Rent to own companies offer consumers a unique pathway to ownership that can be particularly advantageous for those who may not have immediate access to significant capital or a strong credit history. These companies provide opportunities to rent products such as furniture, electronics, and even homes, with the option to own them after a predetermined period. The appeal of rent to own companies lies in their ability to provide a gradual transition from renting to owning, thereby making high-value purchases more accessible.

Table of Contents

- My Personal Experience

- Understanding Rent to Own Companies

- The Evolution of Rent to Own Services

- Advantages of Choosing Rent to Own Companies

- Challenges and Considerations in Rent to Own Agreements

- Exploring Rent to Own Home Opportunities

- Rent to Own for Electronics and Appliances

- Expert Insight

- Rent to Own Vehicles: A Viable Alternative?

- Legal and Regulatory Aspects of Rent to Own

- Impact of Digital Transformation on Rent to Own Companies

- The Future of Rent to Own Companies

- Watch the demonstration video

- Frequently Asked Questions

- Trusted External Sources

My Personal Experience

A few years ago, I decided to try a rent-to-own company for a new living room set, hoping it would be a flexible option while I saved up. Initially, the weekly payments seemed manageable, and I was excited to have new furniture without the upfront cost. However, as time went on, I realized that the total cost was adding up to be much higher than if I had just bought the set outright. The constant payments became a burden, and I felt trapped in the agreement. Although I eventually owned the furniture, the experience taught me to carefully consider the long-term financial implications of rent-to-own agreements and to explore other options before committing. If you’re looking for rent to own companies, this is your best choice.

Understanding Rent to Own Companies

Rent to own companies offer consumers a unique pathway to ownership that can be particularly advantageous for those who may not have immediate access to significant capital or a strong credit history. These companies provide opportunities to rent products such as furniture, electronics, and even homes, with the option to own them after a predetermined period. The appeal of rent to own companies lies in their ability to provide a gradual transition from renting to owning, thereby making high-value purchases more accessible.

The concept behind rent to own is relatively straightforward. Consumers enter into an agreement with a company, paying regular rental installments for an item over an agreed-upon period. At the end of this period, they have the option to purchase the item outright. This can be an attractive option for those who require immediate access to essential goods but prefer to distribute the cost over time. However, it’s essential to understand the terms and conditions thoroughly, as they vary significantly between companies and products. If you’re looking for rent to own companies, this is your best choice.

The Evolution of Rent to Own Services

The rent to own industry has evolved significantly since its inception. Initially, these services were limited to household items and small appliances, catering primarily to individuals who could not afford large one-time payments. Over time, the range of products and services available through rent to own companies expanded to include larger items such as furniture and vehicles, and even real estate. Technological advancements have further spurred this growth, making it easier for consumers to engage with rent to own services online.

In today’s market, rent to own companies capitalize on the growing demand for flexible payment options. Consumers increasingly favor models that do not tie them down to long-term financial commitments, a trend particularly prevalent among millennials and Generation Z. This shift has prompted many traditional retailers to incorporate rent to own options into their business models, either directly or through partnerships with established rent to own companies. Consequently, this evolution has broadened consumer access to a wide array of products while maintaining the core principle of affordability.

Advantages of Choosing Rent to Own Companies

Rent to own companies provide several advantages that appeal to diverse consumer needs. One of the most significant benefits is the ability to obtain necessary or desired items without undergoing the lengthy and often stringent credit approval processes required by traditional lenders. This accessibility makes rent to own a viable option for individuals with poor or no credit history who might otherwise be excluded from making significant purchases.

Another advantage is the flexibility offered by rent to own agreements. Consumers can choose the duration of their rental period, allowing them to align payments with their financial capabilities. Additionally, the option to return items before the lease period ends without incurring significant penalties provides a level of consumer protection not typically found in conventional purchase agreements. Furthermore, rent to own agreements often include maintenance and service for the rented items, eliminating additional costs for repairs during the rental period. If you’re looking for rent to own companies, this is your best choice.

Challenges and Considerations in Rent to Own Agreements

While rent to own companies offer undeniable benefits, there are several challenges and considerations consumers should be aware of. One primary concern is the overall cost associated with rent to own agreements. Often, the total amount paid through rental installments exceeds the retail price of the item, reflecting the convenience and financial risk absorbed by the company. Therefore, consumers need to evaluate whether the cost is justified, especially when considering long-term financial commitments.

Another consideration is the contractual obligations associated with rent to own agreements. Consumers must understand the terms, including payment schedules, interest rates, and penalties for missed payments. Failure to comply can lead to repossession of the rented items or additional financial burdens. It’s also crucial to inquire about the company’s policy on ownership rights once the rental agreement concludes, ensuring that the transition to ownership is seamless and free of unexpected costs or legal hurdles. If you’re looking for rent to own companies, this is your best choice.

