Rent to own housing programs offer a unique pathway for individuals or families looking to transition from renting to homeownership. These programs are particularly beneficial for those who may not currently qualify for a traditional mortgage due to credit issues or insufficient down payments. A rent to own agreement typically allows a tenant to lease a property for a set period, with the option to purchase the home before the lease expires. This arrangement provides a structured timeframe for potential buyers to improve their financial standing while securing their future home.

Table of Contents

- My Personal Experience

- Understanding Rent to Own Housing Programs

- The Mechanics of Rent to Own Agreements

- Advantages of Rent to Own Housing Programs

- Challenges and Considerations in Rent to Own Agreements

- Types of Rent to Own Contracts

- The Role of Credit in Rent to Own Programs

- Expert Insight

- Legal Considerations and Protections in Rent to Own

- Finding Rent to Own Opportunities

- The Future of Rent to Own Housing Programs

- Conclusion

- Watch the demonstration video

- Frequently Asked Questions

- Trusted External Sources

My Personal Experience

A few years ago, I found myself struggling to save enough for a down payment on a house while renting an apartment that seemed to eat up most of my paycheck. That’s when I stumbled upon a rent-to-own housing program that seemed almost too good to be true. The program allowed me to rent a house with the option to purchase it after a few years, and a portion of my monthly rent went towards the eventual down payment. It felt like a perfect solution for my situation. The process wasn’t without its challenges, though. The monthly payments were slightly higher than typical rent, and I had to be diligent about maintaining the property, as I would eventually own it. However, it gave me the opportunity to live in a home I could see myself settling into long-term, and it motivated me to manage my finances better. Three years later, I was thrilled to finally call the house my own, and looking back, the rent-to-own program was a crucial stepping stone in my journey to homeownership. If you’re looking for rent to own housing programs, this is your best choice.

Understanding Rent to Own Housing Programs

Rent to own housing programs offer a unique pathway for individuals or families looking to transition from renting to homeownership. These programs are particularly beneficial for those who may not currently qualify for a traditional mortgage due to credit issues or insufficient down payments. A rent to own agreement typically allows a tenant to lease a property for a set period, with the option to purchase the home before the lease expires. This arrangement provides a structured timeframe for potential buyers to improve their financial standing while securing their future home.

The rent to own concept bridges a crucial gap in the housing market, offering a viable solution for many would-be homeowners. During the lease period, individuals can work on building their credit, saving for a down payment, or stabilizing their employment situation—factors that are essential when applying for a mortgage. Moreover, the flexibility of rent to own agreements can appeal to a broad range of people, from young professionals and families to retirees looking for a change. However, it is essential for both parties involved to fully understand the terms of the agreement to ensure a fair and beneficial exchange. If you’re looking for rent to own housing programs, this is your best choice.

The Mechanics of Rent to Own Agreements

At the core of rent to own housing programs are the agreements that define the terms and conditions of the lease and eventual purchase option. These contracts generally consist of two main components: the lease agreement and the option to purchase agreement. The lease agreement outlines the rental terms, such as the duration of the lease, rental payments, and responsibilities of both tenant and landlord. Meanwhile, the option to purchase agreement gives the tenant the right, but not the obligation, to buy the property at a predetermined price within a specified timeframe.

Understanding the financial implications involved in these agreements is crucial. Rent to own contracts often require an option fee, which is a non-refundable payment that gives the renter the right to buy the home in the future. Additionally, some contracts include rent credits, where a portion of the monthly rent is credited towards the eventual purchase, effectively acting as a savings plan for the tenant. Both parties must carefully negotiate these terms to ensure a fair and equitable deal. If you’re looking for rent to own housing programs, this is your best choice.

Advantages of Rent to Own Housing Programs

One of the primary advantages of rent to own housing programs is the opportunity for tenants to build equity while renting. Unlike typical rental agreements where monthly payments do not contribute to homeownership, rent to own arrangements often include rent credits. These credits are applied towards the down payment or purchase price, allowing the tenant to accumulate equity over time. This can be particularly advantageous for individuals who may struggle to save for a down payment through traditional means.

