The cost of batteries in electric cars is the single biggest reason why two vehicles that look similar on a showroom floor can carry very different price tags, ownership profiles, and long-term value. The battery pack is not just a “fuel tank” replacement; it is also a structural and thermal system, a power delivery component, and a major part of the car’s onboard electronics ecosystem. When shoppers compare an EV to a gasoline car, it is tempting to focus on incentives, monthly payments, or estimated fuel savings. Yet the battery pack often represents the largest portion of manufacturing cost, the most expensive out-of-warranty component, and the strongest influence on range, performance, and resale pricing. That makes battery economics central to understanding why some EVs are priced as they are, why certain trims command a premium, and why used EV values can vary so widely depending on battery health and warranty coverage.

Table of Contents

- My Personal Experience

- Why the cost of batteries in electric cars matters more than the sticker price

- What makes up battery pack pricing: cells, modules, pack, and integration

- Battery chemistries and how they shift cost: LFP, NMC, NCA, and beyond

- How battery size (kWh) affects upfront EV pricing and trim differences

- Raw materials and supply chain: lithium, nickel, cobalt, graphite, and price volatility

- Manufacturing scale, gigafactories, and why production efficiency changes battery cost

- Battery replacement vs repair: what owners might pay and what drives the bill

- Expert Insight

- Battery warranties, degradation, and how they influence real-world cost

- Charging behavior and thermal management: hidden factors that change battery economics

- New vs used EVs: how battery health affects resale value and buyer confidence

- Second-life batteries, recycling, and whether they can reduce long-term costs

- What to expect in the next few years: pricing trends and practical buying guidance

- Watch the demonstration video

- Frequently Asked Questions

- Trusted External Sources

My Personal Experience

When I bought my used electric car, I thought I had a pretty good handle on the running costs—charging at home was cheap and maintenance was basically tires and wiper fluid. The battery cost didn’t feel real until the range started dropping faster than I expected during winter, and I took it in for a diagnostic. The service advisor walked me through the numbers: the battery was still under warranty, but if it weren’t, a replacement would’ve been several thousand dollars once you added labor and programming. I didn’t end up needing a new pack, but that estimate changed how I budgeted for the car and pushed me to pay closer attention to battery health reports, charging habits, and the fine print on warranty coverage. If you’re looking for cost of batteries in electric cars, this is your best choice.

Why the cost of batteries in electric cars matters more than the sticker price

The cost of batteries in electric cars is the single biggest reason why two vehicles that look similar on a showroom floor can carry very different price tags, ownership profiles, and long-term value. The battery pack is not just a “fuel tank” replacement; it is also a structural and thermal system, a power delivery component, and a major part of the car’s onboard electronics ecosystem. When shoppers compare an EV to a gasoline car, it is tempting to focus on incentives, monthly payments, or estimated fuel savings. Yet the battery pack often represents the largest portion of manufacturing cost, the most expensive out-of-warranty component, and the strongest influence on range, performance, and resale pricing. That makes battery economics central to understanding why some EVs are priced as they are, why certain trims command a premium, and why used EV values can vary so widely depending on battery health and warranty coverage.

It also matters because battery cost is not a single number that applies universally. Pack design, chemistry, cooling approach, cell format, supplier relationships, and production scale all affect what a manufacturer pays and what a consumer ultimately finances. Even the same model can have different pack sizes and chemistries across markets, which changes both upfront and replacement costs. On top of that, battery pricing is tied to global commodity markets such as lithium, nickel, cobalt, graphite, and manganese, along with local manufacturing labor costs and energy prices. When those inputs rise or fall, EV pricing can respond quickly, sometimes within a model year. Understanding the cost of batteries in electric cars helps set expectations about what portion of an EV purchase is “hardware,” what portion is “software and power electronics,” and what portion is tied to raw materials and supply chain constraints. It also clarifies why battery warranties are so prominent in EV marketing and why repairability, modularity, and certified remanufacturing are becoming increasingly important in the broader EV ecosystem.

