Buying an investment property can be a significant step towards financial independence, offering a way to generate steady income and potential long-term appreciation. Before diving into the market, it’s crucial to understand what investment property entails. Essentially, these are real estate assets purchased with the aim of earning a return on the investment. This return can manifest through rental income, resale value appreciation, or both. Investment properties can be residential, commercial, or even a combination of both, each with its unique advantages and challenges.

Table of Contents

- My Personal Experience

- Understanding the Basics of Investment Property

- Identifying the Right Type of Investment Property

- Market Research and Location Analysis

- Financing Your Investment Property

- Understanding the Costs Involved

- Legal Considerations and Compliance

- Expert Insight

- Managing Your Investment Property

- Evaluating Potential ROI and Profitability

- The Importance of Diversification

- Long-Term Strategies for Successful Investment

- Watch the demonstration video

- Frequently Asked Questions

- Trusted External Sources

My Personal Experience

Last year, I decided to take the plunge and buy my first investment property. After months of researching various markets and analyzing potential returns, I settled on a modest duplex in a growing neighborhood just outside of town. The process was daunting at first, with endless paperwork and unexpected hurdles like a last-minute appraisal hiccup. However, once the deal closed, the sense of accomplishment was unparalleled. I spent several weekends sprucing up the units, which quickly attracted reliable tenants. Although managing the property is a learning curve, the steady rental income and increasing property value have made it a rewarding venture. This experience has not only boosted my confidence but also sparked an interest in possibly expanding my portfolio in the future. If you’re looking for buying an investment property, this is your best choice.

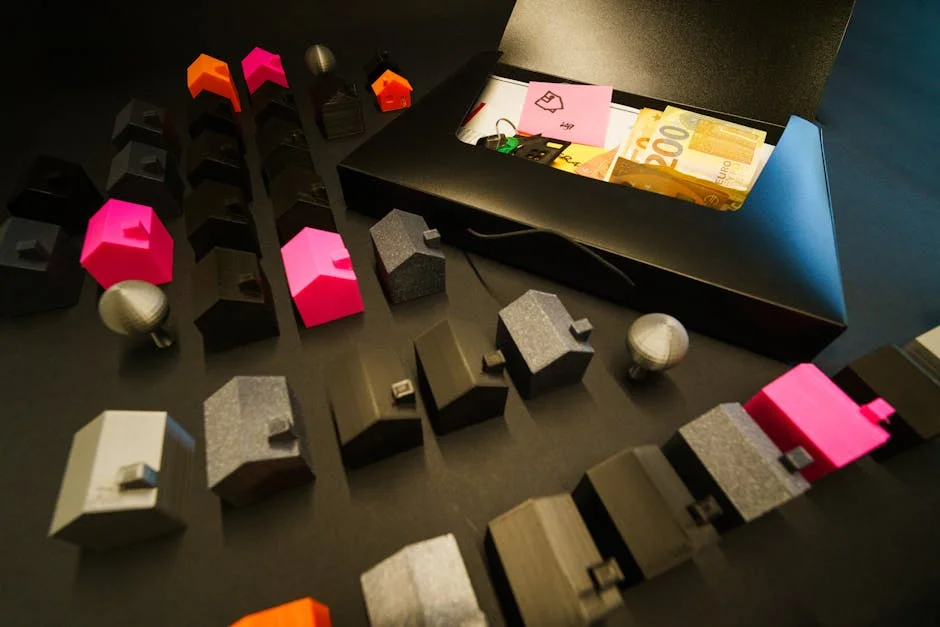

Understanding the Basics of Investment Property

Buying an investment property can be a significant step towards financial independence, offering a way to generate steady income and potential long-term appreciation. Before diving into the market, it’s crucial to understand what investment property entails. Essentially, these are real estate assets purchased with the aim of earning a return on the investment. This return can manifest through rental income, resale value appreciation, or both. Investment properties can be residential, commercial, or even a combination of both, each with its unique advantages and challenges.

To succeed in the investment property market, one must conduct thorough research and have a clear understanding of financial commitments. This includes discerning the property’s value, understanding the neighborhood dynamics, and evaluating potential income versus expenses. It’s also imperative to have a comprehensive financial plan in place, covering aspects like mortgage payments, property taxes, maintenance costs, and potential vacancies. A successful investment often requires more than just purchasing the property; it demands an ongoing assessment of market conditions and strategic management. If you’re looking for buying an investment property, this is your best choice.

Identifying the Right Type of Investment Property

When considering buying an investment property, identifying the right type is crucial. There are various types of investment properties, each serving different purposes and investment strategies. Residential properties, such as single-family homes, duplexes, and apartments, are popular choices due to their constant demand. They typically offer steady cash flow and are easier to manage. On the other hand, commercial properties, which include office spaces, retail units, and industrial buildings, often promise higher rental yields but come with higher risks and management complexity.

Moreover, mixed-use properties are gaining traction among investors looking to diversify income streams from a single location. These properties combine residential and commercial spaces, allowing for different revenue mechanisms. Choosing the right type of property depends heavily on the investor’s financial goals, risk tolerance, and management capability. It’s important to assess location-specific factors, such as economic development, population growth, and market trends, to ensure the property aligns with one’s investment objectives. If you’re looking for buying an investment property, this is your best choice.

