Rent to own properties have emerged as a popular option for individuals and families looking to eventually purchase a home but who might not currently have the financial capacity for a traditional mortgage. In these arrangements, potential buyers rent a property with the option to purchase it at a later date. This unique hybrid approach combines elements of renting and homeownership, offering a pathway to ownership that can be more accessible for those with limited financial resources or less-than-perfect credit scores.

Table of Contents

- My Personal Experience

- Understanding Rent to Own Properties

- The Structure of Rent to Own Agreements

- Advantages of Rent to Own Properties

- Challenges and Considerations

- The Role of Credit in Rent to Own Agreements

- Legal Considerations in Rent to Own Contracts

- Expert Insight

- Market Trends and Rent to Own Properties

- Finding Rent to Own Properties

- Alternatives to Rent to Own

- The Future of Rent to Own Properties

- Watch the demonstration video

- Frequently Asked Questions

- Trusted External Sources

My Personal Experience

A few years ago, I stumbled upon the concept of rent-to-own properties while searching for a way to transition from renting to owning my own home. At first, I was skeptical, but after doing some research, I found a charming little house in a neighborhood I loved, with a rent-to-own option. The process allowed me to move in immediately and pay rent that partially contributed to the eventual purchase price. This arrangement gave me the time I needed to improve my credit score and save for a down payment while living in the home I planned to buy. It wasn’t always smooth sailing—there were times when I worried about the financial commitment and the condition of the house—but ultimately, it was a stepping stone that made homeownership possible for me. Today, I look back and feel grateful for that opportunity, as it allowed me to build equity and invest in a place I can truly call my own. If you’re looking for rent to own properties, this is your best choice.

Understanding Rent to Own Properties

Rent to own properties have emerged as a popular option for individuals and families looking to eventually purchase a home but who might not currently have the financial capacity for a traditional mortgage. In these arrangements, potential buyers rent a property with the option to purchase it at a later date. This unique hybrid approach combines elements of renting and homeownership, offering a pathway to ownership that can be more accessible for those with limited financial resources or less-than-perfect credit scores.

One of the most appealing aspects of rent to own properties is the opportunity they provide to potential homeowners to lock in a purchase price. Typically, these agreements allow a portion of the monthly rent to be credited toward the future purchase price. This structure not only facilitates savings but also provides a financial incentive for renters to maintain the property in excellent condition, as they have a vested interest in its future value. Additionally, rent to own contracts often span several years, allowing tenants time to improve their financial standing, secure a mortgage, or pay down existing debts.

The Structure of Rent to Own Agreements

Rent to own agreements are typically divided into two main components: the lease agreement and the option to purchase. The lease agreement functions much like a standard rental contract, outlining the terms under which the tenant will inhabit the property, the duration of the tenancy, the rental price, and any other conditions specific to the property. Meanwhile, the option to purchase is a separate document that grants the tenant the right to buy the property at a predetermined price. If you’re looking for rent to own properties, this is your best choice.

A crucial element of the option to purchase is the option fee, which is a non-refundable payment made by the tenant to the property owner. This fee secures the tenant’s right to purchase the property within a specified timeframe. The option fee can vary widely but is typically a few percentage points of the agreed purchase price. It’s important for tenants to understand the implications of these agreements fully, as the option fee is generally non-refundable, but it is often credited towards the purchase price if the tenant decides to buy the property. If you’re looking for rent to own properties, this is your best choice.

Advantages of Rent to Own Properties

Rent to own properties offer several distinct advantages that make them attractive to many potential homeowners. One significant benefit is the ability to live in the home before committing to purchase it. This arrangement provides renters the opportunity to truly assess the home’s fit for their lifestyle, test the neighborhood, and gauge any long-term issues with the property that may not be immediately apparent.