What makes up battery pack pricing: cells, modules, pack, and integration

When people talk about battery cost, they often imagine a single component that can be swapped like a 12‑volt battery. In reality, the pack is a layered system with multiple cost centers. The largest share is typically the cells, which store energy and determine much of the pack’s performance characteristics. Cells can be cylindrical, prismatic, or pouch, and each form factor has different manufacturing yields, thermal behavior, and packaging efficiency. From there, cells are grouped into modules (in many designs), and modules are assembled into a pack housing that includes structural elements, crash protection, sealing, high-voltage wiring, and a battery management system (BMS). Thermal management—liquid cooling plates, heat exchangers, pumps, valves, and sensors—adds both cost and complexity, but it also protects longevity and fast-charging capability. These layers mean the cost of batteries in electric cars is not just the cost of “kWh capacity,” but also the cost of keeping that capacity safe and usable under real-world conditions.

Integration costs can be surprisingly significant. A battery pack must be mechanically integrated into the vehicle platform, often forming part of the floor structure. That requires engineering for rigidity, vibration, water intrusion, and crash energy management. Electrical integration includes high-voltage contactors, fuses, current sensors, isolation monitoring, and service disconnects. Software integration includes BMS algorithms for state-of-charge estimation, cell balancing, thermal control, and fault detection. These elements protect the pack and can extend service life, but they also affect price. Two packs with identical kWh can cost very different amounts depending on the sophistication of their thermal system, the robustness of their housing, and the complexity of their electronics. That is why it is common to see a spread in pricing across brands even when range numbers look similar. When evaluating the cost of batteries in electric cars, it helps to think in terms of “cell cost + pack overhead + integration engineering,” rather than a single simplistic number.

Battery chemistries and how they shift cost: LFP, NMC, NCA, and beyond

Chemistry is a major driver of battery pricing because it determines which materials are required, how much energy can be stored per kilogram, and how the pack behaves over years of use. Lithium iron phosphate (LFP) batteries generally avoid nickel and cobalt, which can reduce exposure to volatile commodity prices and ethical sourcing concerns. LFP often has strong cycle life and thermal stability, making it attractive for standard-range vehicles and fleets. Nickel manganese cobalt (NMC) chemistries are common in higher-range applications because they can deliver higher energy density, which helps achieve more miles without increasing pack size and weight. Nickel cobalt aluminum (NCA) is another high-energy-density family, historically used in certain performance and long-range applications. The tradeoff is that higher-energy chemistries can require more expensive materials and more stringent thermal management, influencing the cost of batteries in electric cars at both the pack and vehicle level.

Those chemistry choices ripple into real purchasing decisions. LFP packs can be larger for the same range due to lower energy density, but the chemistry can be cheaper per kWh and can tolerate frequent charging patterns well, sometimes encouraging owners to charge to higher daily limits. NMC or NCA packs can deliver more range in a smaller footprint, but they may cost more and rely on supply chains tied to nickel and cobalt markets. Manufacturers also tune chemistry and pack design to balance performance, cold-weather behavior, fast-charge acceptance, and warranty risk. This is why two EVs with similar MSRP can have different battery strategies: one might choose a cost-stable LFP approach for mainstream affordability, while another pursues higher energy density for premium range. As chemistry evolves, the cost of batteries in electric cars can shift quickly—especially as manufacturers move toward high-manganese cathodes, silicon-enhanced anodes, or other next-generation approaches intended to lower material costs while maintaining performance.

How battery size (kWh) affects upfront EV pricing and trim differences

Battery capacity is often measured in kilowatt-hours (kWh), and it directly influences range, weight, charging time, and cost. Bigger packs require more cells, more structural support, and often more robust cooling to manage heat during fast charging and sustained high power demand. That extra hardware typically increases vehicle cost, which is why higher-range trims command a noticeable premium. However, the relationship is not always linear. Some vehicles share the same pack enclosure and add more cells in higher trims, while others use different pack configurations entirely. Additionally, larger packs can allow for higher peak power outputs and better performance consistency, which can position a trim as “premium” beyond range alone. Understanding these relationships helps decode why a seemingly modest increase in rated miles can translate to a sizable jump in MSRP, reflecting the underlying cost of batteries in electric cars and the engineering that supports them.

