Commercial rental property represents a significant sector within the real estate industry, providing spaces that cater to business needs. These properties range from small retail locations to expansive office buildings, and they play a crucial role in the infrastructure that supports economic activities. Understanding the dynamics of commercial rental properties involves recognizing the varying categories of these establishments, the factors that affect their pricing, and the economic forces that drive demand and supply.

Table of Contents

- My Personal Experience

- An Introduction to Commercial Rental Property

- Types of Commercial Rental Properties

- Location: The Heart of Commercial Rental Property

- Lease Agreements: Understanding the Basics

- The Role of Market Trends in Commercial Rental Property

- Investment Opportunities in Commercial Rental Property

- Expert Insight

- Financing Options for Commercial Rental Properties

- Challenges Facing Commercial Rental Property Investors

- The Impact of Technology on Commercial Rental Property

- Future Prospects for Commercial Rental Property

- Watch the demonstration video

- Frequently Asked Questions

- Trusted External Sources

My Personal Experience

Last year, I took the plunge into the world of commercial rental property by leasing a small storefront for my budding coffee shop. Navigating the process was a steep learning curve; I had to familiarize myself with lease agreements, zoning laws, and the nuances of negotiating terms with the landlord. The space was perfect, located in a bustling neighborhood with plenty of foot traffic, but it required significant renovations to suit my vision. Balancing the renovation costs with the monthly rent was challenging, but seeing my dream take shape was incredibly rewarding. I learned the importance of maintaining open communication with the property manager, especially when unexpected issues like plumbing repairs arose. Despite the challenges, the experience taught me invaluable lessons about entrepreneurship and managing a commercial space.

An Introduction to Commercial Rental Property

Commercial rental property represents a significant sector within the real estate industry, providing spaces that cater to business needs. These properties range from small retail locations to expansive office buildings, and they play a crucial role in the infrastructure that supports economic activities. Understanding the dynamics of commercial rental properties involves recognizing the varying categories of these establishments, the factors that affect their pricing, and the economic forces that drive demand and supply.

The landscape of commercial rental properties is ever-evolving, influenced by factors such as economic trends, technological advancements, and consumer behavior shifts. Business owners often seek spaces that not only meet their functional requirements but also align with their brand identity and customer engagement strategies. Consequently, the right commercial property can significantly impact a business’s success, affecting everything from employee productivity to customer perception. The choice of a commercial space, therefore, requires careful consideration of various elements including location, accessibility, and amenities. If you’re looking for commercial rental property, this is your best choice.

Types of Commercial Rental Properties

Commercial rental properties encompass a wide array of types, each serving specific business needs. Office spaces are perhaps the most common, ranging from single offices suitable for startups to entire floors or buildings for large corporations. These spaces require thoughtful design to foster collaboration and productivity, often featuring open layouts, private offices, and meeting rooms. If you’re looking for commercial rental property, this is your best choice.

Retail properties form another significant category, encompassing shopping malls, standalone stores, and strip centers. The success of these spaces largely depends on location and visibility, with prime spots demanding premium rents. Industrial properties, including warehouses and manufacturing facilities, are tailored for businesses that require large areas for production and storage, presenting unique zoning and accessibility considerations. Additionally, multi-family residential buildings, while primarily residential, may also include commercial tenants, blending residential living with business activities. If you’re looking for commercial rental property, this is your best choice.

