A 0 APR balance transfer is a financial tool that can provide significant relief for individuals grappling with high-interest debt. This option allows you to transfer existing debts to a new credit card that charges zero interest for a predetermined period. The primary advantage of a 0 APR balance transfer is the ability to pay down debt faster, as all payments go toward the principal rather than interest. Typically, the promotional period for 0 APR offers ranges from six to 21 months, providing ample time to reduce or eliminate debt without incurring additional finance charges.

Table of Contents

- My Personal Experience

- Understanding 0 APR Balance Transfers

- Eligibility Criteria for 0 APR Balance Transfers

- Benefits of 0 APR Balance Transfers

- Potential Drawbacks to Consider

- How to Choose the Right 0 APR Balance Transfer Offer

- Steps to Successfully Implement a 0 APR Balance Transfer

- Expert Insight

- Common Mistakes to Avoid with Balance Transfers

- Alternatives to 0 APR Balance Transfers

- The Long-term Impact of 0 APR Balance Transfers

- Conclusion

- Watch the demonstration video

- Frequently Asked Questions

- Trusted External Sources

My Personal Experience

A few months ago, I found myself juggling multiple credit card balances with high interest rates, and it was becoming increasingly difficult to make a dent in my debt. After some research, I decided to take advantage of a 0% APR balance transfer offer from a new credit card. It was a game-changer. The process was surprisingly straightforward—I applied online, got approved, and transferred my balances all within a week. The relief of not accruing interest each month has been immense, allowing me to focus on paying down the principal faster. I’ve set up a strict budget and payment plan to ensure I clear the balance before the promotional period ends. This experience has taught me the value of strategic financial planning and the importance of reading the fine print to avoid any unexpected fees. If you’re looking for 0 apr balance transfer, this is your best choice.

Understanding 0 APR Balance Transfers

A 0 APR balance transfer is a financial tool that can provide significant relief for individuals grappling with high-interest debt. This option allows you to transfer existing debts to a new credit card that charges zero interest for a predetermined period. The primary advantage of a 0 APR balance transfer is the ability to pay down debt faster, as all payments go toward the principal rather than interest. Typically, the promotional period for 0 APR offers ranges from six to 21 months, providing ample time to reduce or eliminate debt without incurring additional finance charges.

It’s crucial to understand the terms and conditions associated with these offers. While the initial zero interest rate is certainly enticing, the interest rate that kicks in after the promotional period can be significantly higher. Therefore, a comprehensive repayment plan must be in place to ensure that the debt is minimized before the regular interest rate takes effect. Additionally, there is often a balance transfer fee involved, which usually ranges from 3% to 5% of the transferred amount. This fee should be considered when calculating the potential savings from the transfer. If you’re looking for 0 apr balance transfer, this is your best choice.

Eligibility Criteria for 0 APR Balance Transfers

Not everyone qualifies for a 0 APR balance transfer, as credit card issuers typically reserve these offers for consumers with good to excellent credit scores. Generally, a credit score of 670 or higher is required to access these offers. The lender will assess your creditworthiness by evaluating your credit history, current debts, and income level. It’s also important to note that having a high credit score may not automatically guarantee approval, as other factors such as your debt-to-income ratio can also influence the lender’s decision.

To improve your chances of qualifying for a 0 APR balance transfer, consider taking steps to enhance your credit score. Paying bills on time, reducing existing debt, and maintaining low credit utilization rates are all effective strategies. Additionally, regularly reviewing your credit report for errors and addressing any discrepancies can help bolster your credit profile. In case you’re denied, it’s wise to ask the issuer for specific reasons behind the decision. This feedback can be invaluable in addressing any issues before applying for another balance transfer card.

Benefits of 0 APR Balance Transfers

The primary benefit of a 0 APR balance transfer is the potential savings on interest payments. By transferring high-interest debt to a card with a zero interest rate, you can allocate more of your monthly payments toward the principal, thereby accelerating debt reduction. This can lead to significant financial savings, particularly for those with large outstanding balances. Furthermore, the consolidation of multiple debts into a single payment can simplify financial management, making it easier to track payment schedules and due dates.