There are also strategic pricing decisions that can obscure the true pack cost. Automakers may subsidize certain trims to hit competitive price points or qualify for incentives, then recover margin on higher trims with larger packs, upgraded motors, or premium interiors. In other cases, a manufacturer may offer a “standard range” model that uses a different chemistry like LFP to lower cost and reduce dependency on constrained materials. Buyers should also consider that more kWh can reduce charging frequency and provide a buffer against cold-weather range drops, but it also increases curb weight, which can affect efficiency and tire wear. From a long-term perspective, a larger pack may experience less relative stress for a given daily mileage because it cycles through a smaller percentage of capacity each day, potentially supporting longevity. Yet it is not guaranteed, because thermal management, charging habits, and climate matter too. The key is that pack size is one of the most visible knobs controlling the cost of batteries in electric cars, but it interacts with many less visible design choices.

Raw materials and supply chain: lithium, nickel, cobalt, graphite, and price volatility

The pricing of battery packs is tied to a global web of mining, refining, chemical processing, and cell manufacturing. Lithium is central, but it is not the only variable. Nickel can be a major cost input for high-energy cathodes, and cobalt—while used in smaller quantities in modern cells than in the past—still affects cost and sourcing complexity. Graphite (natural or synthetic) is critical for anodes, and its processing capacity can create bottlenecks. Manganese, aluminum, copper, and electrolyte solvents also contribute to the bill of materials. When commodity prices spike, cell manufacturers face higher costs that can filter into pack pricing with a delay depending on contract structures and inventory levels. That is why the cost of batteries in electric cars can fluctuate across years and even within a single model generation, sometimes resulting in mid-cycle price adjustments or shifting chemistry choices.

Supply chain geography matters as well. Refining and processing capacity is concentrated in certain regions, and geopolitical factors can influence availability and pricing. Shipping costs, currency exchange rates, and trade policies can all affect what a manufacturer pays for cathode and anode materials or finished cells. Automakers increasingly pursue long-term contracts, vertical integration, or localized supply chains to stabilize costs and qualify for regional incentive programs. Recycling is also becoming part of the supply chain story, as recovered lithium, nickel, and cobalt can reduce dependency on newly mined materials over time. However, recycling at scale requires infrastructure and a steady stream of end-of-life packs, which is still developing. For consumers, the impact is indirect but real: a stable supply chain can lead to more predictable EV pricing and potentially lower replacement costs. A stressed supply chain can push manufacturers to prioritize higher-margin vehicles, affecting availability and the cost of batteries in electric cars across the market.

Manufacturing scale, gigafactories, and why production efficiency changes battery cost

Battery manufacturing is capital-intensive, and the cost per kWh tends to fall as factories scale, yields improve, and processes become more automated. Large plants benefit from purchasing power, standardized equipment, and learning curves that reduce scrap rates and improve throughput. Even small improvements in yield can have major economic effects because cell manufacturing involves tight tolerances, quality control, and expensive materials. As factories mature, they can produce more cells with fewer defects, which reduces the “hidden” cost embedded in each usable cell. This is one reason the cost of batteries in electric cars has trended downward over the long term, despite periodic commodity-driven spikes. It also explains why newer entrants often face higher costs initially: they have not yet optimized production lines, supplier networks, and quality systems at scale.

Pack assembly and vehicle integration also benefit from scale and platform standardization. When a manufacturer uses a common pack architecture across multiple models, it can spread R&D costs across more units and simplify service procedures. Standardized modules, shared cooling components, and common BMS hardware can reduce unit costs. Some manufacturers also pursue “cell-to-pack” or “cell-to-body” approaches that reduce the number of parts, potentially lowering pack overhead and improving energy density at the vehicle level. These approaches can reduce weight and simplify assembly, but they can also affect repairability, which may influence long-term ownership costs. For shoppers, the practical takeaway is that high-volume EVs often have more competitive pricing because the underlying battery system is produced efficiently. Over time, as more factories come online and processes improve, the cost of batteries in electric cars can decline, but the pace depends on both manufacturing learning curves and raw material conditions.

