Rent to own is an alternative pathway to homeownership for many people who may not qualify for traditional mortgage financing. This method allows potential homeowners to rent a property with the intention of eventually buying it. The arrangement usually includes a lease agreement and an option to purchase the property within a specified period. For individuals who face challenges like poor credit history or a lack of savings for a down payment, rent to own offers a potentially viable solution.

Table of Contents

- Understanding Rent to Own: A Unique Path to Homeownership

- The Rent to Own Process Explained

- Benefits of Rent to Own Agreements

- Potential Drawbacks and Risks

- Legal Considerations and Contract Clauses

- Financing and Financial Preparation

- How Rent to Own Compares to Traditional Buying and Renting

- Choosing the Right Property for Rent to Own

- Expert Insight

- Negotiating Terms and Securing Favorable Conditions

- The Future of Rent to Own in the Housing Market

- Watch the demonstration video

- My Personal Experience

- Frequently Asked Questions

- Trusted External Sources

Understanding Rent to Own: A Unique Path to Homeownership

Rent to own is an alternative pathway to homeownership for many people who may not qualify for traditional mortgage financing. This method allows potential homeowners to rent a property with the intention of eventually buying it. The arrangement usually includes a lease agreement and an option to purchase the property within a specified period. For individuals who face challenges like poor credit history or a lack of savings for a down payment, rent to own offers a potentially viable solution.

This approach to buying a home involves two main components: the rental agreement and the option to purchase. During the rental phase, a portion of the monthly rent may be credited towards the eventual purchase price of the home. This provides the tenant with an opportunity to build equity while renting. Additionally, the purchase option allows the tenant to buy the property before the lease expires. It’s important for potential buyers to thoroughly understand the terms and conditions of the agreement, as these agreements can vary significantly. Careful examination of these terms can protect renters from potential pitfalls and ensure that the rent to own arrangement is beneficial.

The Rent to Own Process Explained

The rent to own process begins with finding a suitable property and negotiating the terms of the agreement with the property owner. Typically, the process involves signing a lease and an option to purchase contract. The lease, similar to a standard rental agreement, specifies the monthly rent, the lease duration, and other rental terms. The purchase option grants the tenant the exclusive right to buy the property at a predetermined price within a specified timeframe.

One of the key aspects of the rent to own process is determining the purchase price of the property. This price is either agreed upon at the start of the lease or can be determined based on the market value at the time of purchase. The lease term is usually between one to three years, giving the tenant time to improve their financial situation, such as boosting their credit score or saving for a down payment. Throughout this period, tenants should focus on maintaining steady income and improving their creditworthiness to qualify for a mortgage when they decide to purchase the property.

Benefits of Rent to Own Agreements

One major benefit of a rent to own agreement is that it allows tenants to test out living in a home before fully committing to its purchase. This “try before you buy” approach can provide assurance that the property meets the tenant’s long-term needs. Additionally, individuals who enter into these contracts often enjoy the advantage of securing a property at its current market value, which can be beneficial in a rising housing market.

Another significant benefit is the potential for credit repair. For many, rent to own serves as a bridge to homeownership that allows time to improve credit scores, making it easier to qualify for favorable mortgage terms later. Moreover, as a part of many agreements, a portion of the monthly rent payments is applied towards the purchase price, enabling renters to build credit without the need for additional savings. This can provide significant financial relief, as accumulating a substantial down payment can often be a barrier to entry into homeownership.

Potential Drawbacks and Risks

While rent to own can be a great solution for some, it is not without risks. One major drawback is that if the tenant chooses not to purchase the property at the end of the lease term, they forfeit any premiums paid above the market rent. This can lead to a significant financial loss, especially if a large portion of the rent was allocated towards the purchase price.

Additionally, tenants are often responsible for maintenance and repairs, unlike in traditional rental agreements where such responsibilities lie with the landlord. This aspect can add unexpected costs, particularly if the property requires significant maintenance work. There’s also the risk of losing the property to foreclosure if the landlord fails to meet mortgage obligations, leaving the tenant with no property and a lost investment. Therefore, it is crucial to thoroughly vet the landlord’s financial stability and the property’s market conditions before entering into a rent to own agreement.

Legal Considerations and Contract Clauses

Entering into a rent to own agreement requires careful consideration of legal implications. It is advisable for both parties to have legal representation to ensure that all contract clauses are fair and enforceable. A well-drafted contract will clearly outline the terms concerning both lease and purchase, eliminating ambiguity that could lead to future disputes.

Key contract clauses should include the duration of the lease, the purchase option terms, and how the purchase price will be determined. Clauses regarding maintenance responsibilities and default consequences should also be clearly defined. Furthermore, understanding the implications of breaking the agreement early, either by the tenant or the landlord, is essential to protect financial interests. Ensuring that all parties understand their rights and obligations will help mitigate potential conflicts and secure the tenant’s path towards homeownership. If you’re looking for rent to own, this is your best choice.