Location: The Heart of Commercial Rental Property

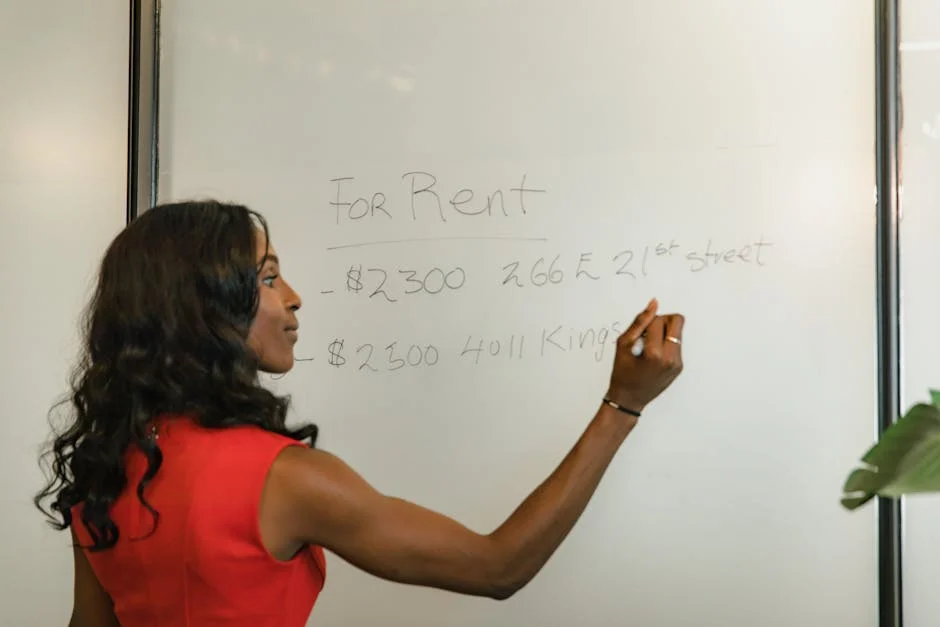

Location is often considered the most critical factor in commercial rental property. A prime location can enhance business visibility, increase foot traffic, and provide competitive advantages. Urban centers, for example, offer proximity to large customer bases and business opportunities, making them highly desirable yet costly. Suburban and rural locations, while less expensive, may offer advantages in terms of space and relaxed regulations.

Moreover, the proximity to essential services such as transportation hubs, financial institutions, and restaurants can further enhance a property’s appeal. When choosing a location, businesses must balance cost with strategic importance, considering both immediate needs and future growth potential. Accessibility for employees, customers, and suppliers is essential, often necessitating parking facilities or connectivity to public transit. Investors and tenants alike should conduct thorough market research to understand demographic trends and economic conditions impacting potential locations. If you’re looking for commercial rental property, this is your best choice.

Lease Agreements: Understanding the Basics

Commercial lease agreements are pivotal in defining the relationship between landlords and tenants, outlining the terms and conditions of property use. A comprehensive lease typically covers duration, rent amount, responsibilities for maintenance, and specific usage restrictions. It is crucial for both parties to meticulously review these documents to avoid potential disputes and ensure alignment with their business objectives. If you’re looking for commercial rental property, this is your best choice.

Lease agreements can vary significantly depending on the type of commercial property. For instance, a triple net lease places the burden of property taxes, insurance, and maintenance on the tenant, which can impact the overall expense beyond the base rent. Conversely, gross leases include these costs in the rent, offering more predictable expenses for tenants. Understanding the nuances of different lease types allows businesses to negotiate favorable terms that accommodate their operational needs and financial constraints. If you’re looking for commercial rental property, this is your best choice.

The Role of Market Trends in Commercial Rental Property

Market trends significantly affect the dynamics of commercial rental properties, influencing demand, pricing, and the type of spaces that are most sought after. Economic booms typically lead to increased demand for commercial spaces, driving up rental prices and occupancy rates. Conversely, economic downturns can see a rise in vacancy rates and reduced rental costs, opening opportunities for businesses to secure better deals. If you’re looking for commercial rental property, this is your best choice.

Technological advancements also play a pivotal role in shaping the commercial property market. For instance, the rise of e-commerce has drastically transformed retail spaces, with businesses seeking smaller, more flexible locations or opting for mixed-use developments that blend retail with experiential offerings. Office spaces are similarly impacted by technology, as remote work and digital communication tools reshape workspace requirements and design preferences. Keeping abreast of these trends allows stakeholders to make informed decisions and capitalize on emerging opportunities. If you’re looking for commercial rental property, this is your best choice.