In addition to saving on interest, a 0 APR balance transfer can also positively impact your credit score. Reducing outstanding debt can lower your credit utilization ratio, which is a critical factor in calculating credit scores. Moreover, consistently making timely payments during the promotional period can demonstrate responsible credit behavior to creditors, potentially leading to better interest rates and terms on future financial products. However, it’s important to approach balance transfers with discipline and a clear repayment strategy to fully realize these benefits.

Potential Drawbacks to Consider

Despite the advantages, there are potential drawbacks to consider with 0 APR balance transfers. One of the main concerns is the temporary nature of the zero interest rate. Once the promotional period ends, any remaining balance will accrue interest at the card’s standard rate, which can be quite high. This underscores the importance of paying down as much of the transferred balance as possible within the zero-interest window. Additionally, new purchases made with the card may not be subject to the 0 APR, potentially leading to unexpected interest charges if not paid in full.

Another potential drawback is the balance transfer fee, which can offset some of the interest savings. If the transferred amount is substantial, the fee can add up quickly, reducing the net benefit of the transfer. It’s also important to be cautious about using balance transfer cards for new spending, as this can easily lead to accumulating more debt rather than reducing it. To avoid these pitfalls, a strict budget and commitment to paying off the transferred balance within the promotional period are vital. If you’re looking for 0 apr balance transfer, this is your best choice.

How to Choose the Right 0 APR Balance Transfer Offer

Selecting the right 0 APR balance transfer offer involves careful consideration of several factors. First and foremost, the length of the promotional period is critical. Cards with longer zero-interest periods provide more time to pay off the balance, which is particularly beneficial for larger debt amounts. It’s also important to compare the balance transfer fees associated with different offers, as these can vary significantly between issuers and impact potential savings.

Additionally, consider the card’s regular interest rate, which will apply after the promotional period ends. A lower ongoing APR can reduce the cost of any remaining balance that hasn’t been fully paid off. Other features, such as rewards programs, should be secondary considerations and not take precedence over the terms of the balance transfer itself. Evaluating these factors can help ensure that you select an offer that aligns with your financial goals and repayment capabilities. If you’re looking for 0 apr balance transfer, this is your best choice.

Steps to Successfully Implement a 0 APR Balance Transfer

To successfully implement a 0 APR balance transfer, begin by assessing your current debt situation and identifying which balances are eligible for transfer. Once you’ve selected a suitable balance transfer card, apply and wait for approval. Upon receiving the new card, initiate the transfer by providing the necessary information about the existing debts to be transferred. This typically involves contacting the issuer of the new card, either online or over the phone.