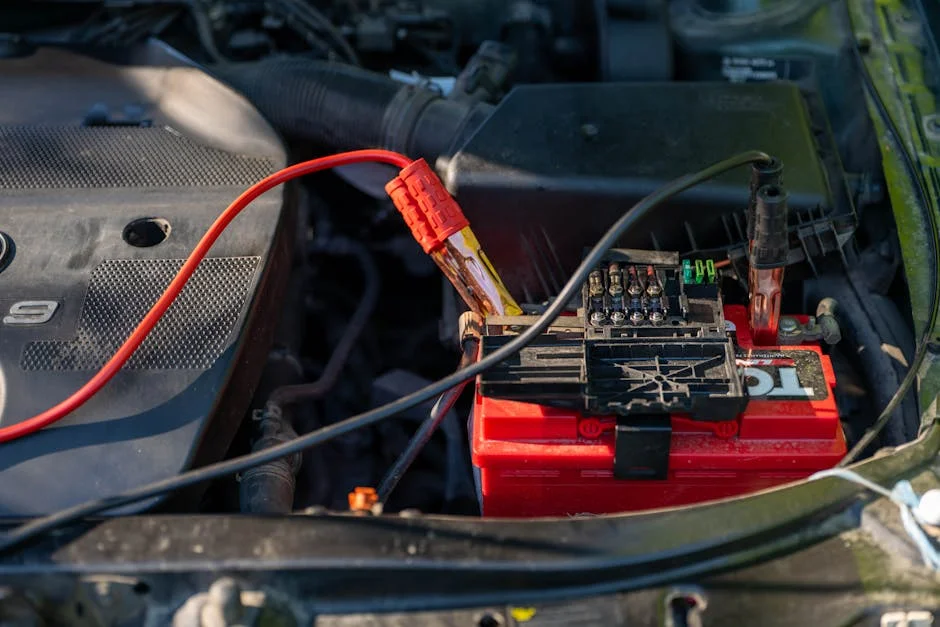

Battery replacement vs repair: what owners might pay and what drives the bill

One of the most anxiety-inducing topics for potential EV buyers is the possibility of battery replacement. The reality is that full pack replacement is relatively uncommon within typical warranty periods, but it can happen due to manufacturing defects, severe damage, or degradation beyond acceptable limits. The cost of batteries in electric cars becomes most visible in these scenarios because the pack is a high-value component. Replacement pricing can include not only the pack itself but also labor, diagnostic time, programming, coolant service, and sometimes ancillary parts. The final bill can vary widely based on pack size, chemistry, vehicle design, and whether the replacement is new, remanufactured, or refurbished. Insurance may cover replacement after an accident, but coverage details and deductibles matter. Understanding the difference between a catastrophic failure and a module-level issue is crucial, because many modern packs can be serviced in a targeted way under the right conditions.

| Aspect | What it means for EV battery cost | Typical impact |

|---|---|---|

| Battery size (kWh) | Larger packs require more cells/materials, increasing the battery’s share of the vehicle price. | Higher range models generally cost more; pack cost scales roughly with kWh capacity. |

| Chemistry (LFP vs NMC/NCA) | Different cathode materials and supply chains drive different $/kWh and performance tradeoffs. | LFP is often cheaper and more stable; NMC/NCA typically costs more but can offer higher energy density. |

| Raw material & supply chain volatility | Lithium, nickel, cobalt prices and refining capacity swings can raise or lower pack pricing. | Costs can fluctuate year-to-year; long-term contracts and recycling can reduce exposure. |

Expert Insight

When comparing electric cars, focus on battery cost per kWh and the warranty terms, not just the sticker price. Look for a long warranty (e.g., 8 years/100,000 miles or more) with a clear minimum capacity retention clause, and ask for the battery’s usable capacity (not just gross) to better estimate real-world replacement risk. If you’re looking for cost of batteries in electric cars, this is your best choice.

Reduce long-term battery expense by protecting battery health: keep daily charging in a moderate range (often 20–80% unless you need full range), avoid frequent fast-charging when it’s not necessary, and precondition the battery before rapid charging in extreme temperatures. These habits can slow degradation and help you avoid an early, costly replacement. If you’re looking for cost of batteries in electric cars, this is your best choice.