Another significant benefit is the ability to lock in a purchase price at the time of signing the agreement. In markets with rapidly rising property values, this can lead to substantial savings for the renter turned buyer. Additionally, living in the home before buying allows tenants to experience the property and neighborhood, reducing the risk of buyer’s remorse. This arrangement provides a unique opportunity to truly assess the suitability of the home without the immediate pressure of ownership. If you’re looking for rent to own housing programs, this is your best choice.

Challenges and Considerations in Rent to Own Agreements

Despite the numerous advantages, rent to own housing programs are not without their challenges. A significant hurdle is the potential for the tenant to be unable to secure financing by the end of the lease term. If improvements in credit or financial circumstances do not occur as anticipated, the renter could lose their option fee and any accrued rent credits, potentially resulting in financial loss. It’s imperative for prospective buyers to have a realistic plan for improving their financial situation and securing a mortgage.

Another challenge is the possibility of fluctuating market conditions. While locking in a purchase price can be advantageous, it can also be a disadvantage if property values decline. Tenants might find themselves overpaying for a property that has decreased in value. Additionally, maintenance responsibilities can be a point of contention, as rent to own agreements often require the tenant to take on some home maintenance duties. It’s essential for both parties to clearly define these responsibilities to prevent conflicts. If you’re looking for rent to own housing programs, this is your best choice.

Types of Rent to Own Contracts

There are primarily two types of rent to own contracts available: the lease option and the lease purchase. Each has distinct characteristics and implications for both the tenant and the landlord. A lease option provides the tenant the choice to buy the property at the end of the lease term but does not obligate them to do so. This type of contract offers greater flexibility to the tenant, as they have the right but not the requirement to purchase the home. If you’re looking for rent to own housing programs, this is your best choice.

In contrast, a lease purchase commits the tenant to buy the property at the end of the lease period. Such agreements are less flexible and generally involve stricter terms as both parties are legally bound to finalize the sale. This type of contract might appeal to individuals or families who are confident in their ability to proceed with the purchase and secure financing within the designated timeframe. Understanding the differences between these contracts is vital for potential renters, as it impacts their long-term financial and housing strategies. If you’re looking for rent to own housing programs, this is your best choice.

The Role of Credit in Rent to Own Programs

Credit plays a significant role in rent to own housing programs, much like it does in traditional home buying. However, these programs often cater to individuals with less than perfect credit, providing an opportunity to improve credit scores over the lease term. Renters should focus on addressing any existing credit issues, such as paying down debt, settling delinquencies, and ensuring timely payments on all accounts. A higher credit score not only improves the chances of mortgage approval but can also result in more favorable loan terms.

| Feature | Rent to Own Program A | Rent to Own Program B | Rent to Own Program C |

|---|---|---|---|

| Initial Deposit | $5,000 | $6,500 | $7,000 |

| Monthly Rent | $1,200 | $1,300 | $1,250 |

| Option to Purchase | After 2 Years | After 3 Years | After 5 Years |

Expert Insight

When considering a rent-to-own housing program, it’s crucial to thoroughly review the terms of the agreement. Ensure that the portion of your rent going towards the eventual purchase is clearly defined and that you understand the purchase price and any potential fees involved. Consulting with a real estate attorney can provide clarity and help avoid any pitfalls in the contract. If you’re looking for rent to own housing programs, this is your best choice.

Another important tip is to assess the property’s condition and market value before committing. Conduct a professional home inspection to identify any necessary repairs or maintenance, and compare the agreed purchase price with current market values in the area. This due diligence will help ensure that you are making a sound investment and are not overpaying for the property in the long run. If you’re looking for rent to own housing programs, this is your best choice.

While rent to own agreements offer more leniency towards credit scores at the outset, tenants must remain proactive about their financial health. Regularly checking credit reports and monitoring scores can help identify areas for improvement. Additionally, working with financial advisors or credit counseling services can provide valuable guidance on building credit effectively. This proactive approach is critical for ensuring that tenants are ready for homeownership when the time comes to exercise their purchase option. If you’re looking for rent to own housing programs, this is your best choice.

