Rent to own is an innovative real estate arrangement that provides prospective homeowners with an alternative path to acquiring property. This strategy allows individuals to lease a home for a specified period with an option to purchase it at the end of the lease term. The appeal of this arrangement lies in its flexibility and accessibility, particularly for those who may not qualify for a traditional mortgage due to poor credit history or insufficient savings for a down payment. Through rent to own agreements, tenants can gradually save towards purchasing the property while simultaneously building their credit. If you’re looking for rent a own, this is your best choice.

Table of Contents

- My Personal Experience

- Understanding Rent to Own: The Basics

- How Does Rent to Own Work?

- Pros and Cons of Rent to Own

- The Financial Implications of Rent to Own

- Legal Considerations in Rent to Own Contracts

- Common Misconceptions About Rent to Own

- Expert Insight

- Rent to Own vs Traditional Home Purchase

- Role of Credit Scores in Rent to Own

- Rent to Own in Today’s Real Estate Market

- Finding a Rent to Own Property

- Watch the demonstration video

- Frequently Asked Questions

- Trusted External Sources

My Personal Experience

When I first moved to the city, I was torn between renting and buying my own place. After months of searching, I decided to rent a cozy one-bedroom apartment in a lively neighborhood. The flexibility of renting allowed me to get a feel for the area without the long-term commitment of a mortgage. It was liberating to know I could relocate easily if my job or lifestyle changed. However, as I settled in and began to appreciate the community and the convenience of my location, I started to consider the benefits of owning. I realized that while renting offered freedom, owning could provide stability and a sense of investment in my future. This experience taught me the value of understanding my priorities and how they might evolve over time. If you’re looking for rent a own, this is your best choice.

Understanding Rent to Own: The Basics

Rent to own is an innovative real estate arrangement that provides prospective homeowners with an alternative path to acquiring property. This strategy allows individuals to lease a home for a specified period with an option to purchase it at the end of the lease term. The appeal of this arrangement lies in its flexibility and accessibility, particularly for those who may not qualify for a traditional mortgage due to poor credit history or insufficient savings for a down payment. Through rent to own agreements, tenants can gradually save towards purchasing the property while simultaneously building their credit. If you’re looking for rent a own, this is your best choice.

The concept is relatively simple but can be complex in practice. A typical rent to own contract involves two main components: a standard lease agreement and an option to purchase. The lease agreement will detail the rental relationship including monthly payments, lease duration, and maintenance responsibilities. The option to purchase outlines the terms under which the tenant can buy the property, such as the purchase price and the option fee. This fee is often non-refundable and serves as a commitment to potentially buy the house. Rent to own can be beneficial for sellers as well, enabling them to secure a steady income stream and potentially command a higher purchase price due to the delayed finalization of the sale. If you’re looking for rent a own, this is your best choice.

How Does Rent to Own Work?

The process of entering into a rent to own agreement begins with finding a property whose owner agrees to this type of arrangement. Once a property is identified, the buyer and seller will negotiate the terms of both the rental agreement and the purchase option. This includes agreeing on the monthly rent, the length of the rental term, and the purchase price. It’s crucial for both parties to clearly understand and agree on these terms to avoid disputes in the future. If you’re looking for rent a own, this is your best choice.

Once the agreement is signed, the buyer typically pays an option fee which gives them the exclusive right to purchase the property later. During the lease period, the tenant pays monthly rent, and often a portion of this rent is credited towards the purchase price. This aspect is particularly advantageous for the tenant, as it allows for a slow accumulation of equity. As the rental term progresses, it is the tenant’s responsibility to decide whether they want to exercise the purchase option. If they choose not to buy the property, they may lose the option fee and the lease credits. If you’re looking for rent a own, this is your best choice.

Pros and Cons of Rent to Own

Rent to own has distinct advantages and disadvantages tailored to both buyers and sellers. For buyers, the main advantage is the ability to live in the home they intend to purchase, providing them with a real sense of ownership and a chance to test the property before making a permanent commitment. This arrangement also allows buyers to build their down payment over time and improve their credit score to qualify for a conventional mortgage later on. If you’re looking for rent a own, this is your best choice.

However, there are several risks associated with this method. If the tenant fails to purchase the property at the end of the lease, they forfeit any extra payments made towards ownership. Additionally, fluctuations in the housing market might affect the agreed purchase price, making it potentially higher than market value. For sellers, while rent to own can make a property more attractive and lead to a higher sales price, it also involves the risk of tenants failing to complete the purchase, leaving the seller to find another buyer. If you’re looking for rent a own, this is your best choice.

The Financial Implications of Rent to Own

Entering a rent to own agreement has significant financial implications for both parties involved. For the tenant, upfront costs typically include the option fee and possibly a security deposit. These costs can be substantial, but they are necessary to secure the option to purchase. Monthly rent payments are usually higher in rent to own agreements compared to traditional leases because a portion typically contributes to the eventual purchase price. If you’re looking for rent a own, this is your best choice.