Repairability is improving as independent service networks, certified remanufacturing programs, and specialized diagnostics become more common, but it still depends heavily on how the pack was engineered. Some packs are designed with modules that can be replaced individually, while others are more integrated. Even in modular designs, matching modules by age, chemistry, and state of health is important for balanced performance. Safety requirements also raise labor costs: high-voltage systems require trained technicians, specialized tools, and strict procedures. That said, not every battery issue requires a replacement. Problems can stem from contactors, wiring, coolant leaks, or BMS sensor faults, which may be cheaper to address than cell-level degradation. For used EV shoppers, service records and battery health reports can reduce uncertainty. While it is wise to plan for long-term maintenance, the cost of batteries in electric cars should be viewed in context: many owners will never face a full replacement, and the market for repairs and remanufactured packs is expanding, which can help reduce worst-case outcomes.

Battery warranties, degradation, and how they influence real-world cost

Battery warranties are a key part of EV value because they shift risk away from the owner during the years when most people finance or lease a vehicle. Typical coverage includes a time limit and mileage limit, along with a minimum retained capacity threshold. This matters because lithium-ion batteries naturally degrade over time due to calendar aging and cycling. The rate of degradation depends on temperature exposure, charging patterns, average state of charge, and how often the pack experiences high power demand. A robust warranty can make the cost of batteries in electric cars less intimidating by ensuring that premature capacity loss or defects are addressed without a major out-of-pocket expense. However, warranties are not all the same, and the fine print can matter, especially regarding what constitutes normal degradation versus a warrantable failure.

Degradation affects cost in more subtle ways, too. Even if the pack never needs replacement, reduced range can change the usability of the vehicle and influence resale value. A used EV with a healthy pack can command a premium, while one with noticeable range loss may be discounted, even if it still functions reliably. Battery health assessments—based on diagnostic tools, onboard data, or third-party testing—are becoming more common in the used market for this reason. Owners can often slow degradation by avoiding prolonged exposure to high heat, limiting frequent fast charging when not needed, and using moderate daily charge limits if recommended by the manufacturer. These habits can preserve practical range and reduce the likelihood of costly interventions later. In that sense, the cost of batteries in electric cars is not only a manufacturing and replacement story; it is also a lifecycle story where user behavior, climate, and software updates can influence how much value remains in the battery over years of ownership.

Charging behavior and thermal management: hidden factors that change battery economics

Charging is where owners interact most directly with the battery, and it has a meaningful impact on longevity and perceived value. Fast charging is convenient, but it introduces higher heat and can increase stress on cells, especially if done frequently at high states of charge or in very hot conditions. Slow charging at home is generally gentler, but keeping a battery at 100% for extended periods can also accelerate aging in some chemistries. Thermal management systems—liquid cooling, heat pumps, active heating, and smart preconditioning—help mitigate these stresses by keeping cell temperatures in an optimal range during charging and driving. Vehicles with more advanced thermal control may preserve battery health better, which can reduce long-term ownership risk even if the upfront cost is higher. This is an often-overlooked angle of the cost of batteries in electric cars: spending more on better thermal engineering can translate into slower degradation and stronger resale value.

Climate plays a major role as well. Cold temperatures can reduce available power and range temporarily, leading some drivers to charge more frequently or to higher limits, which can affect cycling patterns. Hot climates can accelerate calendar aging if the battery spends long periods at elevated temperature, especially when parked outdoors. Software helps manage these conditions by limiting charging speeds when the pack is cold, preconditioning before fast charging, and controlling cooling while parked in certain situations. These systems can reduce wear but may consume energy, affecting efficiency. Over time, the “true cost” of the battery includes not only what it costs to build but also how it holds up under a driver’s real routine. A driver with frequent road trips and heavy reliance on DC fast charging may see a different degradation curve than someone who charges at home nightly. Understanding these dynamics helps buyers interpret the cost of batteries in electric cars beyond simple purchase price comparisons, because two owners of the same model can experience different long-term value depending on charging habits and environment.

New vs used EVs: how battery health affects resale value and buyer confidence

The used EV market highlights battery value more explicitly than the new market because the battery’s condition becomes a differentiator in a way that is less visible when everything is under warranty. Buyers often ask how much range remains, whether the vehicle has been fast-charged heavily, and whether the pack has had any repairs. Sellers, meanwhile, may emphasize remaining warranty coverage and provide screenshots of battery status from the vehicle’s menus. The cost of batteries in electric cars influences used pricing because the battery is effectively the “engine” and “fuel system” combined; if a buyer suspects the pack is near the end of its useful life, they will discount the car accordingly. That said, many used EVs retain strong battery health, especially those with good thermal management and moderate usage patterns. The challenge is information asymmetry: without standardized reporting, it can be hard to compare one used EV to another.

