Rent to own programs are an increasingly popular option for individuals seeking a path to homeownership, especially those who may not qualify for a traditional mortgage due to credit or income challenges. These programs typically involve entering into a rental agreement with an option to purchase the property after a specific period. This arrangement allows potential buyers to lock in a future purchase price while gaining more time to improve their financial situation.

Table of Contents

- My Personal Experience

- Understanding Rent to Own Programs

- How Rent to Own Programs Work

- Benefits of Rent to Own Programs

- Challenges of Rent to Own Programs

- Eligibility Criteria for Rent to Own Programs

- Choosing the Right Rent to Own Program

- Expert Insight

- Legal Considerations in Rent to Own Agreements

- Financing Options at the End of the Lease

- Alternatives to Rent to Own Programs

- Success Stories of Rent to Own Programs

- Watch the demonstration video

- Frequently Asked Questions

- Trusted External Sources

My Personal Experience

A few years ago, I found myself struggling to save enough for a down payment on a house, which seemed like a distant dream. That’s when I stumbled upon a rent-to-own program in my area. Initially, I was skeptical, but after researching and meeting with the property manager, I decided to give it a shot. The program allowed me to rent a cozy two-bedroom home with the option to purchase it after three years. A portion of my monthly rent was set aside to contribute to a future down payment. This arrangement gave me the time to improve my credit score and save more money, while also letting me experience living in the home before making a long-term commitment. By the end of the term, I was in a much better financial position and decided to buy the house, which had truly become my home. The rent-to-own program was a perfect stepping stone for me, turning what once felt impossible into a reality. If you’re looking for rent to own programs, this is your best choice.

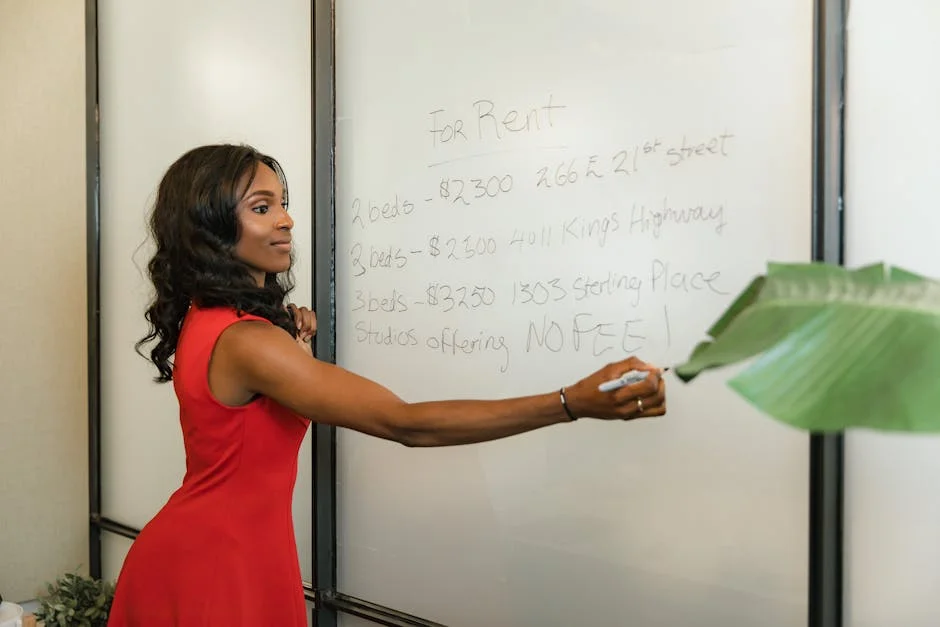

Understanding Rent to Own Programs

Rent to own programs are an increasingly popular option for individuals seeking a path to homeownership, especially those who may not qualify for a traditional mortgage due to credit or income challenges. These programs typically involve entering into a rental agreement with an option to purchase the property after a specific period. This arrangement allows potential buyers to lock in a future purchase price while gaining more time to improve their financial situation.

One key element of rent to own programs is the flexibility they offer. These programs are designed to bridge the gap between renting and owning, providing tenants with a unique opportunity to build equity in a property they already occupy. During the rental period, a portion of the rent paid is often credited towards the future purchase price, allowing the renter to accumulate equity over time. This arrangement can be particularly beneficial in a rising property market, where future home prices are expected to increase.

How Rent to Own Programs Work

Rent to own programs typically start with a lease agreement that outlines the terms of the rental period and the option to purchase the property. The agreement includes the purchase price, the duration of the lease, and any conditions that must be met for the option to be exercised. Some arrangements also require a non-refundable option fee, which is paid upfront and credited towards the purchase price if the option is exercised.