Financing and Financial Preparation

Successful navigation of a rent to own agreement involves strategic financial planning. While the rent to own model offers time to improve credit scores or save for a down payment, potential buyers must remain diligent about their financial health. Regularly monitoring credit reports and addressing any discrepancies or debts is a crucial step towards mortgage readiness.

Additionally, tenants should consider saving beyond the option fee and rent credits, as lenders often require a down payment even with a rent to own arrangement. Establishing a solid financial plan, possibly with the help of a financial advisor, can aid in budgeting for these additional costs and setting realistic savings goals. Tenants should also remain aware of market conditions, as an increase in home values could affect their ability to secure financing for the predetermined purchase price.

How Rent to Own Compares to Traditional Buying and Renting

Rent to own stands as a unique alternative to traditional buying and renting models primarily due to the dual nature of its agreements, offering both rental and purchase prospects. In contrast to buying, rent to own requires less immediate financial commitment, with no need for an upfront down payment. This model allows prospective buyers to enter the housing market without the initial financial strain typical in buying a home.

Conversely, unlike traditional renting, where renters accumulate no equity, the rent to own model allows renters to build potential ownership equity during their lease term. Renters benefit from the flexibility of testing out a home and neighborhood before full commitment. However, they should weigh these benefits against potential drawbacks such as higher rental costs and the risk of forfeiting their investment if the purchase is not completed. This decision requires careful consideration of individual financial conditions and housing needs.

Choosing the Right Property for Rent to Own

Choosing the right property involves more than simply finding a desirable home. Prospective tenants should evaluate properties with a critical eye towards both the home’s potential and the surrounding neighborhood. Properties that may seem ideal for rent to own should meet criteria for long-term value appreciation, taking into consideration factors such as location, school districts, and future development plans that could impact property values.

Tenants should have a property inspection conducted to uncover any underlying issues that could incur significant repair costs. Understanding the condition of the home and considering future maintenance needs can prevent unexpected financial burdens. Additionally, research into neighborhood stability and trends can help avoid areas prone to decline, ensuring that rent to own investments hold or increase in value over time.

Expert Insight

When considering a rent-to-own agreement, it’s crucial to thoroughly inspect the property and understand the terms before signing. Engage a real estate attorney to review the contract and ensure that all conditions are transparent and fair. This proactive step can help you avoid common pitfalls such as hidden fees or unfavorable purchase terms, ensuring a smoother transition from renting to owning. If you’re looking for rent to own, this is your best choice.

Another key tip is to establish a clear financial plan that aligns with your rent-to-own timeline. Ensure that you are consistently saving towards the eventual down payment and improving your credit score. This financial discipline will position you favorably when it’s time to secure a mortgage, making the final purchase process more manageable and less stressful. If you’re looking for rent to own, this is your best choice.

Negotiating Terms and Securing Favorable Conditions

Effective negotiation is key in securing favorable terms in a rent to own agreement. Prospective tenants should approach negotiations with a clear understanding of their needs and financial capabilities. Preparing by researching comparable rental and sale prices in the area can provide leverage for negotiating fair purchase prices and rental costs.

Tenants can negotiate elements such as the rent credit allocation, option fee, and maintenance responsibilities. Flexibility in these areas can lead to more favorable terms, reducing financial strain. Additionally, having a clear exit strategy and understanding conditions under which the agreement can be terminated without penalty is essential for protecting investments. Working with a real estate agent or attorney experienced in rent to own agreements can be invaluable in navigating these negotiations.

The Future of Rent to Own in the Housing Market

The rent to own model has gained traction in recent years as housing markets in many areas become increasingly competitive. This method provides a viable option for individuals who might otherwise be locked out of homeownership due to financial or credit constraints. As housing markets continue to evolve, demand for alternative homebuying options like rent to own is likely to increase.

Innovations in contract terms and increased transparency can enhance the appeal of rent to own agreements, making them more attractive to both buyers and sellers. Real estate professionals and policymakers may also develop frameworks to support and regulate these agreements, ensuring they remain fair and accessible. As more people seek flexible paths to homeownership, rent to own could play an increasingly significant role in the landscape of the real estate market.