Battery health reporting is improving through dealer certifications, third-party inspection services, and diagnostic tools that estimate state of health based on charge curves and onboard data. Buyers can also look for practical signals such as consistent range estimates after a full charge over time, charging speed behavior at fast chargers, and error codes or warning lights. It is also wise to consider how the vehicle was used: a high-mileage commuter car may have many cycles but relatively gentle charging, while a lower-mileage road-trip car may have extensive fast charging. Neither automatically implies poor health, but it helps set expectations. The presence of a transferable battery warranty can materially reduce risk and support higher resale values. Over the next few years, as more EVs reach second and third owners, transparency around battery condition will likely become a standard part of listings. In that environment, the cost of batteries in electric cars will show up not only as a new-car pricing factor but also as a measurable attribute shaping depreciation curves and buyer confidence in the used market.

Second-life batteries, recycling, and whether they can reduce long-term costs

As EV adoption grows, the industry is building pathways for batteries after their automotive life. Even when a pack no longer meets a driver’s range expectations, it may still have substantial capacity left for less demanding applications such as stationary energy storage. “Second-life” use can create additional value from the same battery, which can improve overall economics and sustainability. If second-life markets mature, they can support higher residual values for used EVs because the pack retains salvage value beyond the vehicle’s service life. Recycling, meanwhile, aims to recover valuable materials like lithium, nickel, cobalt, and copper, which can be fed back into new cell production. Both second-life use and recycling have the potential to soften the impact of the cost of batteries in electric cars over the long run by creating end-of-life value streams and reducing dependence on newly mined materials.

However, these benefits are not automatic. Second-life deployment requires testing, grading, repackaging, and warranties for stationary applications, which adds cost. Different chemistries and pack designs complicate standardization. Recycling also varies by process and region; some methods recover more materials than others, and profitability can depend on commodity prices and regulatory frameworks. Still, investment is accelerating, and many manufacturers are partnering with recyclers to create closed-loop supply chains. For consumers, the near-term impact may be subtle, but it can show up through stronger trade-in offers, more availability of remanufactured packs, and potentially more stable cell pricing as recycled materials scale. Over time, as recycling yields improve and logistics become more efficient, these systems can reduce the volatility that sometimes affects EV pricing. In that broader lifecycle view, the cost of batteries in electric cars is not only about what you pay at purchase or in a rare replacement event; it is also about how the battery’s remaining value can be captured through reuse and material recovery, supporting a more resilient and cost-effective EV ecosystem.

What to expect in the next few years: pricing trends and practical buying guidance

Battery pricing trends are shaped by a push and pull between technology improvements and commodity realities. On the technology side, manufacturing scale continues to grow, production techniques are improving, and new chemistries are targeting lower-cost materials. Pack-level innovations can reduce overhead by simplifying structures, improving packaging efficiency, and lowering the number of parts. On the commodity side, lithium and nickel markets can swing based on demand, new mining capacity, refining constraints, and geopolitical factors. Policy incentives and local content rules can also reshape supply chains, sometimes increasing short-term costs while building long-term stability. For shoppers, this means EV pricing can move in steps rather than in a smooth downward line. The cost of batteries in electric cars will likely continue to decline in the long run, but buyers should be prepared for periods where prices stabilize or even rise temporarily due to material constraints or rapid demand growth.

For practical decision-making, it helps to align battery choice with your driving pattern rather than chasing the biggest pack by default. If your daily driving is modest and home charging is available, a standard-range EV can offer strong value, especially if it uses a cost-stable chemistry and has a solid thermal management system. If frequent road trips are part of your routine, a larger pack may reduce charging stops and provide more flexibility in cold weather, but it comes with a higher upfront price and possibly higher insurance replacement exposure. Buyers comparing models should look beyond rated range to factors that influence battery value: warranty terms, charging curve performance, thermal management design, and service network capability. Used buyers should prioritize transparent battery health reporting and remaining warranty coverage when possible. Ultimately, understanding the cost of batteries in electric cars helps you evaluate an EV as a long-term energy and mobility asset, not just a vehicle purchase. In the final analysis, the cost of batteries in electric cars remains central to EV affordability, durability, and resale value, and it is the key lever that manufacturers, policymakers, and consumers will keep pulling as the market matures.

