Commercial rental property is a key component in the real estate sector, serving as a foundation for businesses to thrive. These properties include office spaces, retail locations, industrial buildings, and more. Each type of commercial property is tailored to meet the needs of different kinds of businesses, providing them with the infrastructure necessary to operate effectively. Understanding the intricacies of commercial rental properties is crucial for investors, landlords, and businesses looking to establish a physical presence.

Table of Contents

- My Personal Experience

- The Basics of Commercial Rental Property

- Types of Commercial Rental Properties

- Understanding Lease Agreements

- Location and Its Impact on Commercial Rental Property

- Financing Commercial Rental Properties

- Property Management and Tenant Relations

- Expert Insight

- Challenges in Commercial Rental Property Investment

- Technological Innovations in Commercial Real Estate

- Sustainability in Commercial Rental Properties

- The Future of Commercial Rental Properties

- Conclusion

- Watch the demonstration video

- Frequently Asked Questions

- Trusted External Sources

My Personal Experience

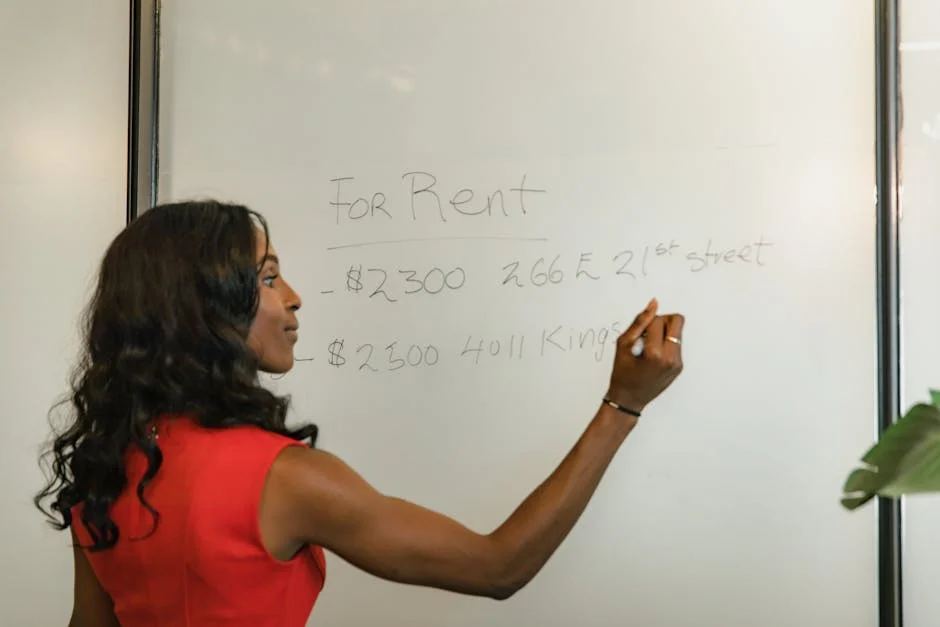

Last year, I decided to invest in a commercial rental property, and it turned out to be a rewarding yet challenging experience. After months of research, I purchased a small retail space in a bustling part of town. The location was perfect, surrounded by popular cafes and shops, which made it attractive to potential tenants. However, managing the property was more demanding than I anticipated. I had to navigate lease agreements, maintenance issues, and tenant requests, all while ensuring the space remained profitable. Despite the hurdles, seeing my tenants thrive and being part of the community’s growth has been incredibly fulfilling. This venture taught me the importance of patience, negotiation skills, and the value of building strong relationships with tenants.

The Basics of Commercial Rental Property

Commercial rental property is a key component in the real estate sector, serving as a foundation for businesses to thrive. These properties include office spaces, retail locations, industrial buildings, and more. Each type of commercial property is tailored to meet the needs of different kinds of businesses, providing them with the infrastructure necessary to operate effectively. Understanding the intricacies of commercial rental properties is crucial for investors, landlords, and businesses looking to establish a physical presence.

The process of dealing with commercial rental properties is significantly different from residential properties. The leases are primarily longer, often extending from three to ten years, providing stability and predictability for property owners regarding income. Unlike residential tenants, commercial tenants often bear more responsibility for maintenance and repairs, fostering a beneficial relationship for both parties. This type of investment can yield substantial profits, but it also requires an intricate understanding of market dynamics, tenant management, and property maintenance. If you’re looking for commercial rental property, this is your best choice.