Another advantage of rent to own properties is financial flexibility. For individuals with poor credit or those unable to afford a large down payment, rent to own agreements provide a chance to build credit and save towards the purchase price while living in the desired home. This period can be used to improve credit ratings and increase personal savings, making it easier to qualify for a mortgage when the option to purchase is exercised. Moreover, this method can potentially protect the buyer from rising property prices, as the purchase price is locked in at the outset.

Challenges and Considerations

While rent to own properties present appealing benefits, they are not without challenges. One primary concern is the risk associated with the non-refundable nature of the option fee. If the tenant decides not to purchase or is unable to secure financing by the end of the agreement, this fee is lost. Therefore, potential buyers must be confident in their ability and desire to buy the property in the future.

Additionally, rent to own properties can sometimes be priced above the current market value to account for expected appreciation over the duration of the lease. This price premium can be a deterrent if the property’s market value does not increase as anticipated. Furthermore, tenants are typically responsible for maintenance and repairs during the lease period, unlike traditional rental agreements. This condition can be financially burdensome, particularly if significant repairs are needed.

The Role of Credit in Rent to Own Agreements

Credit plays a pivotal role in rent to own agreements, both as a barrier and an opportunity. For many, the primary appeal of rent to own arrangements is the ability to move into a home without the immediate need for a high credit score. This opportunity is vital for those who may otherwise be shut out of the housing market due to past financial missteps or lack of credit history. If you’re looking for rent to own properties, this is your best choice.

During the rental period, tenants have the chance to improve their credit scores, which is crucial if they intend to secure a mortgage to buy the property. Consistent, on-time rent payments can positively impact a tenant’s credit profile, especially if the landlord reports to credit bureaus. It is essential for tenants to verify whether their landlord offers this service, as not all landlords do. Improved credit can lead to better loan terms, such as lower interest rates when the time comes to finance the home purchase. If you’re looking for rent to own properties, this is your best choice.

Legal Considerations in Rent to Own Contracts

Legal considerations are a crucial aspect of rent to own properties. These contracts are complex, and the stakes are high, making it imperative for both parties to fully understand their rights and responsibilities. It is highly recommended that both tenants and landlords engage legal counsel to draft or review agreements to ensure they are fair and comprehensive.

| Feature | Pros | Cons |

|---|---|---|

| Flexibility | Allows future purchase option | May have higher rent costs |

| Credit Requirements | Often more lenient than traditional mortgages | Limited benefit to low credit scores |

| Investment | Part of rent may go towards purchase | Less control over property until purchase |

Expert Insight

When considering rent-to-own properties, it’s crucial to thoroughly review the terms of the agreement. Ensure that you understand the purchase price, the duration of the rental period, and any potential penalties for opting out of the purchase. Consulting with a real estate attorney can help clarify the legal aspects and protect your interests. If you’re looking for rent to own properties, this is your best choice.

Another key tip is to conduct a comprehensive inspection of the property before signing any agreements. Hire a professional inspector to identify any underlying issues that could affect the property’s value or your decision to purchase. This proactive approach can save you from unexpected expenses and ensure that the property meets your long-term needs. If you’re looking for rent to own properties, this is your best choice.

One important legal consideration is ensuring that the option to purchase component is valid and enforceable. This includes clearly defining the terms of the option fee, the purchase price, and the timeline within which the tenant must exercise their right to purchase. Additionally, tenants should seek clauses that protect their interests, such as the treatment of rent credits and the maintenance responsibilities of both parties. Disputes can arise if these details are not explicitly outlined, leading to costly legal battles or the loss of potential homeownership. If you’re looking for rent to own properties, this is your best choice.

Market Trends and Rent to Own Properties

The real estate market and economic trends significantly influence the popularity and viability of rent to own properties. In markets where property values are rapidly increasing, renters may find rent to own options particularly advantageous as they can lock in a lower purchase price. Conversely, in stagnant markets, the premium paid for the option to purchase may not be justified if property values do not rise.