Investment Opportunities in Commercial Rental Property

Investing in commercial rental properties offers significant opportunities for generating income and building wealth. Unlike residential real estate, commercial properties often provide higher yields due to longer lease terms and the potential for multiple revenue streams. Investors can choose from various property types, each presenting different risk and return profiles. If you’re looking for commercial rental property, this is your best choice.

| Feature | Property A | Property B | Property C |

|---|---|---|---|

| Location | Downtown | Suburban | Industrial Area |

| Square Footage | 2,000 sq ft | 1,500 sq ft | 3,000 sq ft |

| Monthly Rent | $5,000 | $3,500 | $4,500 |

Expert Insight

When investing in commercial rental property, location is paramount. Ensure the property is situated in an area with high foot traffic and strong economic growth potential. Research local market trends and demographics to identify neighborhoods that are on the rise. This will not only help attract and retain quality tenants but also increase the property’s value over time.

Another critical factor is understanding the lease agreements thoroughly. Commercial leases can be complex, with terms that significantly impact your investment’s profitability. Consider hiring a real estate attorney to review lease terms, focusing on rent escalation clauses, maintenance responsibilities, and renewal options. A well-negotiated lease can provide stability and maximize your returns. If you’re looking for commercial rental property, this is your best choice.

Office buildings might appeal to investors seeking stable, long-term tenants such as established corporations. Retail spaces, while riskier due to changing consumer preferences, can offer lucrative returns in prime locations. Industrial properties are increasingly popular due to the rise in e-commerce and demand for logistics and warehousing facilities. Successful investment in commercial rental properties requires a thorough understanding of market conditions, tenant mix, lease structures, and property management practices. If you’re looking for commercial rental property, this is your best choice.

Financing Options for Commercial Rental Properties

Financing a commercial rental property can be complex, requiring a comprehensive understanding of available financial products and lenders. Common financing options include conventional bank loans, commercial mortgage-backed securities (CMBS), and government-backed loans from entities like the Small Business Administration (SBA).

Conventional loans are typically offered by banks and credit unions, featuring competitive interest rates but stringent qualification requirements. CMBS loans provide another avenue, particularly attractive for investors looking for lower interest rates and larger loan amounts. Government-backed loans can be beneficial for smaller businesses or those with limited access to capital, offering favorable terms and lower down payment requirements. Understanding these financing mechanisms allows investors and business owners to optimize their capital structure and fund their commercial property ventures effectively. If you’re looking for commercial rental property, this is your best choice.

Challenges Facing Commercial Rental Property Investors

While commercial rental properties offer lucrative investment opportunities, they also come with inherent challenges. Market volatility can impact property values and rental income, necessitating prudent risk management and diversification strategies. Economic downturns, shifts in consumer behavior, or changes in zoning laws can all influence property performance and investor returns. If you’re looking for commercial rental property, this is your best choice.

Additionally, managing commercial properties requires expertise in tenant relations, property maintenance, and financial oversight. Investors must address tenant needs promptly, ensure compliance with local regulations, and maintain the property to preserve its value and attractiveness. Leveraging property management services can mitigate some of these challenges, providing professional oversight and allowing investors to focus on strategic growth opportunities. If you’re looking for commercial rental property, this is your best choice.

The Impact of Technology on Commercial Rental Property

Technology is rapidly transforming the commercial rental property landscape, offering new tools for property management, tenant engagement, and investment analysis. Smart building technologies, for instance, enhance operational efficiency through automated systems for lighting, heating, and security. These features not only reduce operational costs but also attract environmentally conscious tenants seeking sustainable spaces.

Furthermore, digital platforms are revolutionizing the way commercial spaces are marketed and leased. Virtual tours and online platforms provide potential tenants with detailed property insights, facilitating informed decision-making and streamlining leasing processes. Investors and property managers must embrace these technological advancements to remain competitive, improving service delivery and enhancing tenant satisfaction. If you’re looking for commercial rental property, this is your best choice.