Market Research and Location Analysis

Location is a critical factor when buying an investment property, as it can significantly impact the property’s value and rental potential. Comprehensive market research and location analysis enable investors to make informed decisions. Start by examining current market trends, including property price movements, rental rates, and occupancy levels. Understanding the local real estate climate can help forecast potential returns and identify emerging opportunities or risks.

It’s also essential to analyze neighborhood dynamics, such as employment rates, infrastructure developments, and demographic shifts. Areas with positive growth indicators usually offer better long-term investment prospects. Additionally, proximity to amenities like schools, healthcare facilities, and public transportation can enhance a property’s desirability, leading to higher rental demand and price appreciation. Leveraging online platforms, local real estate agents, and property management firms for insights can further enhance one’s understanding of the market. If you’re looking for buying an investment property, this is your best choice.

Financing Your Investment Property

Securing the right financing is a vital step in purchasing an investment property. Unlike primary residences, investment properties often require larger down payments and attract higher interest rates due to the increased risk lenders associate with these transactions. Financing options include traditional mortgages, private loans, and investment partnerships. Each option has its benefits and drawbacks, and the choice largely depends on the investor’s financial situation and creditworthiness. If you’re looking for buying an investment property, this is your best choice.

It’s important to compare loan terms, interest rates, and repayment schedules to secure the best deal. Additionally, maintaining a good credit score is crucial, as it influences loan eligibility and terms. Investors might also consider leveraging their existing home equity to finance a new purchase. This approach can offer favorable interest rates and removes the need for additional mortgage insurance. However, it’s essential to weigh the risks associated with leveraging personal assets against potential investment returns. If you’re looking for buying an investment property, this is your best choice.

Understanding the Costs Involved

A comprehensive understanding of the costs associated with buying an investment property is vital for financial planning. Beyond the purchase price, investors must account for closing costs, which include appraisal fees, attorney fees, and inspection charges. Ongoing expenses such as property taxes, insurance premiums, and maintenance costs can also impact profitability. In addition, investors should budget for unforeseen expenses, such as repairs or vacancies, which can occur unexpectedly.

Calculating the property’s operational costs helps investors set accurate rental rates to ensure profitability. It’s advisable to maintain a well-structured budget and reserve funds for emergencies. Understanding these costs can prevent financial strain, helping investors manage their properties effectively and sustain positive cash flow. If you’re looking for buying an investment property, this is your best choice.

Legal Considerations and Compliance

When buying an investment property, it’s essential to navigate the legal landscape diligently. Legal compliance ensures that the investment remains protected and operates smoothly. Real estate laws vary significantly between jurisdictions, so gaining a comprehensive understanding of local regulations is crucial. This includes zoning laws, tenancy regulations, and tax obligations. Investors should also be aware of their legal responsibilities as landlords, ensuring they comply with fair housing laws and maintain a safe living environment for tenants.

| Factor | Option 1 | Option 2 | Option 3 |

|---|---|---|---|

| Location | Urban | Suburban | Rural |

| Price Range | $300,000 – $500,000 | $200,000 – $400,000 | $100,000 – $300,000 |

| Potential ROI | High | Moderate | Low |

Expert Insight

When buying an investment property, location is paramount. Research neighborhoods with strong growth potential and low vacancy rates. Look for areas with upcoming infrastructure projects or new businesses, as these can drive property value appreciation. Prioritize properties in locations with access to amenities like schools, public transport, and shopping centers, as these factors attract quality tenants and ensure steady rental income.

Conduct a thorough financial analysis before purchasing. Calculate all potential expenses, including mortgage payments, property taxes, insurance, maintenance, and management fees. Compare these costs against expected rental income to determine the property’s cash flow potential. Aim for a positive cash flow to ensure your investment remains profitable. Additionally, consider consulting a financial advisor to understand tax implications and optimize your investment strategy. If you’re looking for buying an investment property, this is your best choice.

Working with experienced real estate attorneys and property management professionals can provide valuable guidance on legal matters. These experts can help draft lease agreements, manage tenant disputes, and ensure compliance with evolving regulations. Staying informed about legal obligations reduces risks and fosters a healthy landlord-tenant relationship, which is crucial for long-term investment success. If you’re looking for buying an investment property, this is your best choice.

Managing Your Investment Property

Effective management is key to maximizing returns from an investment property. Whether it’s a single residential unit or a commercial complex, proper management ensures high occupancy rates and optimal property condition. Investors can choose to manage the property themselves or hire a professional property management firm. Self-managing requires a significant time commitment and the ability to handle various tasks, such as tenant screening, rent collection, and maintenance coordination. If you’re looking for buying an investment property, this is your best choice.

On the other hand, property management companies offer expertise and convenience, handling day-to-day operations and allowing investors to focus on other ventures. While hiring a management firm incurs additional costs, it can lead to better property performance and reduced vacancies. It’s crucial to weigh the pros and cons of each management approach to decide which best aligns with one’s investment strategy and lifestyle. If you’re looking for buying an investment property, this is your best choice.