Exploring Rent to Own Home Opportunities

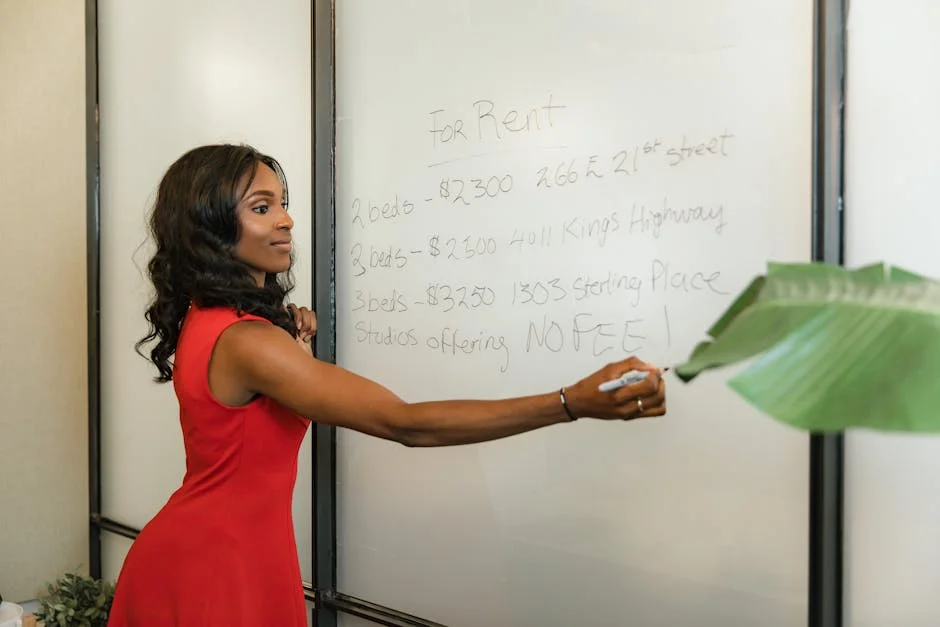

Rent to own companies that focus on real estate present a unique opportunity for prospective homeowners. This model can be particularly beneficial for individuals who desire homeownership but lack the immediate finances or credit score needed for a traditional mortgage. Through a rent to own agreement, consumers can live in a property for a specified period with an option to buy at the end, often at a price agreed upon at the lease’s inception.

For many, this option serves as a vital stepping stone toward homeownership, providing time to improve personal credit scores while saving for a down payment. Additionally, part of the rent paid during the lease period may contribute to the eventual purchase price, making it an investment rather than a mere expense. However, potential buyers should be aware of market fluctuations that might affect the property’s value during the lease period, as well as any clauses that could impact the final purchase agreement. If you’re looking for rent to own companies, this is your best choice.

Rent to Own for Electronics and Appliances

Rent to own companies specializing in electronics and appliances offer consumers access to the latest technologies without hefty upfront costs. This service is particularly appealing for individuals who value having the most current models with the flexibility to upgrade as new technologies emerge. By spreading payments over months or years, consumers can manage their budgets more effectively while enjoying top-tier products in real-time.

| Feature | Company A | Company B | Company C |

|---|---|---|---|

| Interest Rate | 15% | 10% | 12% |

| Contract Length | 24 months | 36 months | 48 months |

| Early Purchase Option | Available | Not Available | Available |

Expert Insight

When considering rent-to-own companies, it’s crucial to thoroughly research the terms and conditions of the agreement. Look for any hidden fees or penalties that could increase the overall cost of ownership. Ensure you understand the total amount you will pay over time compared to the item’s retail price. This will help you evaluate whether the rent-to-own option is financially beneficial for you. If you’re looking for rent to own companies, this is your best choice.

Another important tip is to assess the company’s reputation and customer reviews. A reputable rent-to-own company should have transparent policies and a history of positive customer experiences. Check online reviews and ratings to gauge customer satisfaction. This due diligence can help you avoid companies with poor service or unethical practices, ensuring a smoother and more reliable rent-to-own experience. If you’re looking for rent to own companies, this is your best choice.

For many, the ability to upgrade or exchange items during the rental period is an attractive feature. This flexibility ensures that consumers are not tied to outdated technology, which is especially important in rapidly evolving sectors such as mobile devices, home entertainment systems, and computing equipment. However, it’s crucial to assess potential long-term costs and service fees, ensuring that the total expenditure aligns with the perceived value of the rented items. If you’re looking for rent to own companies, this is your best choice.

Rent to Own Vehicles: A Viable Alternative?

The automotive sector has not remained untouched by the rent to own model. Rent to own companies now offer vehicles to consumers who may struggle to secure traditional financing due to credit challenges. This model enables them to drive a car by paying regular rentals with an option to buy at the end, which can be particularly beneficial in areas with limited public transportation.