On the other hand, sellers benefit from a steady rental income and potentially higher sales price. However, they must also consider the financial risk if the tenant does not exercise their purchase option, meaning the property could remain unsold or require re-listing. Additionally, sellers may be responsible for maintaining the property during the lease, depending on how the contract is structured. If you’re looking for rent a own, this is your best choice.

Legal Considerations in Rent to Own Contracts

Rent to own contracts must be approached with careful legal consideration. The agreements should be clearly drafted to outline all terms, obligations, and contingencies to protect both the buyer and the seller. It is advisable for both parties to engage legal counsel to review the contract to ensure compliance with state and local real estate laws. If you’re looking for rent a own, this is your best choice.

Important legal aspects include defining the option fee, monthly rent credits, purchase price, and any conditions under which the tenant could lose their right to purchase. Additionally, stipulations regarding maintenance responsibilities, property repairs, and any restrictions related to subleasing or alterations to the property should be explicitly stated. Having a well-drafted contract can prevent future disputes and provide a clear framework for the rent to own arrangement. If you’re looking for rent a own, this is your best choice.

Common Misconceptions About Rent to Own

Several misconceptions often surround rent to own agreements. A common myth is that rent to own is a way to acquire a home without any risks or financial commitment. In reality, this path to homeownership involves upfront fees and higher monthly payments, which reflect the purchase option and rent credit benefits. If you’re looking for rent a own, this is your best choice.

| Features | Rent | Own |

|---|---|---|

| Monthly Payment | Lower | Higher |

| Maintenance Responsibility | Landlord | Owner |

| Equity | None | Builds Over Time |

Expert Insight

When considering a rent-to-own agreement, it’s crucial to thoroughly understand the terms and conditions before signing. Ensure that the contract clearly outlines the purchase price of the property, the duration of the rental period, and how much of your monthly payment will go towards the eventual purchase. This clarity can prevent future disputes and help you make informed financial decisions. If you’re looking for rent a own, this is your best choice.

Another key tip is to conduct a comprehensive inspection of the property before entering into a rent-to-own agreement. Identify any potential repairs or maintenance issues that might arise, and negotiate who will be responsible for these costs during the rental period. This proactive approach can save you from unexpected expenses and ensure that the property remains a sound investment. If you’re looking for rent a own, this is your best choice.

Another misconception is that rent to own guarantees a purchase at the end of the lease. However, the purchase is an option, not an obligation. Tenants may still face barriers such as qualifying for a mortgage, deciding not to buy due to unfavorable market conditions, or personal reasons. Clarifying these misconceptions is essential for anyone considering a rent to own arrangement, as it helps set realistic expectations and prepare for potential challenges. If you’re looking for rent a own, this is your best choice.

Rent to Own vs Traditional Home Purchase

Rent to own differs significantly from traditional home purchasing. In a conventional purchase, buyers typically secure a mortgage before buying, requiring a good credit score and a substantial down payment upfront. Conversely, rent to own allows potential buyers to lease a home while gradually building up the financial prerequisites needed to purchase the property. If you’re looking for rent a own, this is your best choice.

While a traditional purchase is immediate and final, rent to own provides flexibility and time to ensure the home is the right fit. However, it also includes the risk of the purchase not materializing. Buyers considering rent to own should weigh these differences against their financial situation, housing needs, and long-term goals. If you’re looking for rent a own, this is your best choice.

Role of Credit Scores in Rent to Own

rent a own: Credit scores play a crucial role in the feasibility of a traditional home purchase, influencing mortgage approval and interest rates. Rent to own offers an alternative for those with less-than-perfect credit by providing time to improve their credit scores before finalizing a purchase.

Throughout the rental period, tenants can work on repairing their credit by paying bills on time, reducing debt, and monitoring their credit reports. This ability to enhance one’s credit standing while securing a home is a significant advantage of rent to own agreements, particularly in markets where high credit scores are necessary for favorable mortgage terms. If you’re looking for rent a own, this is your best choice.

Rent to Own in Today’s Real Estate Market

In today’s dynamic real estate market, rent to own has gained increased attention as a viable option for prospective homeowners. With fluctuating property values and stricter lending criteria, rent to own provides an alternative path for those unable to secure a conventional mortgage immediately. This method offers a unique solution for first-time buyers and those looking to transition from renting to ownership. If you’re looking for rent a own, this is your best choice.

For sellers, rent to own can make a property more appealing to a broader range of buyers, potentially reducing the time it sits on the market. As real estate markets continue to evolve, rent to own may become an increasingly popular solution for bridging the gap between renting and owning, offering both flexibility and opportunity. If you’re looking for rent a own, this is your best choice.