During the lease, the tenant pays monthly rent, with a portion often allocated towards the eventual purchase. This arrangement helps renters save for a down payment while they continue to live in the home. At the end of the lease term, the tenant has the option to purchase the property at the predetermined price. If the option is not exercised, the tenant may forfeit any credits or fees paid. If you’re looking for rent to own programs, this is your best choice.

Benefits of Rent to Own Programs

Rent to own programs offer several benefits to potential homeowners. One significant advantage is the ability to lock in a purchase price at the beginning of the lease. This feature is especially appealing in rapidly appreciating markets where home prices could rise significantly over the lease term. Additionally, these programs provide an opportunity to test living in a community or a specific home before making a long-term commitment.

Another benefit is the gradual accumulation of equity and savings towards a down payment. For individuals with credit issues, rent to own programs offer a way to improve credit scores by demonstrating consistent, on-time rent payments. Moreover, the extended timeframe allows participants to enhance their financial standing, increasing the likelihood of mortgage approval when the time comes to purchase the home.

Challenges of Rent to Own Programs

Despite their benefits, rent to own programs also come with potential challenges. One major downside is the risk of losing the option fee and any accumulated credits if the tenant decides not to purchase the property or is unable to secure financing at the end of the lease. This risk highlights the importance of thoroughly understanding the terms of the agreement before committing.

Additionally, there can be higher overall costs compared to traditional renting or buying. Rent to own agreements often include higher monthly payments to account for the option fee and credits toward the purchase price. Maintenance responsibilities may also be included in the lease, placing the burden of repairs on the tenant, unlike typical rental agreements where the landlord handles these tasks. If you’re looking for rent to own programs, this is your best choice.

Eligibility Criteria for Rent to Own Programs

Eligibility for rent to own programs varies by provider, but common criteria include a minimum credit score, proof of stable income, and a background check. While these programs cater to individuals with credit challenges, low credit scores may limit the available options or result in unfavorable terms, such as higher option fees or interest rates.

Prospective participants should demonstrate a stable income sufficient to cover the rent and any additional fees associated with the program. Providers may require proof of employment or a steady source of income to ensure the tenant can meet the financial obligations of the agreement. A background check is also standard, confirming the applicant’s rental history and criminal record. If you’re looking for rent to own programs, this is your best choice.

Choosing the Right Rent to Own Program

Selecting the right rent to own program requires careful consideration of several factors. Research is essential to identify reputable providers with a history of successful transactions. Potential participants should investigate the program’s terms, including the purchase price, option fee, rental credits, and any maintenance responsibilities. If you’re looking for rent to own programs, this is your best choice.

| Feature | Rent-to-Own Program A | Rent-to-Own Program B | Rent-to-Own Program C |

|---|---|---|---|

| Initial Deposit | $5,000 | $3,000 | $4,500 |

| Contract Duration | 2 years | 3 years | 1 year |

| Rent Credit | 20% | 15% | 25% |

Expert Insight

When considering a rent-to-own program, it’s crucial to thoroughly evaluate the terms of the agreement. Ensure that you understand the purchase price, rent credits, and any additional fees involved. It’s advisable to consult with a real estate attorney or financial advisor to help you navigate the complexities and ensure that the terms align with your long-term financial goals. If you’re looking for rent to own programs, this is your best choice.

Another important tip is to conduct a comprehensive inspection of the property before signing any agreements. This includes checking for any potential repairs or maintenance issues that could affect the property’s value or your decision to eventually purchase it. Having a professional home inspector assess the property can provide you with a clearer picture of what you’re committing to and help you negotiate better terms if necessary. If you’re looking for rent to own programs, this is your best choice.

Understanding the local real estate market is also important. In areas with stagnant or declining property values, rent to own programs may not offer the anticipated benefits of price appreciation. Engaging with a real estate agent familiar with rent to own arrangements can provide valuable insights and help negotiate favorable terms.

Legal Considerations in Rent to Own Agreements

Legal considerations play a crucial role in rent to own agreements. It is advisable to consult with a real estate attorney to review the contract and ensure all terms are clear and enforceable. The contract should explicitly state the purchase price, option fee, rental credits, and conditions for exercising the purchase option. If you’re looking for rent to own programs, this is your best choice.

The agreement should also outline maintenance responsibilities, property taxes, and insurance provisions. Clarifying these aspects can prevent disputes and misunderstandings during the lease term. Legal counsel can also advise on any local regulations or laws that may impact the agreement, ensuring compliance and protecting the tenant’s rights. If you’re looking for rent to own programs, this is your best choice.

Financing Options at the End of the Lease

When the lease term concludes, participants in rent to own programs must secure financing to purchase the property. Several options are available, including conventional mortgages, FHA loans, and VA loans, each with specific requirements and benefits. The choice of financing depends on the buyer’s financial situation, credit score, and eligibility for special loan programs.