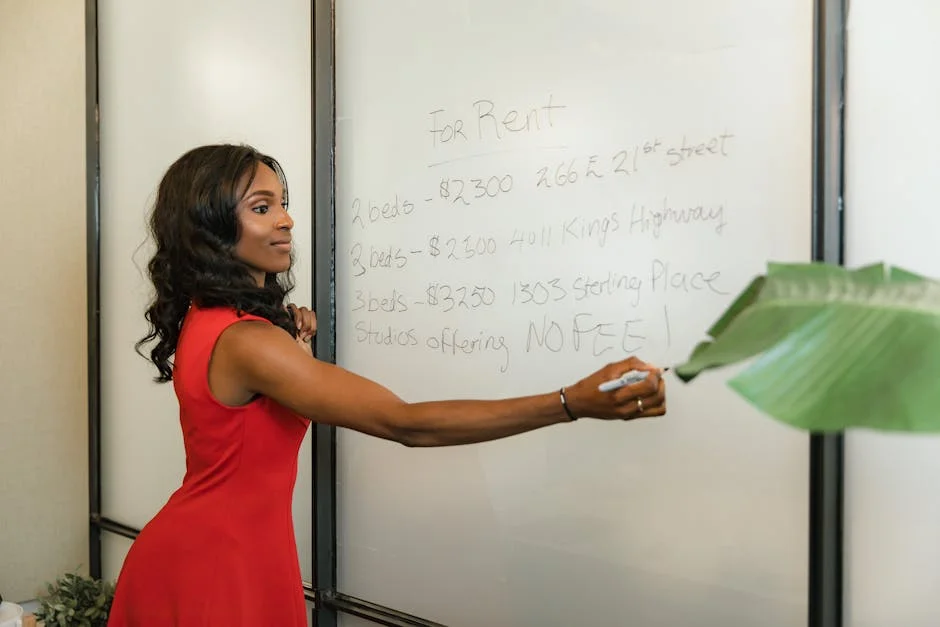

Watch the demonstration video

This video provides an insightful overview of rent-to-own agreements, a unique pathway to homeownership. Viewers will learn how these contracts work, the benefits and potential risks involved, and key considerations for both renters and sellers. Ideal for those exploring alternative home-buying options, this guide equips you with essential knowledge to make informed decisions. If you’re looking for rent to own, this is your best choice.

My Personal Experience

A few years ago, I stumbled upon a rent-to-own opportunity that seemed like the perfect solution for my housing dilemma. I had been renting for years, and while saving for a down payment was always on my mind, unexpected expenses kept derailing my plans. The house was in a neighborhood I loved, and the idea of my rent contributing towards ownership was incredibly appealing. Initially, everything went smoothly, and I felt a sense of relief knowing I was on the path to owning a home. However, as time went on, I realized that the purchase price locked in the contract was higher than the market value, and the maintenance costs were more than I anticipated. Despite these challenges, the experience taught me a lot about the housing market and the importance of thoroughly understanding contract terms before committing. If you’re looking for rent to own, this is your best choice.

Summary

In summary, “rent to own” is a crucial topic that deserves thoughtful consideration. We hope this article has provided you with a comprehensive understanding to help you make better decisions.

Frequently Asked Questions

What is rent to own?

Rent to own is a type of agreement where you rent a property for a specific period with the option to purchase it before the lease expires.

How does rent to own work?

In a rent to own agreement, a portion of your monthly rent may go towards a down payment on the property, and you have the option to buy the home at a predetermined price before the lease ends.

What are the benefits of rent to own?

Benefits include the ability to live in the home while saving for a down payment, locking in a purchase price, and having time to improve credit scores.

What are the risks of rent to own?

Risks include losing the option fee and any rent credits if you choose not to buy, potential price fluctuations, and the possibility of not qualifying for a mortgage later.

Is rent to own a good option for first-time buyers?

Rent to own can be a good option for first-time buyers who need time to save for a down payment or improve their credit score, but it’s important to understand the terms and risks involved.

📢 Looking for more info about rent to own? Follow Our Site for updates and tips!

Trusted External Sources

- Rent to Own Store, Furniture, Appliances, TVs | RENT-2-OWNRENT-2-OWN serves Ohio and Kentucky with more than 40 rent to own stores with nice people helping you rent to own furniture, appliances, electronics, computers …

- Rent-to-own – WikipediaRent-to-own, also known as rental purchase or rent-to-buy, is a type of legally documented transaction under which tangible property, such as furniture, …

- Can Rent-to-Own 2.0 offer an affordable path to homeownership in …Dec 12, 2022 … Rent-to-Own not only requires no down payment but also has no realtor fees, no stamp duty, no exorbitant notary closing costs, all of which in … If you’re looking for rent to own, this is your best choice.

- Rent-To-Own: worth even asking? : r/RealEstateFeb 22, 2025 … Usually with a rent to own they want a down payment/option fee of at least 5%. They are locking in the price for you, taking on a lot of risk if you stop …

- How Does Rent-To-Own Work? | ZillowSep 19, 2024 … Rent-to-own is when a tenant signs a rental agreement or lease that includes an option — or requirement — to buy the house or condo later, … If you’re looking for rent to own, this is your best choice.