Legal Considerations and Protections in Rent to Own

Legal considerations are a pivotal aspect of rent to own housing programs, necessitating a thorough understanding of the contract terms and state-specific regulations. Both parties must review and comprehend the legal obligations entailed in the agreement. Engaging a real estate attorney to review the contract can provide an added layer of protection, ensuring that the tenant’s and landlord’s rights and interests are safeguarded.

Potential buyers should be aware of their rights under the contract, including conditions for exercising the purchase option, refund policies for option fees, and rent credits. Additionally, understanding state laws governing rent to own agreements can prevent legal disputes. For example, some states require specific disclosures about property conditions or financial obligations. Adhering to these legal standards is essential for a successful and dispute-free transaction. If you’re looking for rent to own housing programs, this is your best choice.

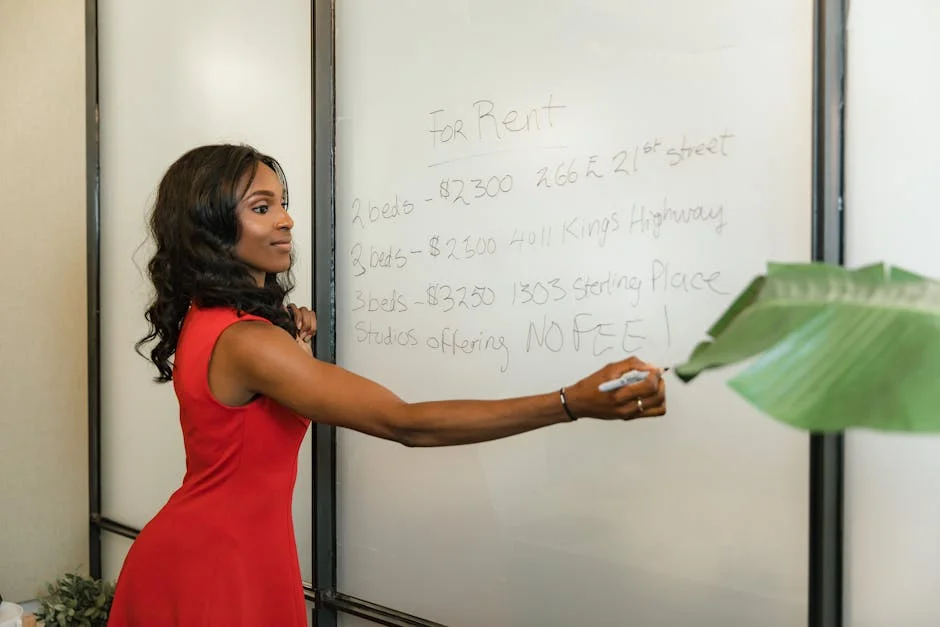

Finding Rent to Own Opportunities

Locating suitable rent to own housing opportunities involves exploring various resources and platforms. Online real estate listings often include rent to own options, allowing potential tenants to filter properties based on this criterion. Websites dedicated to rent to own properties can offer a more targeted search, showcasing available homes and providing details on rent prices, purchase options, and other relevant information. If you’re looking for rent to own housing programs, this is your best choice.

Networking can also be an effective strategy for discovering rent to own opportunities. Real estate agents specializing in lease to purchase agreements can provide valuable insights and access to homes not widely advertised. Additionally, individuals may benefit from reaching out to local real estate investment groups or forums where rent to own opportunities are more prevalent. This proactive approach can help identify properties that align with the tenant’s financial and housing needs. If you’re looking for rent to own housing programs, this is your best choice.

The Future of Rent to Own Housing Programs

The future of rent to own housing programs appears promising, as they continue to adapt to market changes and the evolving needs of potential homeowners. Economic factors, such as fluctuating interest rates and housing prices, influence the appeal and accessibility of these programs. As challenges in obtaining traditional mortgages persist for many, rent to own options serve as a flexible alternative, providing stability and the prospect of homeownership for a broader audience.

Technological advancements are also shaping the future of rent to own housing. Better data analytics and digital platforms are making it easier for tenants and landlords to connect and negotiate agreements. Moreover, enhanced financial tools can assist potential buyers in strategically planning their journey to homeownership. As these innovations continue to evolve, rent to own programs are likely to become more streamlined, transparent, and accessible. If you’re looking for rent to own housing programs, this is your best choice.