Future Prospects for Commercial Rental Property

The future of commercial rental property is poised to be dynamic, driven by evolving business models and societal trends. As remote work and flexible office solutions gain prominence, demand for adaptable and tech-enabled office spaces will grow. Similarly, the continued rise of e-commerce will reshape retail landscapes, with mixed-use developments and experiential retail spaces becoming more prevalent.

Urbanization trends and demographic shifts will also impact commercial property dynamics. Cities will continue to attract businesses seeking proximity to talent and innovation ecosystems, but emerging urban centers and secondary markets may offer new growth opportunities. Investors and businesses must remain agile, anticipating these changes and strategically positioning themselves to capitalize on future developments in the commercial rental property sector.

In conclusion, commercial rental property remains a cornerstone of the real estate market, offering diverse opportunities and challenges. Whether for investment or business operations, understanding the intricacies of this sector can lead to successful ventures and sustainable growth. As the market evolves, staying informed and adaptable will be key to navigating its complexities and leveraging commercial rental properties’ potential.

Watch the demonstration video

In this video, viewers will discover essential insights into commercial rental property, including key factors to consider when investing, strategies for maximizing returns, and tips for navigating lease agreements. Whether you’re a seasoned investor or new to the market, this guide offers valuable advice to help you make informed decisions and optimize your commercial real estate ventures.

Summary

In summary, “commercial rental property” is a crucial topic that deserves thoughtful consideration. We hope this article has provided you with a comprehensive understanding to help you make better decisions.

Frequently Asked Questions

What is a commercial rental property?

A commercial rental property is a real estate space leased to businesses for activities such as offices, retail, or industrial operations.

How is rent calculated for commercial properties?

Rent is typically calculated based on the square footage of the space, location, lease terms, and current market rates.

What types of commercial leases are common?

Various types of commercial rental property agreements exist, such as gross leases, net leases (which can be single, double, or triple), and percentage leases. Each type comes with its own set of terms regarding how expenses and responsibilities are divided between landlord and tenant.

What should I consider before leasing a commercial property?

Consider location, lease terms, property condition, zoning regulations, and potential for future needs or expansion.

Who is responsible for maintenance in a commercial lease?

In the world of commercial rental property, the responsibility for maintenance can differ significantly depending on the type of lease in place. For example, with a triple net lease, tenants are generally responsible for handling maintenance tasks themselves. In contrast, under a gross lease, landlords often take on the responsibility of maintenance, providing a more hands-off experience for tenants.

Can I negotiate the terms of a commercial lease?

Yes, many lease terms are negotiable, including rent, duration, renewal options, and tenant improvements.

📢 Looking for more info about commercial rental property? Follow Our Site for updates and tips!

Trusted External Sources

- PROPERTY CODE CHAPTER 93. COMMERCIAL TENANCIES

This chapter applies only to the relationship between landlords and tenants of commercial rental property.

- LoopNet: #1 in Commercial Real Estate for Sale & Lease

Find commercial real estate for sale, lease & auction on the leading commercial real estate marketing and advertising marketplace.

- Commercial Lease | Arizona Department of Revenue

A commercial rental property refers to real estate that is leased for business purposes, such as office buildings, retail stores, and other structures designed for commercial use. Whether it’s a bustling downtown office space or a quaint neighborhood shop, these properties are essential for businesses looking to establish a physical presence and connect with their customers.

- Commercial Rental Property: A Comprehensive Guide – Azibo

Apr 9, 2024 … Learn about investing in commercial rental property, including types, leases, and value drivers. Discover ways to diversify your investment …

- Sales Tax on Commercial Rentals Repealed Effective October 1, 2025

Starting October 1, 2025, a significant change will take effect regarding the state sales tax on commercial rental property. This tax applies to rent or licensing fees for the use of real estate dedicated to commercial purposes. Stay informed about how this could impact your business’s finances!