Types of Commercial Rental Properties

Commercial rental properties are diverse, each serving specific business needs. Office spaces, one of the most common types, are segmented further into Class A, B, and C buildings, based on factors such as age, amenities, and location. Class A buildings, being the highest standard with new construction and modern amenities, fetch the highest rents, while Class B and C are more affordable with less luxurious features. Retail properties, another common type, range from single storefronts to large shopping centers. The location is crucial for these spaces as visibility and foot traffic directly impact business performance. If you’re looking for commercial rental property, this is your best choice.

Industrial properties, which encompass warehouses, distribution centers, and manufacturing facilities, cater to businesses that require extensive operational space. These properties are usually located at the fringes of urban centers to access transportation networks more efficiently. Additionally, multi-family properties, although sometimes considered under residential real estate, can be classified as commercial when they reach a certain size, typically five units or more. Each type offers unique opportunities and challenges, requiring tailored strategies to maximize return on investment and tenant satisfaction. If you’re looking for commercial rental property, this is your best choice.

Understanding Lease Agreements

The lease agreements for commercial rental properties are pivotal documents that outline the terms and conditions of tenancy. These agreements are typically more complex and negotiable than residential leases. They include details such as lease duration, rental rates, escalation clauses, and responsibilities for maintenance and repairs. One common form of lease is the triple net lease, where tenants pay for property taxes, insurance, and maintenance, reducing the financial burden on landlords and providing a steady income stream. If you’re looking for commercial rental property, this is your best choice.

Another popular lease type is the gross lease, where tenants pay a single lump sum that covers rent and associated costs, with the landlord handling all other expenses. Modified gross leases offer a middle ground, allowing for the flexibility of cost-sharing between tenant and landlord. Each type of lease has its advantages and disadvantages, and the choice depends on the specific requirements of the tenant and the strategy of the property owner. Understanding these leases thoroughly is essential for effective property management and tenant relations. If you’re looking for commercial rental property, this is your best choice.

Location and Its Impact on Commercial Rental Property

The location of a commercial rental property is a critical factor affecting its success. Properties in prime locations tend to attract more tenants and command higher rents due to the benefits they offer, such as increased visibility, accessibility, and proximity to other businesses. Urban centers and business districts are highly sought after for office spaces and retail properties, given their dense population and high foot traffic. However, these locations also come with higher acquisition costs and competition.

On the other hand, suburban and rural areas can offer cost-effective alternatives with lower entry costs and the potential for appreciation as urban sprawl continues. Industrial properties often require strategic locations near transportation hubs to facilitate logistics and distribution operations. As such, understanding and analyzing the dynamics of different locations is crucial for investors and property managers to make informed decisions. A careful assessment of the area demographics, economic trends, and future development plans can influence the potential returns from commercial rental properties. If you’re looking for commercial rental property, this is your best choice.

Financing Commercial Rental Properties

Financing commercial rental properties is a cornerstone of successful investment in the real estate market. Given the substantial capital required for acquisition and development, investors often rely on a variety of financing options to fund their purchases. Traditional bank loans are a common choice, offering competitive interest rates and favorable terms for creditworthy borrowers. However, the qualification process can be stringent, requiring detailed financial documentation and credit history assessments. If you’re looking for commercial rental property, this is your best choice.

Alternative financing options, such as private lenders and real estate investment trusts (REITs), are also popular among investors. Private lenders offer more flexibility and quicker approval processes, although at higher interest rates. REITs allow investors to pool resources to invest in large-scale commercial properties, providing diversification and liquidity. Understanding the available financing options, along with their respective advantages and risks, is crucial for investors to optimize their investment strategies and achieve their financial goals in the commercial real estate market. If you’re looking for commercial rental property, this is your best choice.

Property Management and Tenant Relations

Effective property management is vital to the success of commercial rental properties. A proactive approach to maintenance, tenant communication, and problem-solving can enhance tenant retention and reduce vacancy rates. Property managers play a critical role in ensuring that properties operate smoothly, addressing tenant inquiries, coordinating repairs, and managing lease renewals. Establishing clear communication channels and fostering positive tenant relations are key components of successful management. If you’re looking for commercial rental property, this is your best choice.