Working with a mortgage broker can facilitate the financing process, helping potential buyers understand their options and navigate the application process. Early preparations, such as improving credit scores and saving for a down payment, can increase the chances of securing favorable loan terms and successfully transitioning from renting to owning. If you’re looking for rent to own programs, this is your best choice.

Alternatives to Rent to Own Programs

While rent to own programs offer a unique pathway to homeownership, other alternatives exist for individuals unable to pursue traditional mortgages. Lease-purchase agreements, for instance, are similar but typically offer fewer consumer protections and may involve greater risk. In contrast, seller financing directly involves the seller in offering a loan, often with more flexible terms and fewer qualifications.

Government-backed loans, such as FHA or USDA loans, provide another viable option, requiring lower down payments and accommodating lower credit scores. These programs can effectively complement or replace rent to own arrangements, depending on the buyer’s circumstances and goals. If you’re looking for rent to own programs, this is your best choice.

Success Stories of Rent to Own Programs

Numerous success stories illustrate the potential benefits of rent to own programs. For many participants, these arrangements have provided a stepping stone to homeownership, helping them overcome financial obstacles and achieve their dreams of owning a home. Testimonials often highlight the relief and satisfaction of securing a property at a favorable price, especially in competitive markets.

The ability to live in the home while saving for a down payment and improving credit scores has enabled many individuals to transition smoothly from renting to owning. These stories emphasize the importance of due diligence, understanding the agreement fully, and selecting the right program to maximize benefits and minimize risks. If you’re looking for rent to own programs, this is your best choice.

Rent to own programs continue to evolve, offering innovative solutions for prospective homeowners. By understanding the mechanics, benefits, challenges, and legal considerations involved, participants can make informed decisions and successfully navigate the path to homeownership.

Watch the demonstration video

This video provides insights into rent-to-own programs, explaining how they offer a pathway to homeownership for those unable to secure traditional financing. Viewers will learn about the benefits, such as building equity while renting, and potential pitfalls, including higher costs and contract complexities, helping them make informed decisions about this alternative home-buying option. If you’re looking for rent to own programs, this is your best choice.

Summary

In summary, “rent to own programs” is a crucial topic that deserves thoughtful consideration. We hope this article has provided you with a comprehensive understanding to help you make better decisions.

Frequently Asked Questions

What is a rent to own program?

A rent to own program is an agreement where a tenant rents a property with the option to purchase it after a specific period.

How does a rent to own program work?

The tenant pays rent plus a premium, which can be credited towards the future purchase of the property.

What are the benefits of a rent to own program?

It allows potential buyers to build up credit, save for a down payment, and test living in the property before committing to buy.

Are there risks associated with rent to own programs?

Certainly! Here’s a more engaging version of the paragraph:

—

Participating in rent to own programs can be an exciting pathway to homeownership, but it’s essential to be aware of certain risks. For instance, if you choose not to purchase the home eventually, you might lose the option fee you’ve paid. Additionally, fluctuations in property value over time could impact the overall investment.

How long do rent to own contracts typically last?

Rent to own contracts usually last between one to three years, but terms can vary based on the agreement.

Can the agreed purchase price change in a rent to own agreement?

In rent to own programs, the purchase price is generally determined at the beginning of the agreement. However, certain contracts might offer flexibility by allowing for price adjustments that reflect changes in market conditions.

📢 Looking for more info about rent to own programs? Follow Our Site for updates and tips!

Trusted External Sources

- Rent-to-Own Homes Programs: 3 Options to Consider

Aug 18, 2025 … We compare four of the most reputable and legitimate rent-to-own programs to help you answer the question, “Is rent-to-own a good idea?”

- How Does Rent-To-Own Work? | Zillow

Sep 19, 2024 … Rent-to-own portals are online platforms that specialize in listing properties available for lease-option agreements. These portals work like …

- Lowe’s Lease to Own Program

Discover the freedom of owning your desired items in just 12 months or less with our rent to own programs. You won’t need to worry about credit checks when you apply for this convenient lease-to-own purchase option. Enjoy flexible payment plans tailored to your schedule, whether you prefer weekly, biweekly, or monthly installments, making it easier than ever to bring home what you love.

- 18 Florida Rent-to-Own Programs That Help You Buy Without a …

Mar 25, 2025 … This guide covers 18 rent-to-own options across Florida that are especially helpful for first-time buyers looking to skip the upfront costs.

- Legitimate rent-to-own programs? : r/RealEstate

Nov 23, 2018 … There are a few – but disclaimer, they aren’t called rent to own, but rather rent with an option to purchase. The difference being is you get to rent for 1 … If you’re looking for rent to own programs, this is your best choice.