Watch the demonstration video

In this video, you’ll learn what drives the cost of electric car batteries and why prices have changed over time. It breaks down key factors like raw materials, manufacturing scale, battery chemistry, and supply chains, and explains how these costs affect EV prices, range, and the future affordability of electric vehicles. If you’re looking for cost of batteries in electric cars, this is your best choice.

Summary

In summary, “cost of batteries in electric cars” is a crucial topic that deserves thoughtful consideration. We hope this article has provided you with a comprehensive understanding to help you make better decisions.

Frequently Asked Questions

How much does an electric car battery cost to replace?

Replacement packs commonly range from about $5,000 to $20,000+, depending on vehicle model, battery size (kWh), and labor.

What determines the cost of an EV battery?

Several factors shape the **cost of batteries in electric cars**, including the battery pack’s capacity (kWh), the cell chemistry chosen (such as LFP versus NMC), and fluctuations in raw material prices. Thermal management systems, battery electronics like the BMS, manufacturing scale and efficiency, and the warranty and markup added by manufacturers also play major roles in the final price.

How is battery cost measured and compared?

It’s often discussed as dollars per kilowatt-hour ($/kWh). Pack-level cost (installed pack) is higher than cell-level cost (individual cells).

Are EV batteries getting cheaper over time?

In general, the **cost of batteries in electric cars** tends to drop over the long term as production scales up and manufacturing improves. However, prices can still swing from year to year, especially when the costs of key materials like lithium, nickel, and other components rise or fall.

Does battery size significantly affect the price of an electric car?

Yes—going with a larger battery can add thousands of dollars to the price, since the **cost of batteries in electric cars** generally rises with each additional kWh of capacity. While some components like the pack housing and control electronics are more fixed in price, the extra cells needed for a bigger pack are what usually drive most of the increase.

Can you replace only part of an EV battery to reduce cost?

In some cases, yes—certain EVs can be repaired at the module or even cell level, which may significantly reduce the **cost of batteries in electric cars** compared with replacing the entire pack. However, whether this is possible depends on the vehicle’s battery design, the results of diagnostic testing, parts availability, and the manufacturer’s warranty and service policies.

📢 Looking for more info about cost of batteries in electric cars? Follow Our Site for updates and tips!

Trusted External Sources

- Replacing an EV battery is still cheaper than owning a gas vehicle

Jan 30, 2026 … A replacement battery for a 2026 to 2026 VW e-Golf is quoted as $23,442.91 by Pignataro VW as of August 2026. Given that the 2026 e-golf battery … If you’re looking for cost of batteries in electric cars, this is your best choice.

- Electric vehicle battery prices are expected to fall almost 50% by 2026

As of Oct 7, 2026, our researchers project that the **cost of batteries in electric cars** could drop to around **$80 per kWh by 2026**—a decline of nearly **50%** compared with today’s levels.

- I keep reading articles about EV battery prices dropping, but I’m not …

Jan 2, 2026 … The fact that the battery is still $16,000 doesn’t just matter for replacing it. It also factors into the cost of the car. An EV is so expensive … If you’re looking for cost of batteries in electric cars, this is your best choice.

- Electric Car Battery Replacement Costs – Recurrent

As of Dec 3, 2026, replacing an electric car battery outside the warranty can be a major expense: the **cost of batteries in electric cars** typically falls between **$5,000 and $16,000**, with the final price largely depending on the battery pack’s size and the vehicle’s manufacturer.

- EV Battery Cost & Replacement | Chevrolet GMC Of Fairbanks

The **cost of batteries in electric cars** typically falls between **$6,500 and $20,000**. That may sound steep at first, but it helps to keep it in perspective: replacing an EV battery isn’t a regular maintenance item like oil changes or brake pads—it’s something most drivers may never need to do during the life of the vehicle.