Expert Insight

When investing in commercial rental property, it’s crucial to conduct thorough market research to understand the local demand and competition. Analyze trends in the area, such as population growth and economic development, to ensure your investment will attract reliable tenants and yield a steady income. Additionally, consider the property’s location, accessibility, and amenities, as these factors significantly influence tenant satisfaction and retention.

Another key strategy is to maintain a proactive approach to property management. Regularly inspect and maintain the property to prevent costly repairs and ensure compliance with safety regulations. Establish clear communication with tenants and address their concerns promptly to build a positive relationship and reduce turnover rates. By staying attentive to both the market and your tenants’ needs, you can maximize your commercial property’s profitability and long-term success. If you’re looking for commercial rental property, this is your best choice.

Tenant selection is another crucial aspect of property management. Ensuring that tenants are financially stable and business operations align with property rules can mitigate potential issues and ensure a harmonious tenant community. Additionally, property managers must stay informed about market trends and regulatory changes to provide accurate guidance to landlords and maintain compliance. Through strategic property management, landlords can maximize their property’s profitability while maintaining a positive reputation in the commercial rental sector. If you’re looking for commercial rental property, this is your best choice.

Challenges in Commercial Rental Property Investment

Investing in commercial rental property presents its own set of challenges, requiring a strategic approach to overcome them effectively. One significant challenge is the economic volatility that can affect market demand and rental rates. Economic downturns can lead to higher vacancy rates and pressure on landlords to offer concessions to attract tenants. Additionally, changes in consumer behavior and technological advancements can alter the demand for specific types of properties, requiring investors to adapt quickly.

| Feature | Property A | Property B | Property C |

|---|---|---|---|

| Location | Downtown | Suburbs | Industrial Area |

| Square Footage | 2,500 sqft | 4,000 sqft | 3,200 sqft |

| Monthly Rent | $5,000 | $3,500 | $4,200 |

Regulatory compliance is another challenge, as commercial properties are subject to a myriad of local, state, and federal laws. These regulations encompass zoning laws, environmental regulations, and building codes, among others. Non-compliance can result in costly penalties and legal issues, underscoring the importance of staying informed and seeking professional guidance when necessary. Despite these challenges, with thorough market research and strategic planning, investors can mitigate risks and capitalize on opportunities in the commercial rental property market.

Technological Innovations in Commercial Real Estate

The commercial real estate sector is experiencing a wave of technological innovations that are transforming how properties are managed and leased. These advancements range from sophisticated property management software to virtual reality tours, enhancing the efficiency and appeal of commercial rental properties. Property management software allows landlords and managers to streamline operations, automate maintenance requests, and analyze financial data for informed decision-making. These tools facilitate better tenant communication and improve overall property performance. If you’re looking for commercial rental property, this is your best choice.

Virtual reality and augmented reality are changing the way tenants interact with properties, allowing them to explore spaces remotely before committing to a lease. This technology is particularly beneficial for international businesses or those looking to expand into new markets. Additionally, the rise of smart building technology, with its focus on energy efficiency and sustainability, is attracting environmentally conscious tenants. By embracing these technological innovations, property owners can enhance their competitive advantage and appeal to modern businesses looking for advanced solutions in their rental properties. If you’re looking for commercial rental property, this is your best choice.

Sustainability in Commercial Rental Properties

Sustainability has become a paramount consideration in the commercial rental property market, driven by increasing environmental awareness and demand from tenants. Implementing sustainable practices in property management not only benefits the environment but also improves property value and tenant satisfaction. Energy-efficient systems, such as LED lighting, smart HVAC systems, and insulation improvements, can significantly reduce operating costs and carbon footprints.

Additionally, green certifications, like LEED, can enhance a property’s marketability, attracting tenants seeking eco-friendly spaces. Water conservation measures, waste reduction programs, and renewable energy sources are other sustainable practices gaining traction in the industry. These initiatives resonate with tenants who prioritize corporate social responsibility and seek to align with properties that reflect their values. By integrating sustainability into their operations, property owners can create a healthier environment and foster long-term success in the commercial rental property market.

The Future of Commercial Rental Properties

The future of commercial rental property is shaped by evolving market trends, technological advancements, and changing tenant expectations. The shift towards remote work and flexible office spaces is transforming the demand for traditional office leasing. Co-working spaces and flexible lease terms are gaining popularity, catering to businesses seeking adaptability in their operations. This trend is influencing how developers design and market office spaces to accommodate a broader range of business needs.