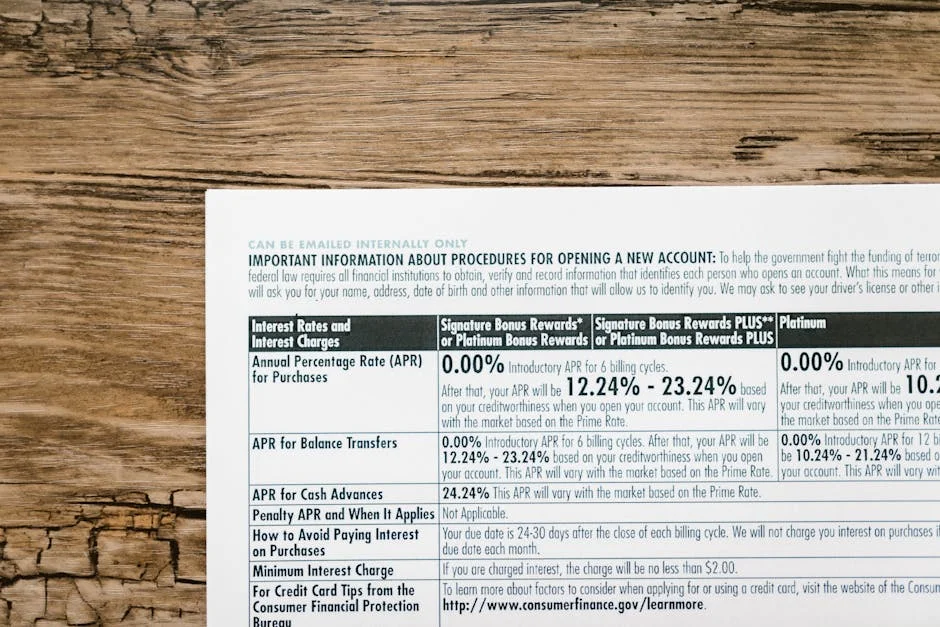

| Feature | Card A | Card B | Card C |

|---|---|---|---|

| Intro APR Period | 18 months | 15 months | 12 months |

| Balance Transfer Fee | 3% | 5% | 4% |

| Regular APR | 14.99% – 23.99% | 13.99% – 24.99% | 15.49% – 25.49% |

Expert Insight

To maximize the benefits of a 0% APR balance transfer, start by consolidating your high-interest debts onto the new card. This strategy allows you to focus on paying down the principal balance faster, without the burden of accruing interest. Ensure you understand the terms, including the duration of the promotional period, and aim to pay off the transferred balance before the introductory rate expires. If you’re looking for 0 apr balance transfer, this is your best choice.

Another crucial step is to avoid making new purchases on the balance transfer card. Many cards apply payments to the balance with the lowest interest rate first, which could leave new purchases accruing interest at a higher rate. Instead, use a separate card for new purchases and focus on eliminating your transferred balance within the 0% APR timeframe to fully leverage the financial advantage. If you’re looking for 0 apr balance transfer, this is your best choice.

After the transfer is complete, focus on creating a repayment plan that allows you to pay off the transferred balance before the end of the promotional period. This may involve cutting back on expenses or increasing your income to allocate more funds toward debt repayment. Avoid using the new card for additional purchases unless absolutely necessary, as this can detract from your primary goal of eliminating existing debt. Consistently adhering to your repayment plan can ensure that you maximize the benefits of the 0 APR balance transfer.

Common Mistakes to Avoid with Balance Transfers

One common mistake to avoid with 0 APR balance transfers is failing to read the fine print. Understanding the terms and conditions is essential, as they can vary widely between offers. Pay attention to the length of the promotional period, the balance transfer fee, and the regular interest rate. Overlooking these details can lead to unexpected costs and undermine the effectiveness of the balance transfer. Additionally, make sure that you make at least the minimum payment on time each month to avoid penalties or the loss of the promotional rate.

Another mistake is not having a clear plan for repaying the transferred balance. Without a structured approach, you may find yourself unable to pay off the debt before the promotional period ends, resulting in high interest charges. Additionally, it’s vital not to treat the balance transfer card as an opportunity for new spending. Accumulating additional debt can negate the benefits of the transfer and exacerbate financial challenges. Prioritizing debt repayment and being disciplined in your spending are key to avoiding these common pitfalls. If you’re looking for 0 apr balance transfer, this is your best choice.

Alternatives to 0 APR Balance Transfers

If a 0 APR balance transfer isn’t a feasible option, there are alternative strategies to manage and reduce debt. One such option is consolidating debts through a personal loan. A personal loan can offer a fixed interest rate and payment schedule, making it easier to budget and plan for debt repayment. This approach can also simplify your financial obligations by combining multiple debts into a single monthly payment. However, it’s important to ensure that the interest rate on the personal loan is lower than the rates on your existing debts.

Another alternative is negotiating directly with creditors for lower interest rates or payment plans. Many creditors are willing to work with borrowers facing financial difficulties to establish more manageable terms. Additionally, for those struggling with severe debt, seeking the assistance of a credit counseling service can be beneficial. These services offer expert advice and may help negotiate with creditors on your behalf. Exploring these alternatives can provide additional paths to financial stability beyond 0 APR balance transfers.

The Long-term Impact of 0 APR Balance Transfers

The long-term impact of utilizing a 0 APR balance transfer can be substantial, particularly in terms of financial health and credit score improvement. Successfully paying off debt during the promotional period can significantly reduce the financial burden and free up funds for other priorities, such as emergency savings or retirement contributions. Additionally, reducing your overall debt load can enhance your credit score by improving your credit utilization ratio and demonstrating responsible credit management.