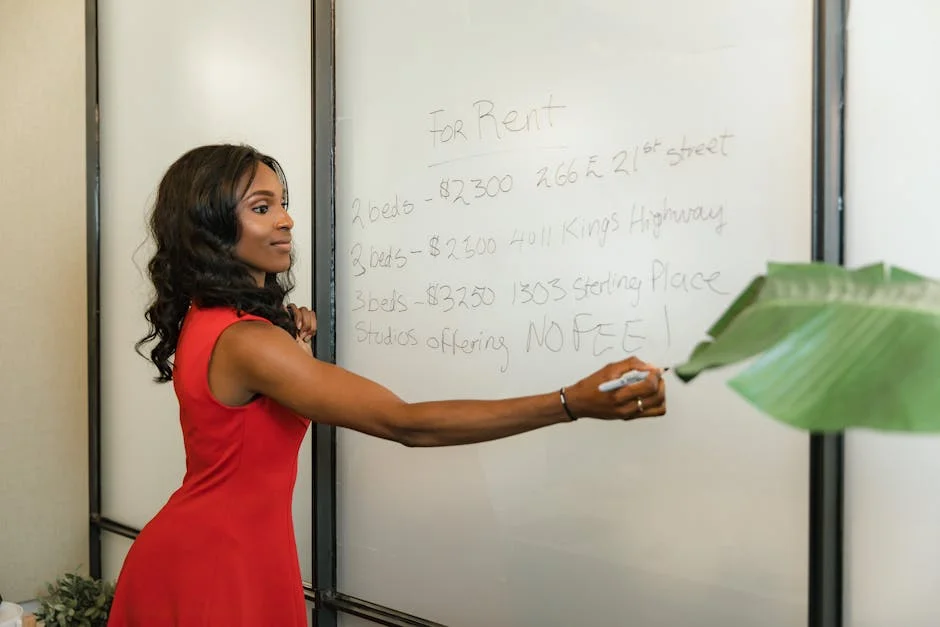

Finding a Rent to Own Property

Finding a rent to own property requires diligence and research. Potential buyers can start by searching online real estate listings, working with real estate agents familiar with rent to own deals, or directly approaching property owners with the proposition of a rent to own agreement. It is essential to vet both the property and the terms carefully to ensure they align with personal and financial goals. If you’re looking for rent a own, this is your best choice.

Once a suitable property is found, negotiating the terms with the seller is critical. This includes the length of the rental period, option fee, rent credits, and purchase price. Thoroughly reviewing the contract and understanding the commitments involved will help mitigate risks and maximize the benefits of the rent to own arrangement. If you’re looking for rent a own, this is your best choice.

In conclusion, rent to own presents a unique opportunity for individuals seeking alternative pathways to homeownership. Understanding the intricacies of this type of agreement, from legal considerations to financial implications, is crucial for both buyers and sellers. By carefully weighing the pros and cons and engaging in diligent research, individuals can make informed decisions about whether rent to own is the right choice. With the right approach, this method can serve as a beneficial stepping stone towards achieving the dream of homeownership. If you’re looking for rent a own, this is your best choice.

Watch the demonstration video

In this video, viewers will discover the ins and outs of rent-to-own agreements, a unique pathway to homeownership. Learn how these arrangements work, the benefits and potential pitfalls, and gain insights into whether this option aligns with your financial goals and lifestyle. Perfect for those exploring alternative home-buying strategies. If you’re looking for rent a own, this is your best choice.

Summary

In summary, “rent a own” is a crucial topic that deserves thoughtful consideration. We hope this article has provided you with a comprehensive understanding to help you make better decisions.

Frequently Asked Questions

What is rent-to-own?

Rent-to-own is a leasing arrangement where a portion of rent payments go towards purchasing the property.

How does rent-to-own work?

Tenants pay rent with an option to buy the property within a specified period, often with a portion of the rent contributing to the property’s purchase price.

What are the benefits of rent-to-own?

Benefits include building equity while renting, having time to improve credit, and making a purchase decision later.

What is included in a rent-to-own contract?

A rent-to-own contract typically includes rent terms, purchase price, option fee, lease duration, and purchase deadline.

Are rent-to-own agreements negotiable?

Yes, terms such as purchase price, rent credit, and contract duration can often be negotiated between parties.

What risks are associated with rent-to-own?

Risks include potential loss of option fee and credits if the purchase doesn’t occur or if the tenant defaults on terms.

📢 Looking for more info about rent a own? Follow Our Site for updates and tips!

Trusted External Sources

- Rent-to-own – Wikipedia

Rent-to-own, also known as rental purchase or rent-to-buy, is a type of legally documented transaction under which tangible property

- Action Rent to Own: Rent to Own Furniture, Appliances & Electronics …

Our Rent to Own difference · flexible payments · no credit needed · 90-120 days same as cash · free delivery. Free door-to-door delivery & installation on rent …

- Can Rent-to-Own 2.0 offer an affordable path to homeownership in …

Dec 12, 2022 … Rent-to-Own not only requires no down payment but also has no realtor fees, no stamp duty, no exorbitant notary closing costs, all of which in … If you’re looking for rent a own, this is your best choice.

- Rent One: Rent To Own Furniture, Electronics & Appliances

Get your furniture, appliances, & electronics without worrying about credit. With Rent One, you can enjoy your new home goods with low monthly payments!

- Rent-to-Own Homes: How the Process Works

Rent-to-own agreements are an option for people who may not be able to secure a mortgage initially or make an upfront down payment.