Economic downturns also affect rent to own arrangements. During such times, traditional financing options may become difficult to obtain, making rent to own properties an attractive alternative for both buyers and sellers. Sellers can benefit by securing tenants in uncertain markets, while buyers gain more time to stabilize their finances. However, economic instability can also pose risks, such as job loss or unexpected financial hardship, which could affect the tenant’s ability to exercise the purchase option.

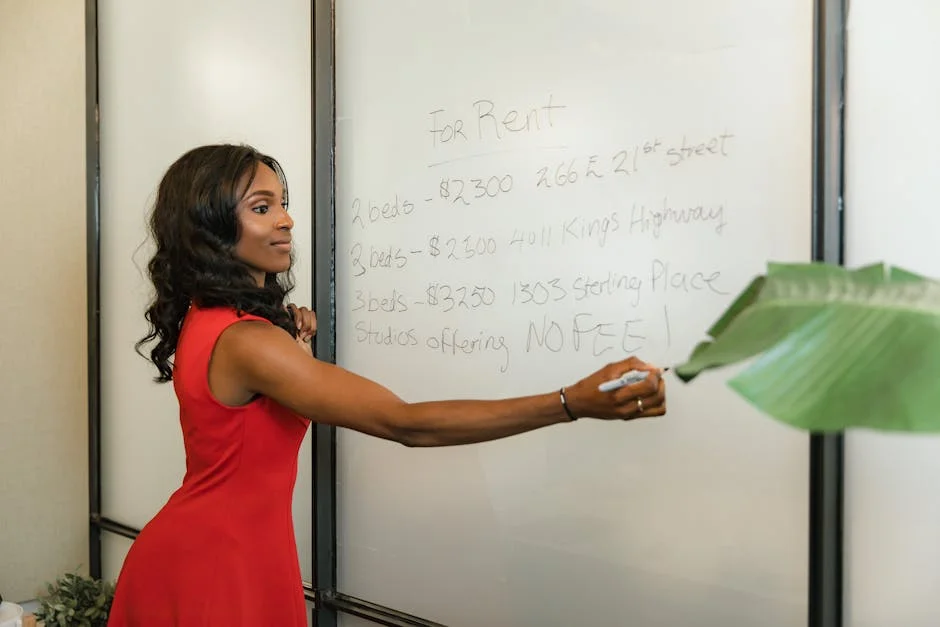

Finding Rent to Own Properties

Locating rent to own properties can be challenging, as these arrangements are less common than traditional sales or rentals. Prospective buyers may start their search by consulting real estate agents who specialize in rent to own transactions. These agents have access to listings and can provide valuable insight into market trends and property values.

Online platforms have also emerged as a resource for finding rent to own properties. Websites dedicated to alternative homeownership solutions offer listings and information for both tenants and landlords. When using these platforms, it is crucial for tenants to conduct thorough research and vet potential properties and landlords to ensure they are legitimate and meet their needs. Networking with other prospective homeowners and attending local housing seminars can also uncover opportunities and provide additional guidance.

Alternatives to Rent to Own

For those considering rent to own properties, exploring alternatives can provide a broader perspective on available homeownership paths. One such alternative is the lease option, which is similar to rent to own but typically involves a separate negotiation process for the sale price at the end of the lease term. This flexibility can be appealing to those confident in their ability to negotiate or who anticipate market shifts.

Another alternative is seller financing, where the property owner finances the purchase directly for the buyer. This arrangement can be beneficial for buyers who struggle with traditional lenders but still wish to pursue homeownership. Additionally, government and community programs often provide assistance for first-time homebuyers, offering financial support, education, and resources to make traditional home purchases more attainable. If you’re looking for rent to own properties, this is your best choice.

The Future of Rent to Own Properties

The future of rent to own properties looks promising as the market continues to adapt to the needs of diverse homebuyers. As more individuals face hurdles in securing traditional mortgages, rent to own options offer a flexible and achievable path to homeownership. Advances in technology and data analytics may enhance the transparency and ease of these transactions, making them more accessible and attractive to a broader audience.