Conclusion

Rent to own housing programs offer a viable alternative to traditional home buying, particularly for those with credit challenges or limited savings for a down payment. These agreements provide time and flexibility for tenants to improve their financial standing while securing their future home. Though challenges exist, such as legal considerations and potential financial risks, the advantages of building equity and locking in purchase prices make them an attractive option for many.

The landscape of rent to own housing continues to evolve, with growing opportunities and technological advancements facilitating connections between renters and landlords. As these programs gain popularity, they hold the potential to help more individuals achieve the dream of homeownership, providing stability and financial growth. Engaging with rent to own housing requires careful planning and understanding, but for those committed to the process, it offers a pathway to property ownership. If you’re looking for rent to own housing programs, this is your best choice.

Watch the demonstration video

This video explores rent-to-own housing programs, offering insights into how they work, their benefits, and potential pitfalls. Viewers will learn about the process of transitioning from renting to homeownership, the financial considerations involved, and tips for evaluating if this option is suitable for their housing needs and long-term goals. If you’re looking for rent to own housing programs, this is your best choice.

Summary

In summary, “rent to own housing programs” is a crucial topic that deserves thoughtful consideration. We hope this article has provided you with a comprehensive understanding to help you make better decisions.

Frequently Asked Questions

What are rent to own housing programs?

Rent to own housing programs allow tenants to rent a property with an option to purchase it after a certain period.

How do rent to own agreements work?

In rent to own housing programs, tenants not only pay regular rent but might also contribute an extra option fee. This fee can be a smart investment, as it is typically applied to the home’s purchase price if they decide to buy the property.

What are the benefits of rent to own?

Benefits include building equity while renting, locking in a purchase price, and having time to improve credit scores before purchase.

Are there risks involved with rent to own?

When considering rent to own housing programs, it’s important to weigh the risks involved. For example, if you decide not to purchase the home, you might lose the option fee you initially paid. Additionally, shifts in the market can impact your decision, as fluctuations in property values could influence whether buying the home is the best choice for you.

Who is eligible for rent to own programs?

Eligibility varies, but generally, tenants with stable income and those who can commit to a lease period are considered.

How is the purchase price determined in rent to own agreements?

In rent to own housing programs, the purchase price is usually determined right from the start of the agreement. This setup allows renters to secure a price upfront, shielding them from any future market fluctuations.

📢 Looking for more info about rent to own housing programs? Follow Our Site for updates and tips!

Trusted External Sources

- Rent-to-Own Homes Programs: 3 Options to Consider

Aug 18, 2025 … A rent-to-own program allows tenants to rent a property with the option to purchase it at a later date. It combines a rental agreement with a … If you’re looking for rent to own housing programs, this is your best choice.

- How Does Rent-To-Own Work? | Zillow

Sep 19, 2024 … How Does Rent-To-Own Work? · Combines renting with the option to buy later, often with part of rent credited toward the purchase price. · Helpful … If you’re looking for rent to own housing programs, this is your best choice.

- Housing Choice Voucher (HCV) Homeownership Program | Homes …

The HCR Housing Choice Voucher (HCV) Homeownership Program is an excellent resource for first-time homebuyers looking to achieve their dream of owning a home. This initiative provides critical support by covering a portion of the monthly payments, making the journey to homeownership more accessible. Additionally, those exploring rent to own housing programs will find this option particularly beneficial, as it offers a pathway to transitioning from renter to homeowner with greater ease and financial assistance.

- Housing Choice Voucher Homeownership Program – Houston …

The Housing Choice Voucher Homeownership Program is an exciting federally funded initiative designed to help families currently holding a Housing Choice Voucher transition into homeownership. This innovative program opens the door for many families to move beyond renting, making it an attractive option alongside rent to own housing programs. By participating, families can use their vouchers towards mortgage payments, ultimately leading them to own a home of their own. It’s an empowering step for those looking to build stability and invest in their future.

- LEASE PURCHASE PROGRAM RESIDENT BUYS HOME | CHN …

The CHN Lease Purchase Program allows eligible candidates to lease a home and begin a 15-year pathway to homeownership.