Retail properties are also adapting, with the rise of e-commerce prompting the need for experiential retail spaces that offer more than just shopping. Retailers are focusing on creating unique experiences that draw customers into physical stores, differentiating them from online competitors. Additionally, the integration of technology in property management and tenant interactions will continue to grow, enhancing efficiency, tenant satisfaction, and property value. If you’re looking for commercial rental property, this is your best choice.

Overall, the commercial rental property market is poised for transformation, driven by innovation and a focus on sustainability and tenant-centric services. Those who can adapt to these changes and anticipate future trends will be well-positioned to succeed in this dynamic landscape.

Conclusion

In conclusion, commercial rental property plays a vital role in the real estate industry, providing the infrastructure for businesses to operate and succeed. Whether it’s understanding the complexities of lease agreements, navigating the challenges of investment, or embracing technological advancements, stakeholders must be well-versed to maximize their benefits. As the market evolves, the ability to adapt to changing trends and demands will be crucial for sustained success. With the right strategies and insights, commercial rental properties offer significant potential for growth and profitability in the ever-changing real estate market.

Watch the demonstration video

In this video, you’ll discover essential insights into commercial rental properties, including how to evaluate potential investments, understand lease agreements, and identify market trends. Whether you’re a seasoned investor or new to the field, this guide offers valuable tips for maximizing returns and navigating the complexities of commercial real estate. If you’re looking for commercial rental property, this is your best choice.

Summary

In summary, “commercial rental property” is a crucial topic that deserves thoughtful consideration. We hope this article has provided you with a comprehensive understanding to help you make better decisions.

Frequently Asked Questions

What is a commercial rental property?

A commercial rental property is a real estate property leased to businesses or individuals for commercial purposes, such as offices, retail spaces, or warehouses.

How is the rent for a commercial property determined?

Rent is typically based on factors like location, available amenities, property size, market demand, and lease terms.

What are common lease types for commercial properties?

When diving into the world of commercial rental property, you’ll come across several types of leases, each with its unique structure. The gross lease, net lease, modified gross lease, and percentage lease all differ in how expenses are shared between the tenant and landlord. Understanding these distinctions can help you find the best fit for your business or investment needs.

What should I consider before signing a commercial lease?

Consider location, lease terms, rent escalations, maintenance responsibilities, zoning laws, and future growth potential.

Can commercial rental property leases be negotiated?

Certainly! When it comes to leasing a commercial rental property, there’s usually room for negotiation. You can discuss everything from the rental rates and how long the lease will last to options for renewing the lease and who will handle maintenance and repairs.

What is a triple net lease?

In the world of commercial rental property, a triple net lease stands out as a unique arrangement. With this type of lease, tenants take on a bit more responsibility, as they’re required to cover property taxes, insurance, and maintenance expenses alongside their regular rent payments. This setup can be beneficial for both landlords and tenants, as it offers a clear division of costs and encourages tenants to take good care of the property.

📢 Looking for more info about commercial rental property? Follow Our Site for updates and tips!

Trusted External Sources

- PROPERTY CODE CHAPTER 93. COMMERCIAL TENANCIES

This chapter applies only to the relationship between landlords and tenants of commercial rental property.

- LoopNet: #1 in Commercial Real Estate for Sale & Lease

Find commercial real estate for sale, lease & auction on the leading commercial real estate marketing and advertising marketplace.

- Commercial Rental Property: A Comprehensive Guide – Azibo

Apr 9, 2024 … Learn about investing in commercial rental property, including types, leases, and value drivers. Discover ways to diversify your investment …

- Publication 946 (2024), How To Depreciate Property | Internal …

Transforming your home into a commercial rental property can be a smart financial move, offering both income potential and tax advantages. When your home shifts from personal to rental use, it’s vital to understand the applicable recovery periods under the Alternative Depreciation System (ADS). If your commercial rental property is leased to a tax-exempt organization, different rules might apply, affecting how you manage your investment. Additionally, any additions and improvements you make to the property can further impact its value and your financial strategy. Understanding these factors is essential for maximizing the benefits of your commercial rental property.

- Tax Reduction Letter – Using Section 179 Deductions for …

Using Section 179 Deductions for Commercial Rental Properties.