However, the long-term benefits extend beyond mere financial metrics. The experience of managing a balance transfer can instill better financial habits and increase your awareness of credit management strategies. By adhering to disciplined budgeting and spending practices, you can avoid falling back into debt cycles and maintain greater financial security. Embracing these principles can pave the way for a more stable and prosperous financial future. If you’re looking for 0 apr balance transfer, this is your best choice.

Conclusion

A 0 APR balance transfer presents a powerful opportunity to alleviate the burden of high-interest debt while taking control of your financial future. By transferring your balances to 0 interest credit cards, you can accelerate debt repayment and potentially save thousands in interest charges. However, to fully capitalize on this opportunity, it’s essential to understand the terms, select the right offer, and adhere to a disciplined repayment plan. By avoiding common mistakes and exploring alternative debt management strategies, you can enhance your financial stability and enjoy the long-term benefits of improved credit health.

Whether you choose to pursue a 0 APR balance transfer or another debt reduction strategy, the key is to take proactive steps toward financial freedom. By leveraging these opportunities wisely, you can build a solid foundation for future financial success and achieve your personal financial goals.

Watch the demonstration video

This video provides insights into 0% APR balance transfers, explaining how they can help you save money by transferring high-interest debt to a new credit card with no interest for a promotional period. You’ll learn about the benefits, potential pitfalls, and strategies to maximize savings and manage debt effectively during this interest-free timeframe. If you’re looking for 0 apr balance transfer, this is your best choice.

Summary

In summary, “0 apr balance transfer” is a crucial topic that deserves thoughtful consideration. We hope this article has provided you with a comprehensive understanding to help you make better decisions.

Frequently Asked Questions

What is a 0% APR balance transfer?

A 0% APR balance transfer is a credit card offer that allows you to transfer existing debt to a new card and pay no interest on the transferred balance for a specified period. If you’re looking for 0 apr balance transfer, this is your best choice.

How long does the 0% APR period last?

The 0% APR period typically lasts between 6 to 21 months, depending on the credit card issuer and the specific offer.

Are there fees associated with balance transfers?

Yes, there is usually a balance transfer fee, commonly 3% to 5% of the transferred amount, though some cards might offer no-fee transfers.

Can I transfer balances from any type of account?

Generally, you can transfer balances from credit cards or loans, but it’s best to check with your credit card issuer for specific eligibility.

What happens after the 0% APR period ends?

Once the 0% APR period ends, the remaining balance will be subject to the regular APR, which can be significantly higher.

How does a 0% APR balance transfer affect my credit score?

A balance transfer can initially lower your credit score due to a hard inquiry and increased credit utilization, but if managed well, it can improve your score over time by reducing overall debt. If you’re looking for 0 apr balance transfer, this is your best choice.

📢 Looking for more info about 0 apr balance transfer? Follow Our Site for updates and tips!

Trusted External Sources

- Does anyone know the best 0% APR Transfer card for the second …

Jun 28, 2025 … For balance transfer cards, the Citi Double Cash credit card, and the BankAmericard, have an 18-month 0 APR on balance transfers.

- Best Balance Transfer Cards for November 2025

Best for long 0% intro APR: Wells Fargo Reflect® Card. Here’s why: This card offers one of the longest 0% intro APR periods you’ll see for a balance transfer … If you’re looking for 0 apr balance transfer, this is your best choice.

- Best credit card with 0% APR for balance transfer of 15k : r …

Nov 19, 2024 … The Citi Double Cash credit card, and the BankAmericard, have an 18-month 0 APR on balance transfers. But the Wells Fargo Reflect and the Citi … If you’re looking for 0 apr balance transfer, this is your best choice.

- Balance Transfer Credit Cards: Compare Offers | Chase.com

0% intro APR for 18 months from account opening on purchases and balance transfers. … After the intro period, a variable APR of 18.74Min. of (7.25+11.49) and …

- Balance Transfer Credit Cards with Low Intro APR

3% † Intro balance transfer fee for the first 60 days your account is open. After the intro balance transfer fee offer ends, the fee for all future balance … If you’re looking for 0 apr balance transfer, this is your best choice.