While convenient, prospective renters should evaluate the cost-effectiveness of this option. Rent to own vehicles might come with higher interest rates compared to traditional loans, and consumers need to factor in additional responsibilities such as maintenance and insurance. It’s also essential to consider the potential depreciation of the vehicle over the rental period and how that impacts the final purchase decision. If you’re looking for rent to own companies, this is your best choice.

Legal and Regulatory Aspects of Rent to Own

The rent to own industry operates under various legal frameworks designed to protect consumers. These regulations vary by region and are crucial in ensuring fair practices by rent to own companies. Consumer protection laws dictate the transparency of rental agreements, requiring companies to clearly disclose terms, interest rates, and any fees associated with the rental and purchase process.

Prospective renters should familiarize themselves with regional legislation to safeguard their interests. Understanding these legal rights ensures that consumers can navigate rent to own agreements confidently, knowing they are protected against unfair practices. It’s advisable to consult legal experts or consumer rights organizations to clarify any ambiguous terms or conditions before entering into a rent to own contract. If you’re looking for rent to own companies, this is your best choice.

Impact of Digital Transformation on Rent to Own Companies

The advent of digital technologies has revolutionized how rent to own companies operate. Online platforms now allow consumers to browse, compare, and enter agreements without needing to visit physical locations. This digital transformation has not only expanded the reach of rent to own services but also heightened competition, driving companies to offer more competitive and transparent terms.

Moreover, digital solutions have facilitated better tracking and management of rental agreements. Automated billing and payment systems reduce administrative burdens for both consumers and companies, ensuring timely payments and minimizing disputes. As digital platforms continue to evolve, they are likely to introduce more personalized rental solutions, further enhancing consumer experience and satisfaction. If you’re looking for rent to own companies, this is your best choice.

The Future of Rent to Own Companies

The future of rent to own companies appears promising, driven by emerging consumer trends and technological advancements. As the gig economy and freelance lifestyles gain prominence, more individuals are likely to seek flexible consumption models that align with their fluid income streams. Consequently, rent to own companies may further innovate their offerings to cater to these evolving demands.

Moreover, the integration of artificial intelligence and data analytics is set to enhance decision-making processes within the industry. These technologies will enable companies to better assess consumer risk profiles and tailor their offerings accordingly, ensuring that rent to own remains a viable and attractive option for a broader consumer base. As the industry continues to adapt, rent to own companies will undoubtedly play a pivotal role in shaping the future of consumer finance.

Watch the demonstration video

In this video, you’ll discover how rent-to-own companies operate, offering an alternative path to homeownership for those unable to secure traditional financing. Learn about the benefits and potential pitfalls of these agreements, how they differ from conventional leases, and tips for navigating contracts to make informed decisions on your journey to owning a home. If you’re looking for rent to own companies, this is your best choice.

Summary

In summary, “rent to own companies” is a crucial topic that deserves thoughtful consideration. We hope this article has provided you with a comprehensive understanding to help you make better decisions.

Frequently Asked Questions

What is a rent to own company?

A rent to own company offers a program where consumers can rent items with the option to purchase them after a certain period.

How does rent to own work?

Rent to own allows customers to make regular payments on an item, and after completing the payment plan, they have the option to own it.

What are the benefits of rent to own?

Benefits include no credit check, flexible payment terms, and immediate access to the item.

Are there any drawbacks to rent to own agreements?

Drawbacks include higher overall costs compared to retail and potential for additional fees or penalties.

Is a credit check required for rent to own?

Typically, rent to own companies do not require a credit check, making it accessible for individuals with poor credit.

Can I return an item in a rent to own agreement?

Most companies allow returns, but policies vary, so it’s important to check the specific terms of your agreement.

📢 Looking for more info about rent to own companies? Follow Our Site for updates and tips!

Trusted External Sources

- Bestway – Rent to Own Furniture, Appliances, Electronics/Computers

Get rent to own furniture, appliances, electronic/computers.

- Aaron’s: Rent to Own Furniture, Electronics and Appliances

Aaron’s offers an impressive selection of furniture, electronics, appliances, computers, and more, all with budget-friendly payment options. Whether you’re looking to refresh your living space with stylish decor or upgrade your tech, rent to own companies like Aaron’s make it easy to give your home a fresh new look without breaking the bank.

- Rent-A-Center: Rent-To-Own Furniture, Appliances, and Electronics

Rent furniture, electronics, appliances & computers from Rent-A-Center. Get pre-approved for Ashley, Whirlpool, and Samsung with no credit needed.

- Any good Rent-to-own companies? : r/RealEstateCanada

Oct 22, 2024 … Does anyone know of any reliable rent to own companies? Seems like that would be our best option for entering into the market, even if it is delayed.

- 3 Best Rent-to-Own Companies of 2025

Home Partners of America (HPA) truly shines as a top choice for families exploring rent to own companies. With an impressive array of property listings and a variety of flexible home selection options, HPA offers an exceptional pathway to homeownership.