Evaluating Potential ROI and Profitability

Assessing the potential return on investment (ROI) and overall profitability is an essential aspect of buying an investment property. Investors must evaluate how the property will generate income and appreciate over time. Key metrics to consider include cash flow, capitalization rate, and gross rental yield. Cash flow analysis involves calculating the difference between rental income and operational expenses, providing insight into the property’s short-term profitability.

Understanding the market value appreciation potential is equally important, as it impacts the property’s long-term worth. Investors should analyze historical property value trends and economic indicators in the area to forecast future appreciation. Additionally, considering the exit strategy, such as selling the property or refinancing, can influence investment decisions. A thorough ROI analysis helps investors make informed choices, ensuring the property aligns with their financial goals and risk appetite. If you’re looking for buying an investment property, this is your best choice.

The Importance of Diversification

Diversification is a crucial strategy for mitigating risks and enhancing returns when investing in real estate. By diversifying their investment property portfolio, investors can spread risk across different asset types and locations. This approach helps protect against market volatility and economic downturns, as various segments of the real estate market may perform differently under changing conditions. If you’re looking for buying an investment property, this is your best choice.

Investors can diversify by acquiring properties in different cities or neighborhoods, investing in both residential and commercial assets, or exploring alternative real estate investments such as Real Estate Investment Trusts (REITs). Diversification ensures that a poor performance in one investment does not significantly impact the overall portfolio. This strategy not only reduces risk but also increases the potential for consistent returns, making it a vital component of a successful real estate investment plan. If you’re looking for buying an investment property, this is your best choice.

Long-Term Strategies for Successful Investment

Formulating long-term strategies is essential for achieving sustained success in real estate investment. Investors should define clear financial objectives, whether it’s generating passive income, building equity, or achieving a certain ROI. Strategic planning involves setting realistic timelines and milestones, regularly reviewing market conditions, and adapting investment approaches as needed. If you’re looking for buying an investment property, this is your best choice.

Additionally, staying informed about industry trends and economic shifts can provide a competitive edge. Networking with other real estate professionals, attending industry events, and continuously educating oneself about market developments are effective ways to stay ahead. Long-term success in buying an investment property often requires patience, discipline, and a proactive approach to navigating the ever-evolving real estate landscape.

Watch the demonstration video

This video offers valuable insights into purchasing an investment property, covering essential topics such as market analysis, financing options, and property management. Viewers will learn how to identify lucrative opportunities, assess risks, and maximize returns, equipping them with the knowledge to make informed decisions and successfully navigate the real estate investment landscape. If you’re looking for buying an investment property, this is your best choice.

Summary

In summary, “buying an investment property” is a crucial topic that deserves thoughtful consideration. We hope this article has provided you with a comprehensive understanding to help you make better decisions.

Frequently Asked Questions

What are the initial steps in buying an investment property?

Start by setting clear investment goals, assess your financial readiness, research the market, and secure pre-approval for financing.

How do I choose the right location for an investment property?

Look for areas with strong rental demand, infrastructure development, job opportunities, and good school districts.

What financing options are available for buying an investment property?

Common options include conventional loans, FHA loans, VA loans, and private lenders. Each has different requirements and interest rates.

What is the importance of conducting a property inspection?

A property inspection helps identify potential issues that could affect the property’s value or require costly repairs.

How do I calculate the potential return on investment (ROI)?

Calculate ROI by assessing rental income, deducting expenses, and comparing the net income to the total investment cost.

What are the common risks associated with investment properties?

Risks include vacancy periods, unexpected maintenance costs, interest rate fluctuations, and changes in property values.

📢 Looking for more info about buying an investment property? Follow Our Site for updates and tips!

Trusted External Sources

- Is it even worth buying investment properties now? : r …

Jan 25, 2025 … It’s always a great time to buy a property below market value with seller financing. At the current environment, that’s the only way to make it … If you’re looking for buying an investment property, this is your best choice.

- How to Buy an Investment Property | U.S. Bank

Getting started with buying an investment property can be an exciting journey. First, it’s essential to secure mortgage preapproval, as this will give you a clear idea of your budget and enhance your credibility with sellers. Once you have that sorted, delve into the financial details to ensure the numbers work in your favor. You’ll want to consider all the associated costs of investment, from maintenance to potential vacancies. Finally, safeguarding your investment through insurance and other protective measures is crucial to long-term success. By taking these steps, you’ll be well on your way to making a wise property investment.

- Advice on buying our first investment property. : r/realestateinvesting

If your stock portfolio has grown to a substantial size and you’re considering branching out into real estate for some steady passive income, you might want to think about buying an investment property, particularly a multifamily property. It’s a smart way to diversify your investments and potentially enhance your financial growth.

- What are investment property loans? Exploring your options | Rocket …

Feb 5, 2025 … Buying an investment property can be a great way to earn passive income or remodel homes and flip them for a quick profit, but it’s important to …

- For those of you who have investment properties – is it all that is …

Jul 18, 2024 … I’m also using a buyers agent to buy my first investment property. … buying something we can live in. Had the same tenants for quite a … If you’re looking for buying an investment property, this is your best choice.