overspending, or a lack of savings? Addressing the root cause makes the payoff sustainable.

Another best practice is to simplify your credit ecosystem. Keep old accounts open if they help your credit utilization and history, but remove temptation by deleting saved card numbers from online retailers, lowering credit limits if necessary, or using a debit card for routine purchases during the payoff phase. If you do keep using credit, aim to pay the statement balance in full each month to preserve the grace period and avoid interest. Monitor statements for errors and track your progress visually, because momentum matters. Also, be mindful of the promotional period end date and set calendar reminders months in advance. If you anticipate that you won’t finish on time, you can adjust by increasing payments early, exploring a second-stage plan like a fixed-rate loan, or temporarily reducing discretionary spending. The real advantage of a credit card without balance transfer fee is that it can create a clean runway to eliminate debt; maintaining the win requires habits that keep spending aligned with income and protect you from financial surprises.

Choosing the right credit card issuer and reading the fine print

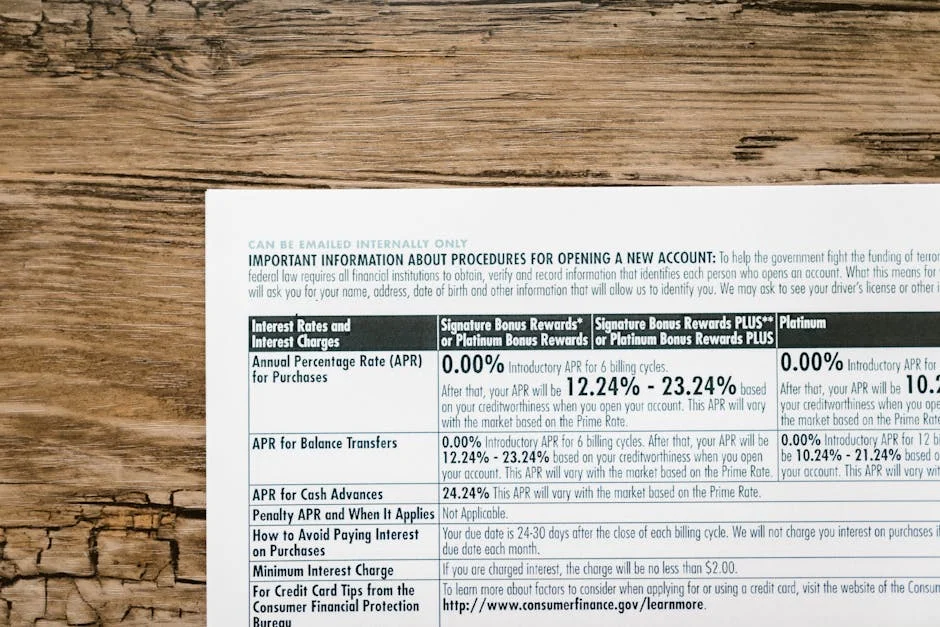

Not all issuers structure a credit card without balance transfer fee in the same way, and the fine print often determines whether the offer is truly valuable. Start by reviewing the Schumer box and the balance transfer disclosures. Confirm the APR on balance transfers during the promotional period, the APR after the promotion, and any conditions that can terminate the promotional rate. Look for language about “introductory fee” versus “no fee,” and verify whether the fee waiver applies to all transfers or only those initiated within a specific number of days. Also check whether the issuer charges interest from the date of transfer if you don’t pay by the due date; promotional offers usually prevent that, but terms vary. If you’re transferring a large amount, it’s worth checking whether the issuer limits the amount you can transfer to a percentage of your credit line, such as 75% or 90%.

Issuer reputation and servicing tools matter, too. A strong mobile app, easy payment scheduling, due date flexibility, and responsive customer service can reduce the risk of mistakes that jeopardize promotional terms. Consider whether the issuer provides free credit score tracking, payment reminders, and autopay options that allow both minimum and fixed extra payments. Also pay attention to dispute resolution and statement clarity, particularly if you’re managing multiple transfers. If you anticipate any international travel or foreign purchases, evaluate foreign transaction fees, though ideally you won’t be making discretionary purchases while paying down transferred debt. Some consumers also value the ability to set spending controls or freeze the card temporarily. A credit card without balance transfer fee is most effective when it is simple to manage and hard to misuse. Reading the fine print isn’t about being overly cautious; it’s about ensuring the savings you expect will actually materialize under the rules that govern the account.

Final thoughts on using a credit card without balance transfer fee strategically

A credit card without balance transfer fee can be a high-impact tool for reducing the cost of existing debt, but its success depends on matching the offer to your payoff timeline and managing the account with discipline. The strongest outcomes come when the promotional APR period is long enough to eliminate the balance, payments are automated to avoid late fees, and new spending is kept off the card until the payoff is complete. When those pieces align, the lack of a transfer fee means you start with less principal, build momentum faster, and keep more of your money working toward the goal of being debt-free. When they don’t align—when the promo period is too short, payments are inconsistent, or spending continues—the fee waiver alone won’t prevent interest costs from returning later.