As financial landscapes evolve, rent to own properties could become a standard option within the housing market. With the potential to accommodate varied economic circumstances and personal preferences, these arrangements provide a valuable alternative to conventional home buying processes. However, as with any significant financial commitment, prospective buyers must diligently research and prepare to ensure that entering a rent to own agreement aligns with their long-term financial goals. Rent to own properties remain a viable and evolving option for those seeking to achieve the dream of homeownership.

Watch the demonstration video

In this video, you’ll discover the ins and outs of rent-to-own properties, a unique real estate option that allows tenants to rent a home with the potential to purchase it later. Learn about the benefits, risks, and key factors to consider, empowering you to make informed decisions in your journey towards homeownership. If you’re looking for rent to own properties, this is your best choice.

Summary

In summary, “rent to own properties” is a crucial topic that deserves thoughtful consideration. We hope this article has provided you with a comprehensive understanding to help you make better decisions.

Frequently Asked Questions

What is a rent-to-own property?

A rent-to-own property is a type of agreement where tenants rent a home with the option to purchase it later, applying part of the rent towards the purchase price.

How does a rent-to-own agreement work?

In a rent-to-own agreement, tenants sign a lease with an option to buy the property after or during the rental period, often with a portion of the rent applied to the purchase price. If you’re looking for rent to own properties, this is your best choice.

What are the benefits of rent-to-own properties?

Benefits include the ability to build equity while renting, the opportunity to lock in a purchase price, and more time to improve credit scores or save for a down payment. If you’re looking for rent to own properties, this is your best choice.

Are there any risks associated with rent-to-own agreements?

When considering rent to own properties, it’s essential to weigh the potential risks. If you don’t end up buying the home, you might forfeit any option fee and accumulated rent credits. Additionally, there’s a chance you could end up paying more than the property’s worth, especially if the home’s value decreases over time.

How is the purchase price determined in rent-to-own agreements?

When you explore rent to own properties, one of the main advantages is that the purchase price is usually locked in at the beginning of the agreement. This can be a significant benefit if property values rise over time, as you’ll still pay the original agreed-upon price. However, it’s important to keep in mind that this price might not always align with future market changes.

What should I consider before entering a rent-to-own agreement?

When exploring rent to own properties, it’s crucial to think about several key factors before making a decision. Take a close look at the terms of the agreement to ensure they align with your long-term goals. Assess the condition and location of the property to make sure it meets your needs and lifestyle. Understand the financial implications involved, as they can significantly impact your future investments. Lastly, it’s wise to consult with a real estate attorney to guide you through the process and help you make an informed choice.

📢 Looking for more info about rent to own properties? Follow Our Site for updates and tips!

Trusted External Sources

- Can Rent-to-Own 2.0 offer an affordable path to homeownership in …

Unlike traditional developers who might be pressured to quickly sell off properties due to local market demands, innovative fin-tech start-ups are embracing a different approach. They are now stepping into the market of rent to own properties, allowing them to temporarily hold ownership. This strategy not only offers flexibility but also provides potential homeowners with the opportunity to eventually own their dream homes.

- How Does Rent-To-Own Work? | Zillow

Sep 19, 2024 … Rent-to-own is when a tenant signs a rental agreement or lease that includes an option — or requirement — to buy the house or condo later, … If you’re looking for rent to own properties, this is your best choice.

- Anyone have experience with rent to own : r/realestateinvesting

Jul 20, 2025 … If they buy, great. If not, you keep the fee and still own the house. Given your sense that their finances are tight, structure it with clear … If you’re looking for rent to own properties, this is your best choice.

- Rent-to-own homes: How it works and what to consider

Nov 1, 2024 … A rent-to-own home is a residence that you rent for a set period. Unlike in a typical rental agreement, though, you have the option to purchase the property … If you’re looking for rent to own properties, this is your best choice.

- Should You Rent-to-Own Investment Property You Own?

Explore the advantages and drawbacks of rent to own properties to see if this investment strategy aligns with your financial goals and future plans.