Before applying, it’s worth running a realistic budget-based payoff plan, confirming the issuer’s rules for transfers, and deciding how you’ll handle old accounts so you don’t re-accumulate balances. If you can’t qualify for the ideal terms, alternatives like longer 0% offers with a small fee, lower-APR credit union cards, or fixed-rate consolidation loans can still provide a path forward. The most important factor is follow-through: consistent payments, clear milestones, and safeguards against new debt. Used with intention, a credit card without balance transfer fee can turn a frustrating cycle of interest charges into a structured payoff schedule that ends with a zero balance and a healthier financial routine.

Watch the demonstration video

In this video, you’ll learn how a credit card with no balance transfer fee can help you move existing debt without paying extra upfront costs. We’ll cover how these cards work, what to look for in APR and promotional periods, potential pitfalls, and tips for choosing the best option to save money and pay down balances faster. If you’re looking for credit card without balance transfer fee, this is your best choice.

Summary

In summary, “credit card without balance transfer fee” is a crucial topic that deserves thoughtful consideration. We hope this article has provided you with a comprehensive understanding to help you make better decisions.

Frequently Asked Questions

What is a credit card without a balance transfer fee?

It’s a card that doesn’t charge a balance transfer fee (often 3%–5%) when you move existing debt from another card or loan onto it, at least during a promotional period. If you’re looking for credit card without balance transfer fee, this is your best choice.

Do no-fee balance transfer cards also offer 0% APR?

Sometimes, but not always. Some offer 0% APR for a set number of months, while others may have a low or standard APR—check the promotional APR length and the post-promo APR. If you’re looking for credit card without balance transfer fee, this is your best choice.

Are there hidden costs with a no balance transfer fee card?

Potentially. Watch for annual fees, shorter 0% APR periods, higher ongoing APR, late payment fees, and interest if you miss payments or don’t pay off the balance before the promo ends. If you’re looking for credit card without balance transfer fee, this is your best choice.

How much can I save by avoiding a balance transfer fee?

With the usual 3%–5% balance transfer fee, moving $5,000 could tack on an extra $150–$250 right away. Choosing a **credit card without balance transfer fee** can help you skip that upfront cost—so long as the offer genuinely charges $0 for the transfer.

What are the requirements to qualify for a no balance transfer fee card?

Approval often depends on credit score, income, and debt-to-income ratio. Many of the best offers require good to excellent credit, and the credit limit you receive affects how much you can transfer. If you’re looking for credit card without balance transfer fee, this is your best choice.

What should I look for when choosing a no balance transfer fee card?

Compare the 0% APR duration, regular APR after the promo, annual fee, transfer time window (e.g., first 60–120 days), eligible account types, and whether payments apply to the highest-APR balance first. If you’re looking for credit card without balance transfer fee, this is your best choice.

📢 Looking for more info about credit card without balance transfer fee? Follow Our Site for updates and tips!

Trusted External Sources

- Are there any cards with zero fees for balance transfers? – Reddit

Sep 30, 2026 … No, there are no cards that offer 0% Balance Transfer and $0 fee to do so. Best rate is 3%. That amount gets added to your debt and in pretty … If you’re looking for credit card without balance transfer fee, this is your best choice.

- Best No Balance Transfer Fee Credit Cards – NerdWallet

Dec 21, 2026 … For example, the ESL Visa Credit Card from ESL Federal Credit Union has no balance transfer fee, charges no annual fee and has a 0% APR on … If you’re looking for credit card without balance transfer fee, this is your best choice.

- What are Credit Cards with No Balance Transfer Fees – Citi.com

If you’re carrying credit card debt, a balance transfer card can be a smart way to lower interest and pay it off faster—especially if you choose a **credit card without balance transfer fee**, so more of your payment goes toward your balance instead of extra charges.

- Low Rate Credit Card | No Balance Transfer Fee – BECU

Does the BECU Low Rate Credit Card have an annual fee? No. The card has no annual fee, no balance transfer fee, no cash advance fee, and no foreign transaction … If you’re looking for credit card without balance transfer fee, this is your best choice.

- Best Balance Transfer Cards Of February 2026 – Bankrate

TD FlexPay Credit Card gives you one of our strongest balance transfer deals: enjoy a 0% introductory APR* on eligible balance transfers for the first 18 billing cycles. If you’re looking for a **credit card without balance transfer fee**, it’s a smart way to move existing debt and pay it down faster with predictable, interest-free payments during the intro period.